Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Margot, 44, and Craig, 43, plan to retire when Margot reaches age 61 and Craig reaches age 60. They estimate that they will need

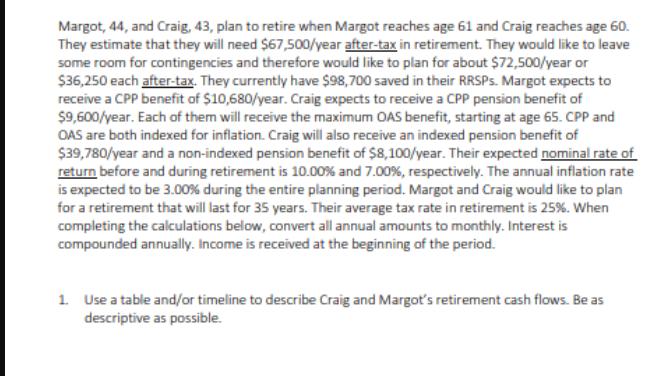

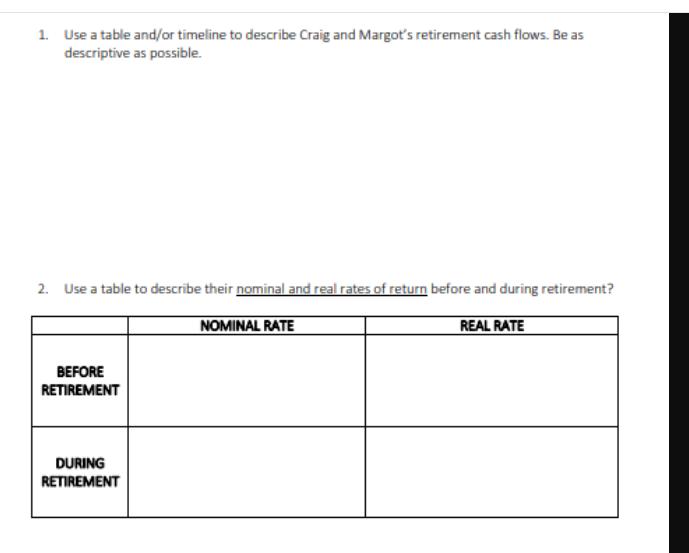

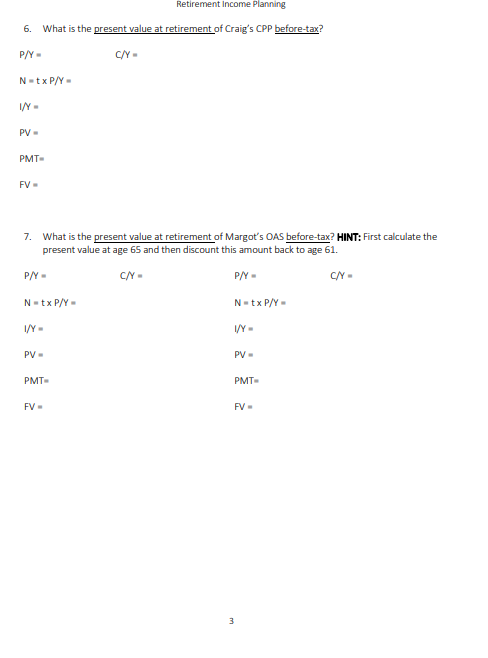

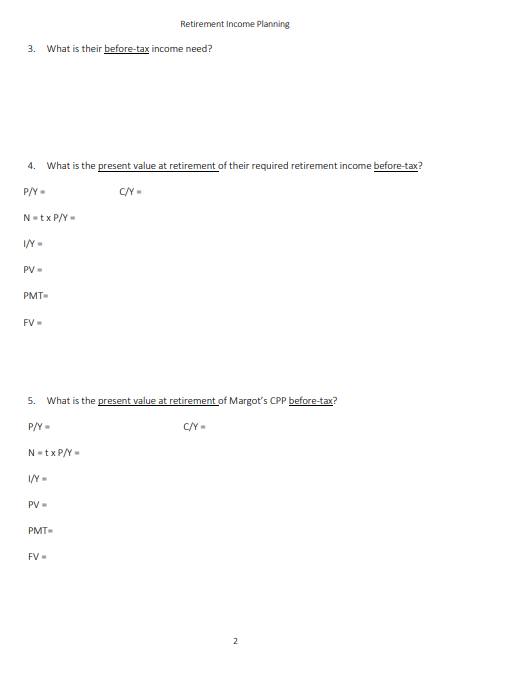

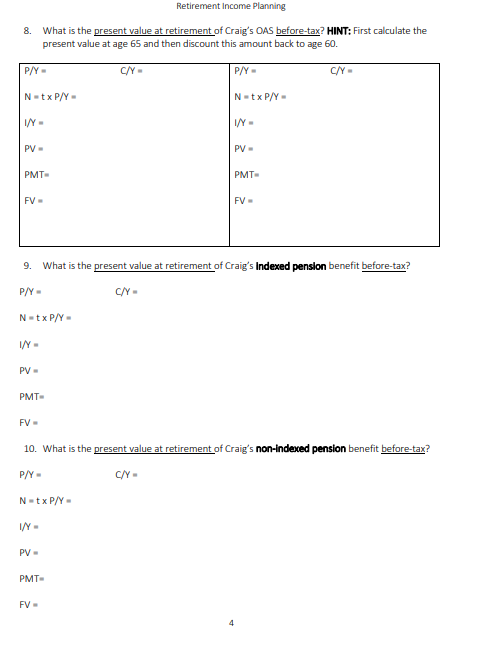

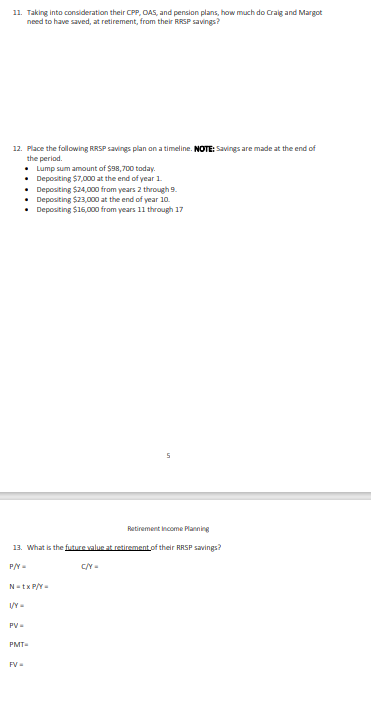

Margot, 44, and Craig, 43, plan to retire when Margot reaches age 61 and Craig reaches age 60. They estimate that they will need $67,500/year after-tax in retirement. They would like to leave some room for contingencies and therefore would like to plan for about $72,500/year or $36,250 each after-tax. They currently have $98,700 saved in their RRSPs. Margot expects to receive a CPP benefit of $10,680/year. Craig expects to receive a CPP pension benefit of $9,600/year. Each of them will receive the maximum OAS benefit, starting at age 65. CPP and OAS are both indexed for inflation. Craig will also receive an indexed pension benefit of $39,780/year and a non-indexed pension benefit of $8,100/year. Their expected nominal rate of return before and during retirement is 10.00% and 7.00 %, respectively. The annual inflation rate is expected to be 3.00% during the entire planning period. Margot and Craig would like to plan for a retirement that will last for 35 years. Their average tax rate in retirement is 25%. When completing the calculations below, convert all annual amounts to monthly. Interest is compounded annually. Income is received at the beginning of the period. 1. Use a table and/or timeline to describe Craig and Margot's retirement cash flows. Be as descriptive as possible. 1. Use a table and/or timeline to describe Craig and Margot's retirement cash flows. Be as descriptive as possible. 