Answered step by step

Verified Expert Solution

Question

1 Approved Answer

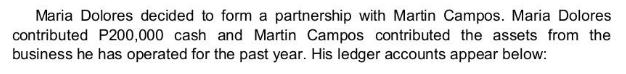

Maria Dolores decided to form a partnership with Martin Campos. Maria Dolores contributed P200,000 cash and Martin Campos contributed the assets from the business

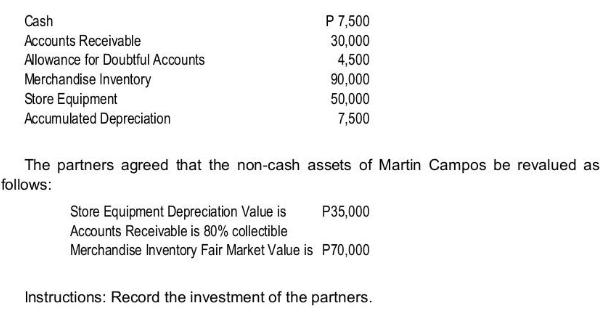

Maria Dolores decided to form a partnership with Martin Campos. Maria Dolores contributed P200,000 cash and Martin Campos contributed the assets from the business he has operated for the past year. His ledger accounts appear below: Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Store Equipment Accumulated Depreciation P 7,500 30,000 4,500 90,000 50,000 7,500 The partners agreed that the non-cash assets of Martin Campos be revalued as follows: P35,000 Store Equipment Depreciation Value is Accounts Receivable is 80% collectible Merchandise Inventory Fair Market Value is P70,000 Instructions: Record the investment of the partners.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record the investment of the partners in the partnership we will make the necessary journal entries First we need to revalue Martin Camposs noncash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started