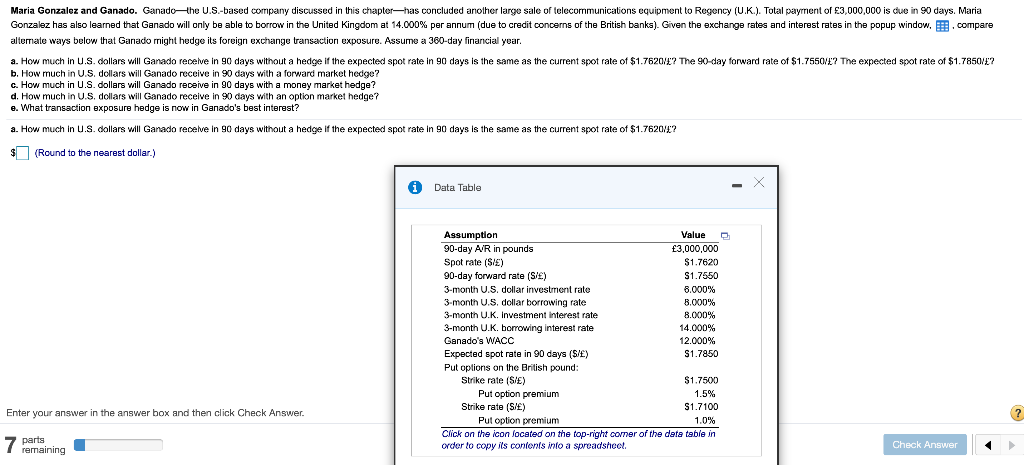

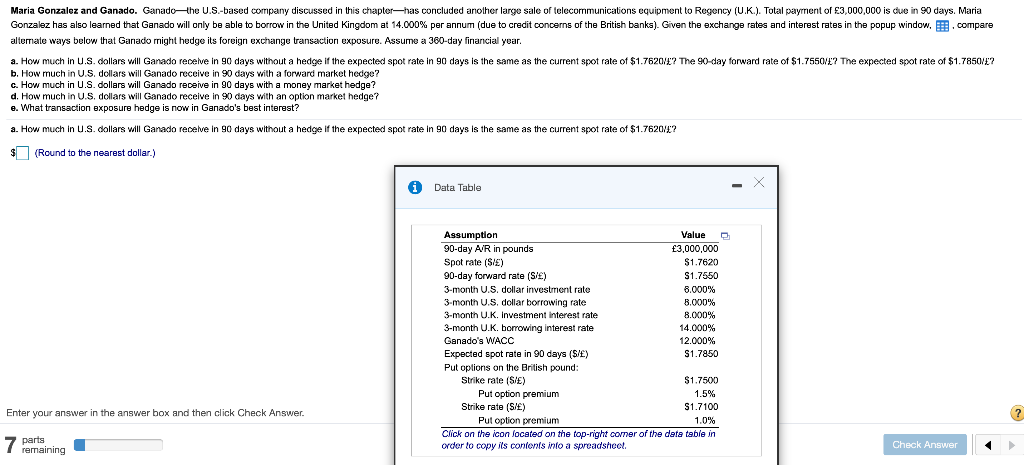

Maria Gonzalez and Ganado. Ganadothe U.S.-based company discussed in this chapterhas concluded another large sale of telecommunications equipment to Regency (U.K.). Total payment of 3,000,000 is due in 90 days. Maria Gonzalez has also learned that Ganado will only be able to borrow in the United Kingdom at 14.000% per annum (due to credit concerns of the British banks). Given the exchange rates and interest rates in the popup window, B.compare alternate ways below that Ganado right hedge its foreign exchange transaction exposure. Assume a 360-day financial year. a. How much in U.S. dollars will Ganado receive in 90 days without a hedge if the expected spot rate in 90 days is the same as the current spot rate of $1.7620/? The 90-day forward rate of $1.7550/? The expected spot rate of $1.7850/? b. How much in U.S. dollars will Ganado receive in 90 days with a forward market hedge? c. How much in U.S. dollars will Ganado receive in 90 days with a money market hedge? d. How much in U.S. dollars will Ganado receive in 90 days with an option market hedge? e. What transaction exposure hedge is now in Ganado's best interest? a. How much in U.S. dollars will Ganado receive in 90 days without a hedge of the expected spot rate in 90 days is the same as the current spot rate of $1.7620? (Round to the nearest dollar.) i Data Table - Assumption Value 90-day A/R in pounds 3,000,000 Spot rate (SIE $1.7620 90-day forward rate (S/E) S1.7550 3-month U.S. dollar investment rate 6.000% 3-month U.S. dollar borrowing rate 8.000% 3-month U.K. Investment interest rate 8.000% 3-month U.K. borrowing interest rate 14.000% Ganado's WACC 12.000% Expected spot rate in 90 days (S/E) $1.7850 Put options on the British pound: Strike rate (S/E) $1.7500 Put option premium 1.5% Strike rate (S/E) $1.7100 Put option premium 1.0% Click on the icon located on the top-right corner of the dete table in order to copy its contents into a spreadsheet Enter your answer in the answer box and then click Check Answer. ? 7 parts 7 Check Answer remaining Maria Gonzalez and Ganado. Ganadothe U.S.-based company discussed in this chapterhas concluded another large sale of telecommunications equipment to Regency (U.K.). Total payment of 3,000,000 is due in 90 days. Maria Gonzalez has also learned that Ganado will only be able to borrow in the United Kingdom at 14.000% per annum (due to credit concerns of the British banks). Given the exchange rates and interest rates in the popup window, B.compare alternate ways below that Ganado right hedge its foreign exchange transaction exposure. Assume a 360-day financial year. a. How much in U.S. dollars will Ganado receive in 90 days without a hedge if the expected spot rate in 90 days is the same as the current spot rate of $1.7620/? The 90-day forward rate of $1.7550/? The expected spot rate of $1.7850/? b. How much in U.S. dollars will Ganado receive in 90 days with a forward market hedge? c. How much in U.S. dollars will Ganado receive in 90 days with a money market hedge? d. How much in U.S. dollars will Ganado receive in 90 days with an option market hedge? e. What transaction exposure hedge is now in Ganado's best interest? a. How much in U.S. dollars will Ganado receive in 90 days without a hedge of the expected spot rate in 90 days is the same as the current spot rate of $1.7620? (Round to the nearest dollar.) i Data Table - Assumption Value 90-day A/R in pounds 3,000,000 Spot rate (SIE $1.7620 90-day forward rate (S/E) S1.7550 3-month U.S. dollar investment rate 6.000% 3-month U.S. dollar borrowing rate 8.000% 3-month U.K. Investment interest rate 8.000% 3-month U.K. borrowing interest rate 14.000% Ganado's WACC 12.000% Expected spot rate in 90 days (S/E) $1.7850 Put options on the British pound: Strike rate (S/E) $1.7500 Put option premium 1.5% Strike rate (S/E) $1.7100 Put option premium 1.0% Click on the icon located on the top-right corner of the dete table in order to copy its contents into a spreadsheet Enter your answer in the answer box and then click Check Answer. ? 7 parts 7 Check Answer remaining