Answered step by step

Verified Expert Solution

Question

1 Approved Answer

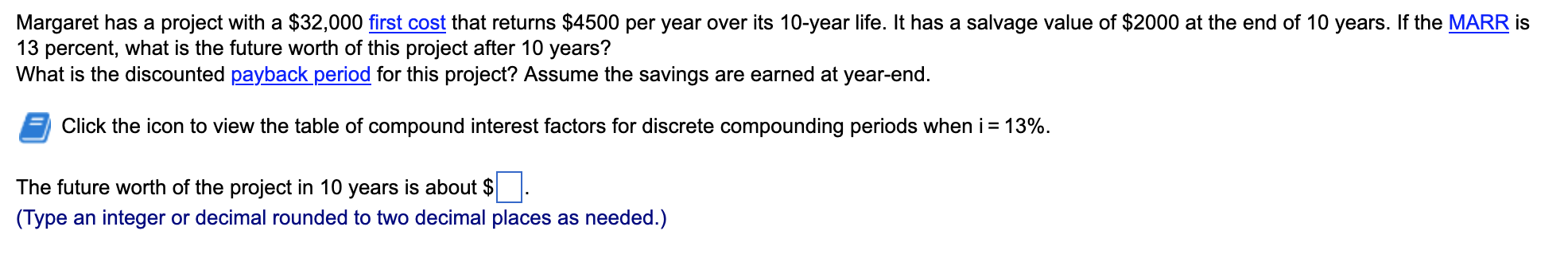

Margaret has a project with a $32,000 first cost that returns $4500 per year over its 10-year life. It has a salvage value of

