Answered step by step

Verified Expert Solution

Question

1 Approved Answer

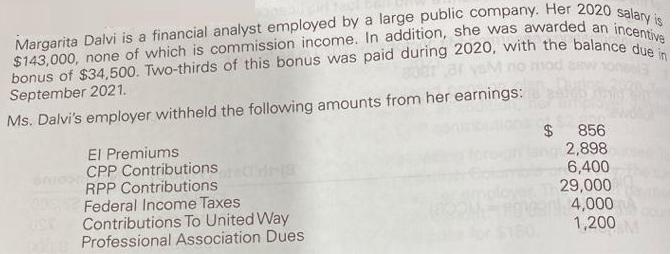

September 2021. Ms. Dalvi's employer withheld the following amounts from her earnings: El Premiums CPP Contributions RPP Contributions Federal Income Taxes Contributions To United

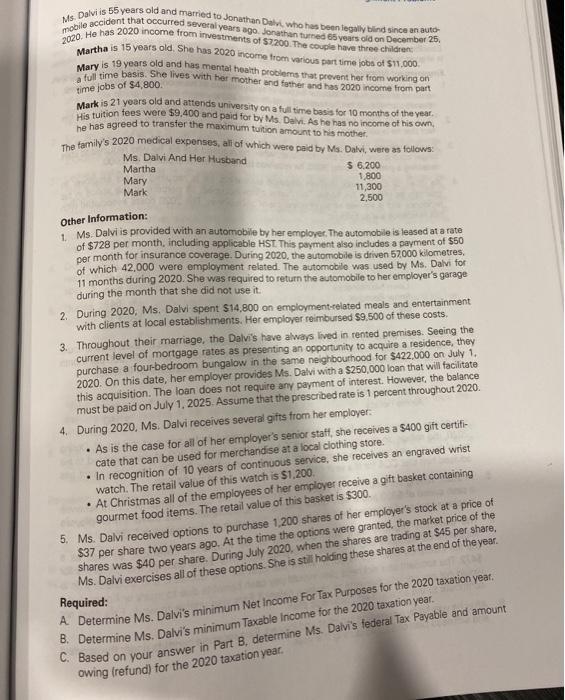

September 2021. Ms. Dalvi's employer withheld the following amounts from her earnings: El Premiums CPP Contributions RPP Contributions Federal Income Taxes Contributions To United Way Professional Association Dues 856 2,898 6,400 29,000 4,000 1,200 The family's 2020 medical expenses, al of which were paid by Ms. Dalvi, were as folows: mobile accident that occurred several years ago. Jonathan turned 65 years old on December 25, Ms. Dalvi is 55 years old and married to Jonathan Dalvi, who has been legally blind since an auto Mary is 19 years old and has mental health problems that prevent her from working on Martha is 15 years old, She has 2020 income trom various part time jobs of $11,000. a full time basis. She lives with her mother and father and has 2020 income from part 2020. He has 2020 income from investments of $7200. The couple have three children time jobs of $4,800. Mark is 21 years old and attends university on a full time basis for 10 months of the year. tuition fes were $9,400 and paid for by Ms. Dalvi. As he has no income of his own, His e agreed to transfer the maximum tuition amount to his mother. Ms. Dalvi And Her Husband Martha Mary Mark $ 6.200 1,800 11,300 2,500 Other Information: 1 Ms. Dalvi is provided with an automobile by her employer. The automobile is leased at a rate of $728 per month, including applicable HST This payment also includes a payment of $50 per month for insurance coverage. During 2020, the automobile is driven 57000 kilometres, of which 42,000 were employment related. The automobile was used by Ms. Dalvi for 11 months during 2020. She was required to return the automobile to her employer's garage during the month that she did not use it. 2. During 2020, Ms. Dalvi spent $14,800 on employment-related meals and entertainment with clients at local establishments. Her employer reimbursed $9,500 of these costs. 3. Throughout their marriage, the Dalvi's have always lived in rented premises. Seeing the current level of mortgage rates as presenting an opportunity to acquire a residence, they purchase a four-bedroom bungalow in the same neighbourhood for $422,000 on July 1, 2020. On this date, her employer provides Ms. Dalvi with a $250,000 loan that will facilitate this acquisition. The loan does not require any payment of interest. However, the balance must be paid on July 1, 2025. Assume that the prescribed rate is 1 percent throughout 2020. 4. During 2020, Ms. Dalvi receives several gifts from her employer: As is the case for all of her employer's senior staff, she receives a $400 gift certifi- cate that can be used for merchandise at a local clothing store. In recognition of 10 years of continuous service, she receives an engraved wrist watch. The retail value of this watch is $1,200. At Christmas all of the employees of her employer receive a gift basket containing gourmet food items. The retail value of this basket is $300. 5. Ms. Dalvi received options to purchase 1,200 shares of her employer's stock at a price of $37 per share two years ago, At the time the options were granted, the market price of the shares was $40 per share. During July 2020, when the shares are trading at $45 per share, Ms. Dalvi exercises all of these options. She is stil holding these shares at the end of the year. Required: A Determine Ms. Dalvi's minimum Net Income For Tax Purposes for the 2020 taxation year. O. Determine Ms. Dalvi's minimum Taxable Income for the 2020 taxation year. C. Based on your answer in Part B. determine Ms. Dalvi's federal Tax Payable and amount owing (refund) for the 2020 taxation year.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATION OF Ms Dalvis MINIMUM NET INCOME FOR TAX PURPOSE FOR 2020 PARTICULARS AMOUNT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started