Answered step by step

Verified Expert Solution

Question

1 Approved Answer

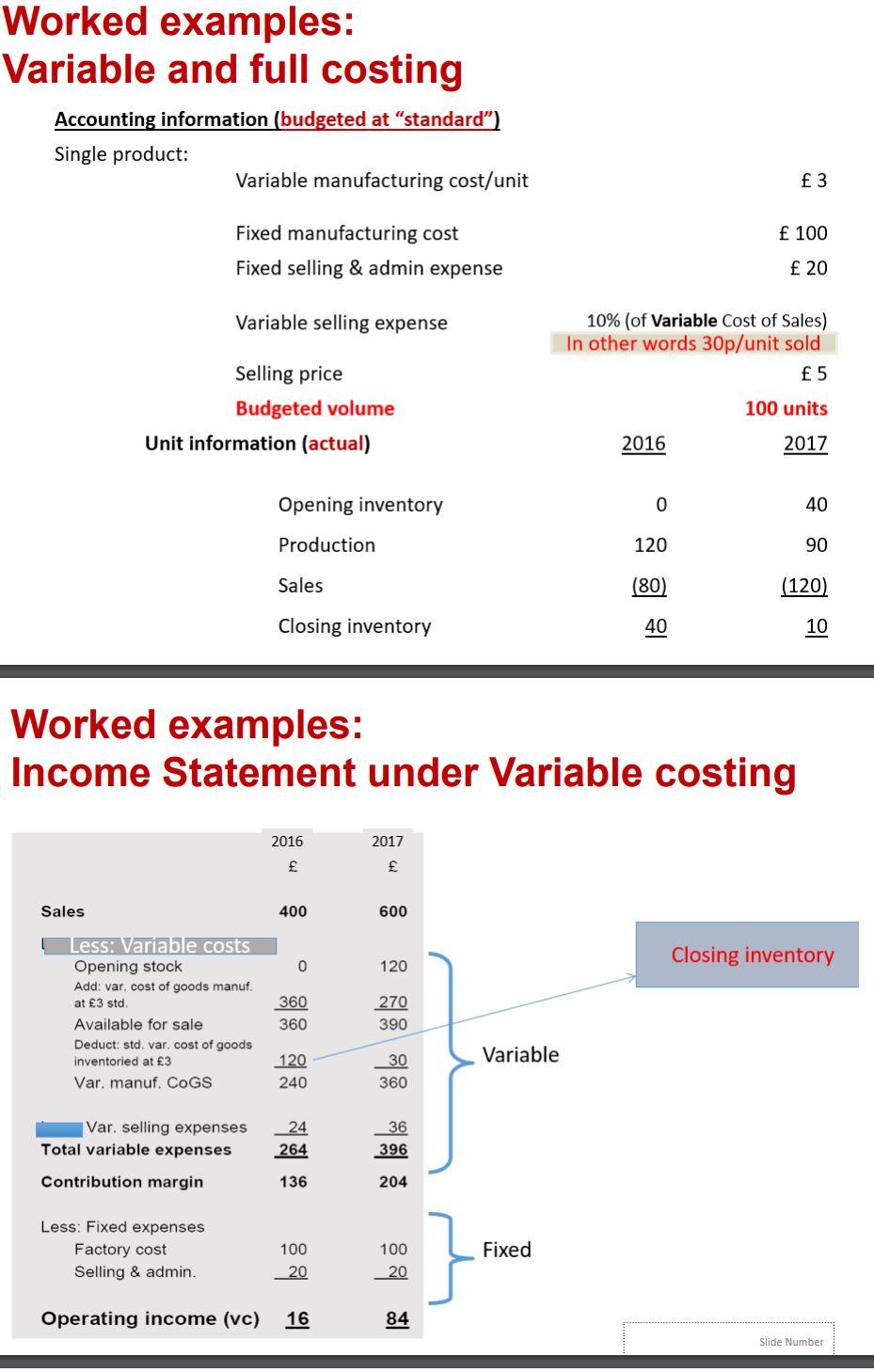

Marginal costing base: Revenue-variable cost (manufacturing and non-manufacturing)=contribution-fixed cost=operating profit: Worked examples: Variable and full costing Accounting information (budgeted at standard) Single product: Sales Variable

Marginal costing base:

Revenue-variable cost (manufacturing and non-manufacturing)=contribution-fixed cost=operating profit:

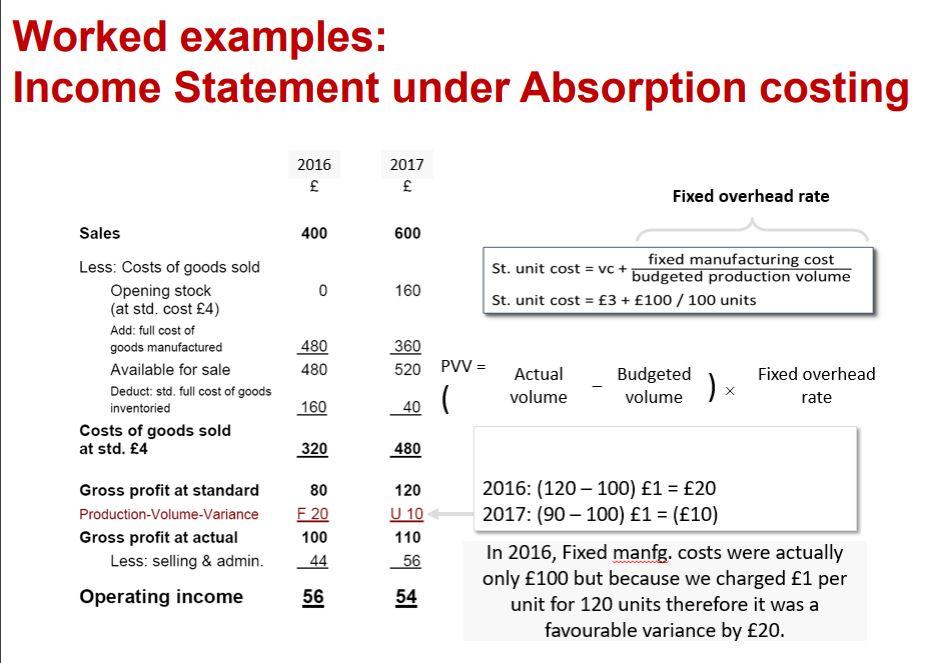

Also, in the 2nd pic, under absorption costing, why do we have to add PVV? And could you please explain how to get the values in the last four rows?

Worked examples: Variable and full costing Accounting information (budgeted at "standard) Single product: Sales Variable manufacturing cost/unit Fixed manufacturing cost Fixed selling & admin expense Variable selling expense Selling price Budgeted volume Unit information (actual) Less: Variable costs Opening stock Add: var. cost of goods manuf. at 3 std. Available for sale Deduct: std. var. cost of goods inventoried at 3 Var. manuf. CoGS Var. selling expenses Total variable expenses Contribution margin Less: Fixed expenses Factory cost Selling & admin. Opening inventory Production Operating income (vc) Sales Closing inventory Worked examples: Income Statement under Variable costing 2016 400 0 360 360 120 240 24 264 136 100 20 16 2017 600 120 270 390 30 360 36 396 204 100 20 84 Variable Fixed 2016 10% (of Variable Cost of Sales) In other words 30p/unit sold 5 100 units 2017 0 120 (80) 40 3 100 20 40 90 (120) 10 Closing inventory Slide Number

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

here are the calculations and explanations for the values in the last four rows of the income statem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started