Answered step by step

Verified Expert Solution

Question

1 Approved Answer

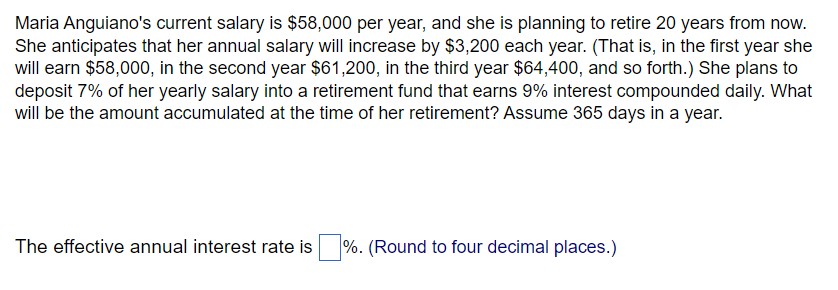

Maria Anguiano's current salary is $58,000 per year, and she is planning to retire 20 years from now. She anticipates that her annual salary

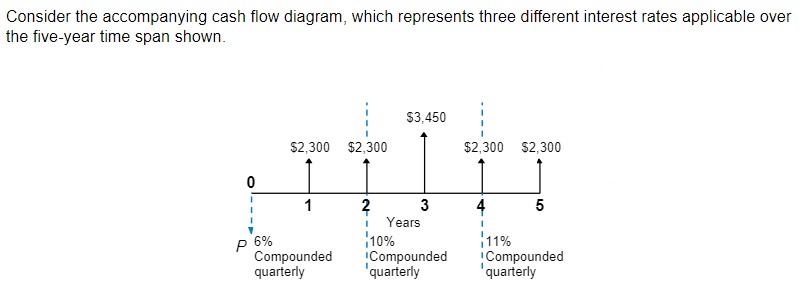

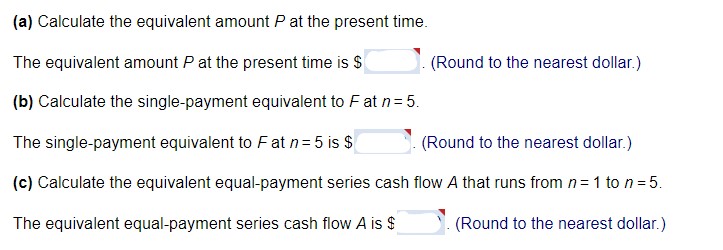

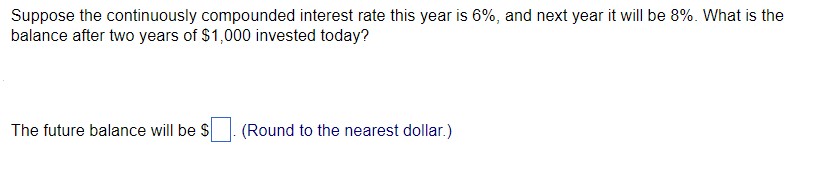

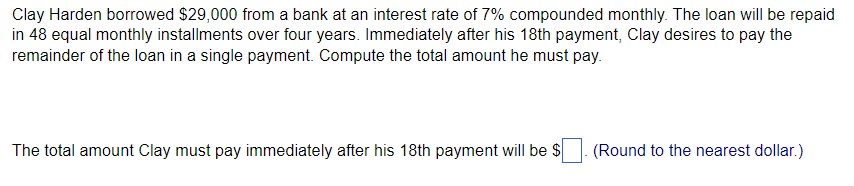

Maria Anguiano's current salary is $58,000 per year, and she is planning to retire 20 years from now. She anticipates that her annual salary will increase by $3,200 each year. (That is, in the first year she will earn $58,000, in the second year $61,200, in the third year $64,400, and so forth.) She plans to deposit 7% of her yearly salary into a retirement fund that earns 9% interest compounded daily. What will be the amount accumulated at the time of her retirement? Assume 365 days in a year. The effective annual interest rate is %. (Round to four decimal places.) Consider the accompanying cash flow diagram, which represents three different interest rates applicable over the five-year time span shown. $3,450 $2,300 $2,300 $2,300 $2,300 0 1 2 3 5 Years P 6% 10% 11% Compounded quarterly Compounded Compounded quarterly quarterly (a) Calculate the equivalent amount P at the present time. The equivalent amount P at the present time is $ (Round to the nearest dollar.) (b) Calculate the single-payment equivalent to F at n = 5. The single-payment equivalent to F at n = 5 is $ (Round to the nearest dollar.) (c) Calculate the equivalent equal-payment series cash flow A that runs from n = 1 to n = 5. The equivalent equal-payment series cash flow A is $ (Round to the nearest dollar.) Suppose the continuously compounded interest rate this year is 6%, and next year it will be 8%. What is the balance after two years of $1,000 invested today? The future balance will be $ (Round to the nearest dollar.) Clay Harden borrowed $29,000 from a bank at an interest rate of 7% compounded monthly. The loan will be repaid in 48 equal monthly installments over four years. Immediately after his 18th payment, Clay desires to pay the remainder of the loan in a single payment. Compute the total amount he must pay. The total amount Clay must pay immediately after his 18th payment will be $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started