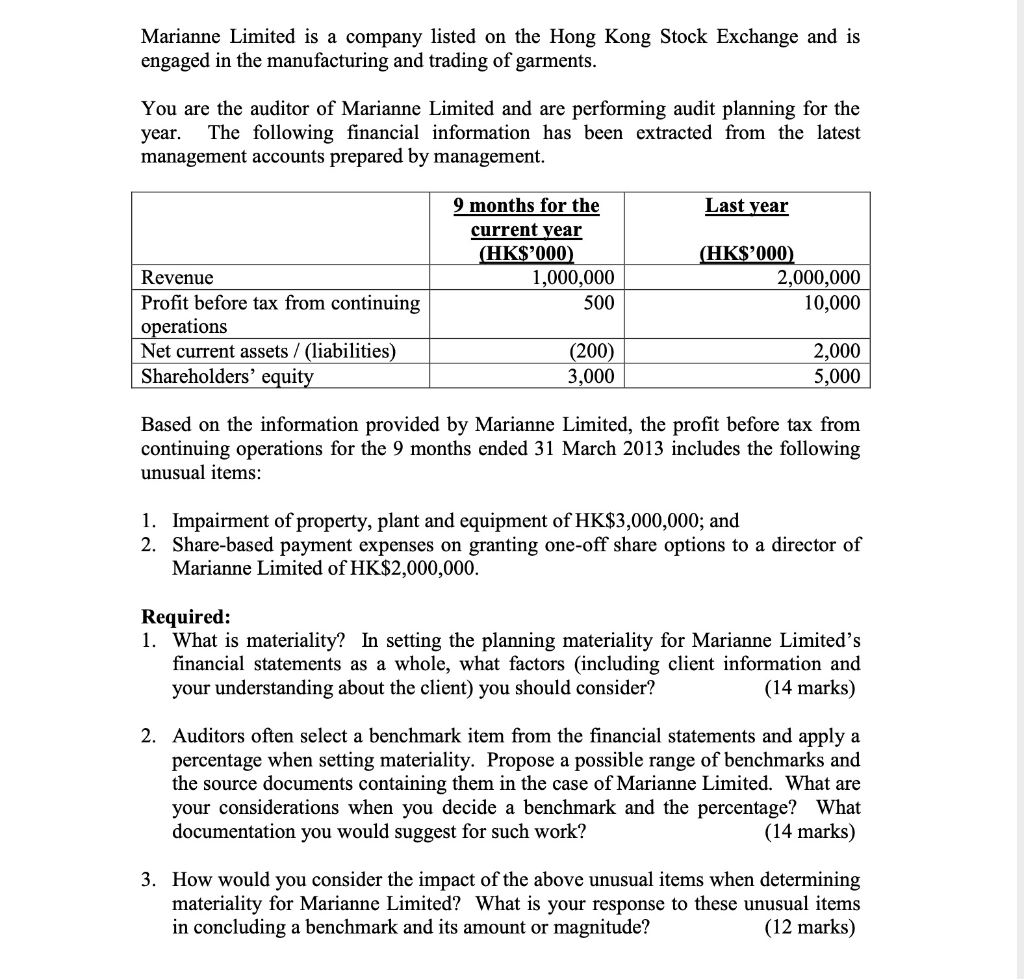

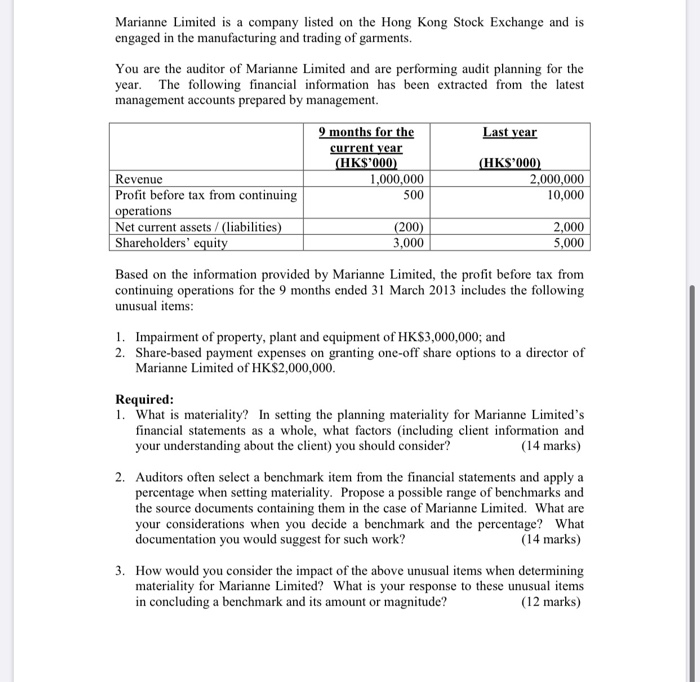

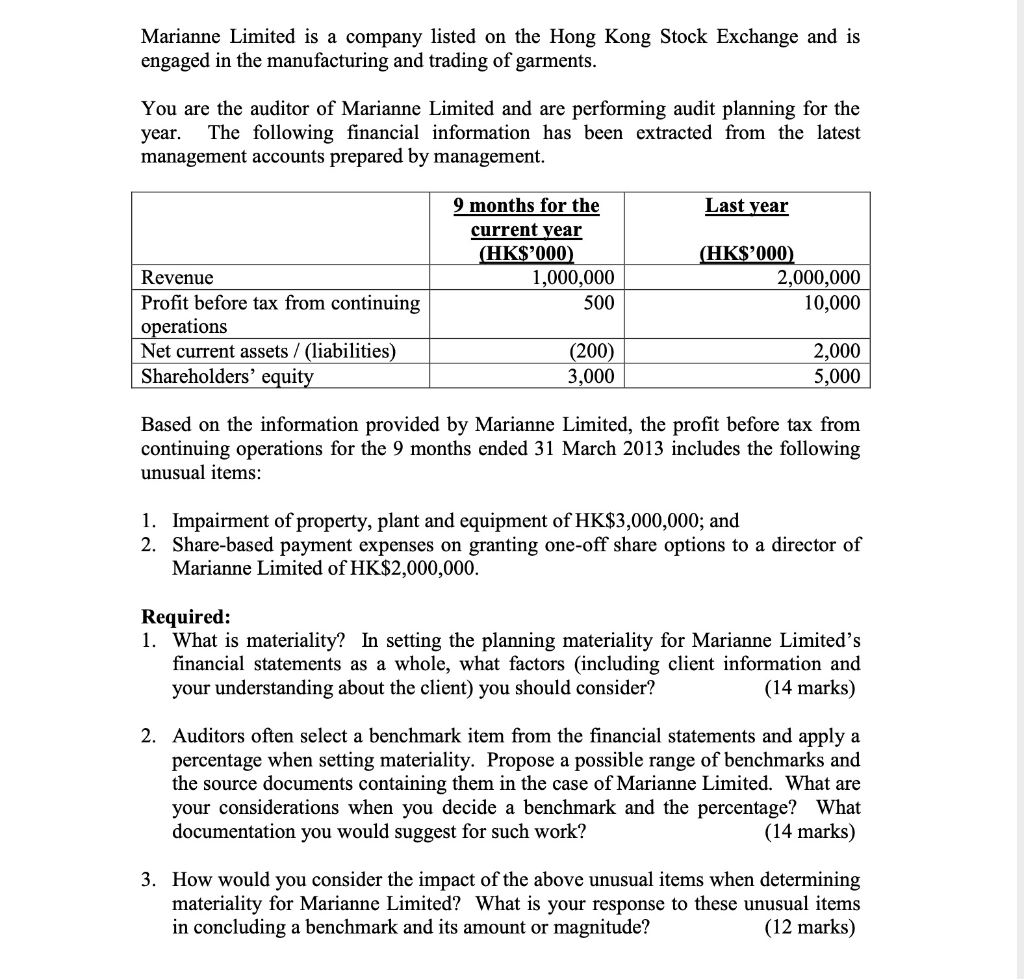

Marianne Limited is a company listed on the Hong Kong Stock Exchange and is engaged in the manufacturing and trading of garments. You are the auditor of Marianne Limited and are performing audit planning for the year. The following financial information has been extracted from the latest management accounts prepared by management. Last year 9 months for the current year (HK$'000) 1,000,000 500 (HK$'000) 2,000,000 10,000 Revenue Profit before tax from continuing operations Net current assets/ (liabilities) Shareholders' equity (200) 3,000 2,000 5,000 Based on the information provided by Marianne Limited, the profit before tax from continuing operations for the 9 months ended 31 March 2013 includes the following unusual items: 1. Impairment of property, plant and equipment of HK$3,000,000; and 2. Share-based payment expenses on granting one-off share options to a director of Marianne Limited of HK$2,000,000. Required: 1. What is materiality? In setting the planning materiality for Marianne Limited's financial statements as a whole, what factors (including client information and your understanding about the client) you should consider? (14 marks) 2. Auditors often select a benchmark item from the financial statements and apply a percentage when setting materiality. Propose a possible range of benchmarks and the source documents containing them in the case of Marianne Limited. What are your considerations when you decide a benchmark and the percentage? What documentation you would suggest for such work? (14 marks) 3. How would you consider the impact of the above unusual items when determining materiality for Marianne Limited? What is your response to these unusual items in