2. Use a table to describe their nominal and real rates of return before and during retirement? REAL RATE BEFORE RETIREMENT DURING RETIREMENT NOMINAL RATE Retirement Income Planning 6. What is the present value at retirement of Craig's CPP before-tax? P/Y= N=tx P/Y- I/Y= PV = PMT- FV= 7. What is the present value at retirement of Margot's OAS before-tax? HINT: First calculate the present value at age 65 and then discount this amount back to age 61. P/Y= N=tx P/Y- I/Y= PV- PMT= C/Y= FV= C/Y= P/Y= N=tx P/Y= I/Y= PV- PMT= FV= 3 C/Y= 3. What is their before-tax income need? 4. What is the present value at retirement of their required retirement income before-tax? P/Y= N=tx P/Y- I/Y= PV = PMT- FV= N=tx P/Y- 5. What is the present value at retirement of Margot's CPP before-tax? P/Y= I/Y= PV- Retirement Income Planning PMT- C/Y= FV= C/Y= 2 Retirement Income Planning 8. What is the present value at retirement of Craig's OAS before-tax? HINT: First calculate the present value at age 65 and then discount this amount back to age 60. C/Y= P/Y= N=tx P/Y- I/Y= PV- PMT= FV= P/Y= N=tx P/Y- I/Y= PV = PMT= FV= 9. What is the present value at retirement of Craig's Indexed pension benefit before-tax? N=tx P/Y- I/Y= PV = PMT- C/Y= FV= P/Y= N=tx P/Y- C/Y= I/Y= 10. What is the present value at retirement of Craig's non-indexed pension benefit before-tax? P/Y= PV- PMT= FV= C/Y= 4 11. Taking into consideration their CPP, OAS, and pension plans, how much do Craig and Margot need to have saved, at retirement, from their RRSP savings? 12. Place the following RRSP savings plan on a timeline. NOTE: Savings are made at the end of the period. Lump sum amount of $98,700 today. Depositing $7,000 at the end of year 1. Retirement Income Planning 13. What is the future value at retirement of their RRSP savings? P/Y= C/Y= Depositing $24,000 from years 2 through 9. Depositing $23,000 at the end of year 10. Depositing $16,000 from years 11 through 17 N=tx P/Y- V/Y= PV = PMT- FV=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started