Question

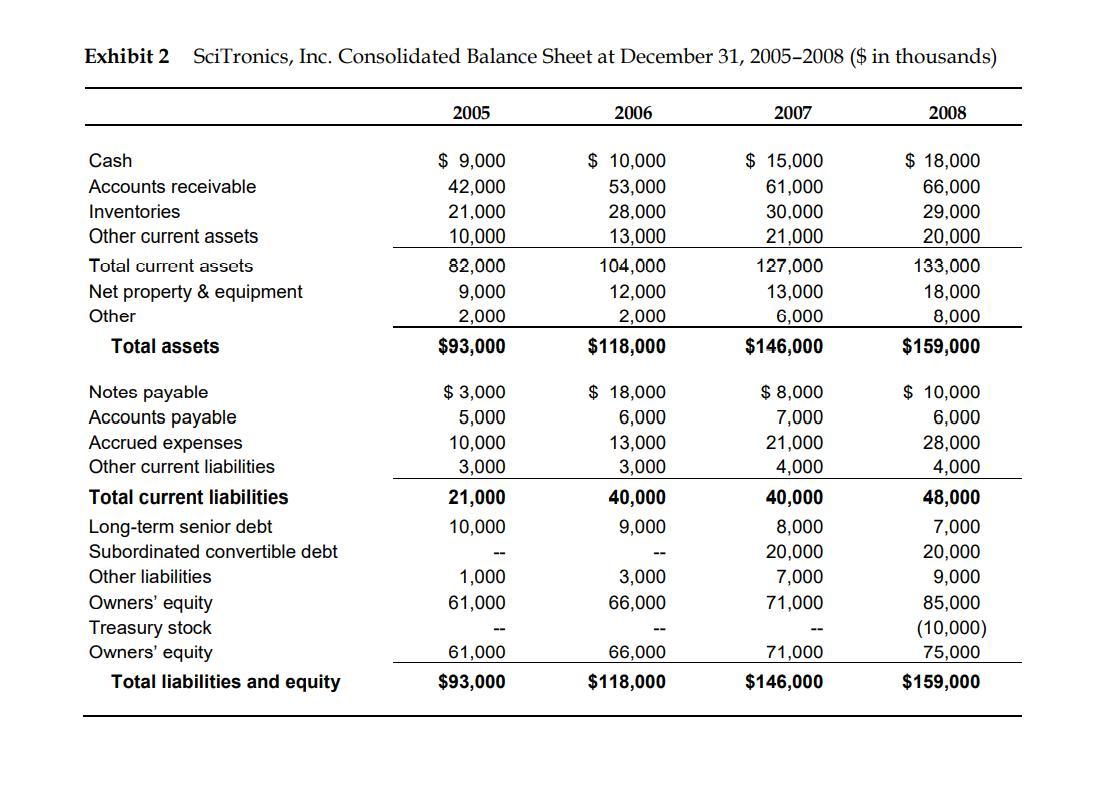

Financial Risks: Describe the potential impacts of the following types of financial risk on the company featured in the case study: (1) Interest Rate Risk:

Financial Risks: Describe the potential impacts of the following types of financial risk on the company featured in the case study:

(1) Interest Rate Risk:

(2) Economic Risk:

(3) Credit risk

(4) Operational risk

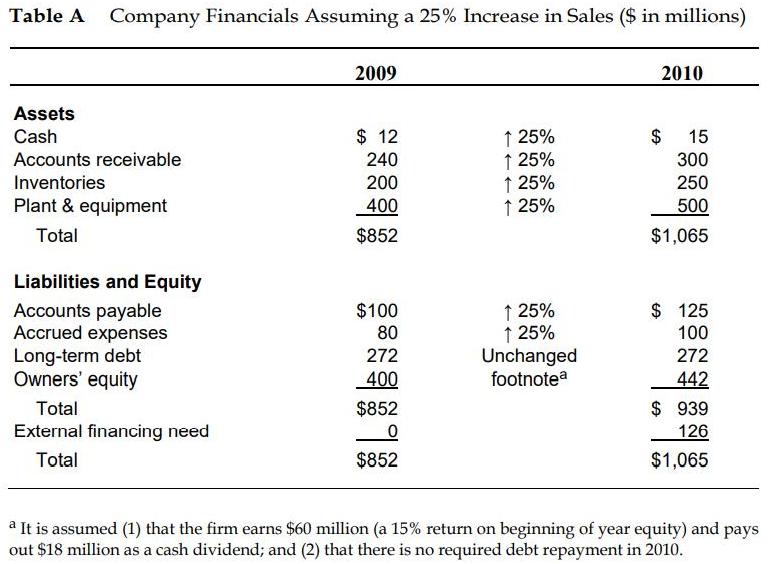

Lower Growth Impact: Explain the impact that a lower growth in sales could have on the dividend policy and retained earnings for the company described in the case study.

Higher Growth Impact: Explain the impact that a higher growth in sales could have on the dividend policy and retained earnings for the company described in the case study.

Table A Company Financials Assuming a 25% Increase in Sales ($ in millions) Assets Cash Accounts receivable Inventories Plant & equipment Total Liabilities and Equity Accounts payable Accrued expenses Long-term debt Owners' equity Total External financing need Total 2009 $12 240 200 400 $852 $100 80 272 400 $852 . $852 25% 25% 25% 25% 25% 25% Unchanged footnotea 2010 $ 15 300 250 500 $1,065 $125 100 272 442 $ 939 126 $1,065 a It is assumed (1) that the firm earns $60 million (a 15% return on beginning of year equity) and pays out $18 million as a cash dividend; and (2) that there is no required debt repayment in 2010.

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

fs 1 a fs ab s a s 1 a s bb ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started