concluding a benchmark and its amount or magnitude? (12 marks) Marianne Limited is a company listed on the Hong Kong Stock Exchange and is engaged in the manufacturing and trading of garments. You are the auditor of Marianne Limited and are performing audit planning for the year. The following financial information has been extracted from the latest management accounts prepared by management. Last year 9 months for the current vear (HK$'000) 1,000,000 500 (HKS'000) 2,000,000 10,000 Revenue Profit before tax from continuing operations Net current assets/ (liabilities) Shareholders' equity (200) 3,000 2,000 5,000 Based on the information provided by Marianne Limited, the profit before tax from continuing operations for the 9 months ended 31 March 2013 includes the following unusual items: 1. Impairment of property, plant and equipment of HK$3,000,000; and 2. Share-based payment expenses on granting one-off share options to a director of Marianne Limited of HK$2,000,000. Required: 1. What is materiality? In setting the planning materiality for Marianne Limited's financial statements as a whole, what factors (including client information and your understanding about the client) you should consider? (14 marks) 2. Auditors often select a benchmark item from the financial statements and apply a percentage when setting materiality. Propose a possible range of benchmarks and the source documents containing them in the case of Marianne Limited. What are your considerations when you decide a benchmark and the percentage? What documentation you would suggest for such work? (14 marks) 3. How would you consider the impact of the above unusual items when determining materiality for Marianne Limited? What is your response to these unusual items in concluding a benchmark and its amount or magnitude? (12 marks)