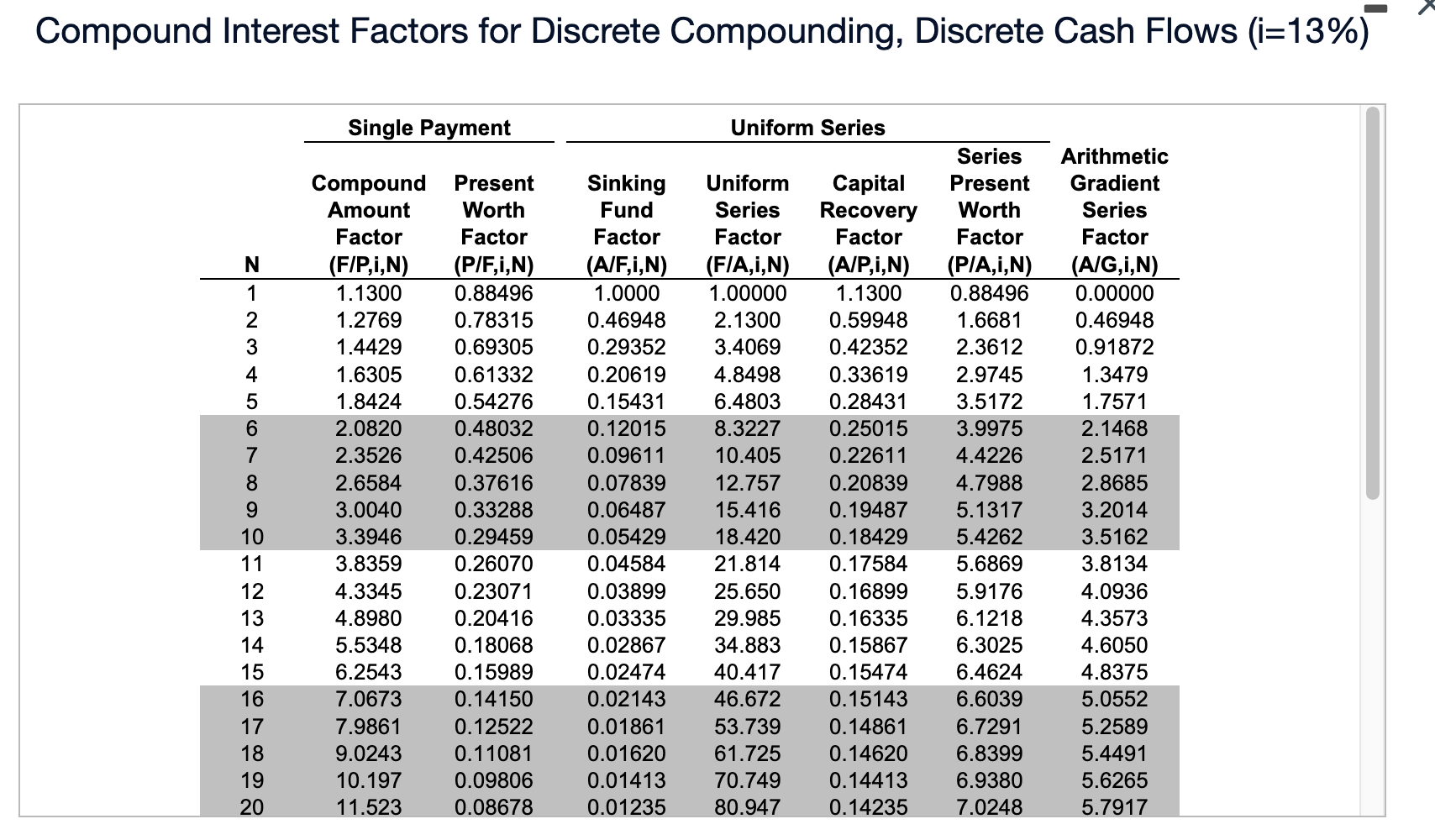

Margaret has a project with a $32,000 first cost that returns $4500 per year over its 10-year life. It has a salvage value of $2000 at the end of 10 years. If the MARR is 13 percent, what is the future worth of this project after 10 years? What is the discounted payback period for this project? Assume the savings are earned at year-end. Click the icon to view the table of compound interest factors for discrete compounding periods when i = 13%. The future worth of the project in 10 years is about $ (Type an integer or decimal rounded to two decimal places as needed.) Compound Interest Factors for Discrete Compounding, Discrete Cash Flows (i=13%) NZ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Single Payment Compound Present Worth Amount Factor Factor (F/P,i,N) (P/F,i,N) 1.1300 0.88496 1.2769 0.78315 1.4429 0.69305 1.6305 1.8424 2.0820 2.3526 2.6584 3.0040 3.3946 3.8359 4.3345 4.8980 5.5348 6.2543 7.0673 7.9861 9.0243 10.197 11.523 0.61332 0.54276 0.48032 0.42506 0.37616 0.33288 0.29459 0.26070 0.23071 0.20416 0.18068 0.15989 0.14150 0.12522 0.11081 0.09806 0.08678 Sinking Fund Factor (A/F,I,N) 1.0000 0.46948 0.29352 0.20619 0.15431 0.12015 0.09611 0.07839 0.06487 0.05429 0.04584 0.03899 0.03335 0.02867 0.02474 0.02143 0.01861 0.01620 0.01413 0.01235 Uniform Series Series Arithmetic Uniform Capital Present Gradient Series Recovery Worth Series Factor Factor Factor Factor (F/A,I,N) (A/P,I,N) (P/A,I,N) (A/G,i,N) 1.00000 1.1300 0.88496 0.00000 0.59948 0.46948 0.42352 0.91872 1.3479 1.7571 2.1468 2.5171 2.8685 3.2014 3.5162 3.8134 4.0936 4.3573 4.6050 4.8375 5.0552 5.2589 5.4491 5.6265 5.7917 2.1300 3.4069 4.8498 0.33619 2.9745 6.4803 0.28431 3.5172 8.3227 0.25015 3.9975 10.405 0.22611 4.4226 12.757 0.20839 15.416 0.19487 18.420 21.814 1.6681 2.3612 4.7988 5.1317 0.18429 5.4262 0.17584 5.6869 25.650 0.16899 29.985 0.16335 34.883 0.15867 40.417 0.15474 46.672 0.15143 53.739 61.725 70.749 80.947 5.9176 6.1218 6.3025 6.4624 6.6039 0.14861 6.7291 0.14620 6.8399 0.14413 6.9380 0.14235 7.0248

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Analyasis for disccounted payback periodi T A PVA 113 T Year Net Cash Present Val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started