Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marianne has started to rent out her home while she is away travelling with work. In 2023/24 she rented her house out for eight

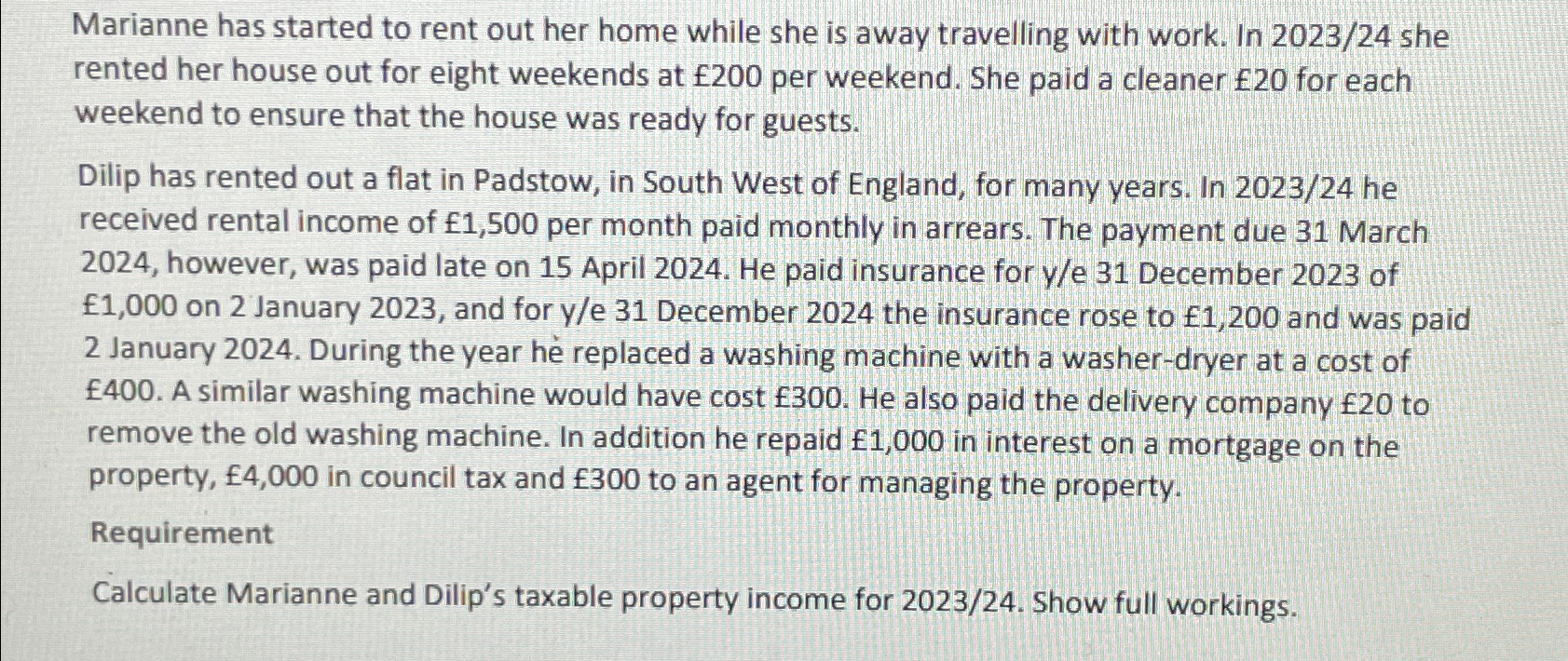

Marianne has started to rent out her home while she is away travelling with work. In 2023/24 she rented her house out for eight weekends at 200 per weekend. She paid a cleaner 20 for each weekend to ensure that the house was ready for guests. Dilip has rented out a flat in Padstow, in South West of England, for many years. In 2023/24 he received rental income of 1,500 per month paid monthly in arrears. The payment due 31 March 2024, however, was paid late on 15 April 2024. He paid insurance for y/e 31 December 2023 of 1,000 on 2 January 2023, and for y/e 31 December 2024 the insurance rose to 1,200 and was paid 2 January 2024. During the year he replaced a washing machine with a washer-dryer at a cost of 400. A similar washing machine would have cost 300. He also paid the delivery company 20 to remove the old washing machine. In addition he repaid 1,000 in interest on a mortgage on the property, 4,000 in council tax and 300 to an agent for managing the property. Requirement Calculate Marianne and Dilip's taxable property income for 2023/24. Show full workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Marianne and Dilips taxable property income for 202324 we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started