Answered step by step

Verified Expert Solution

Question

1 Approved Answer

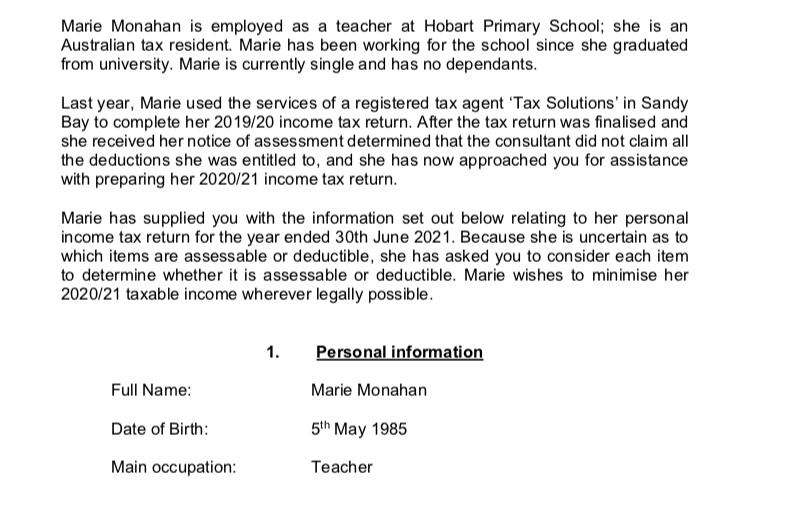

Marie Monahan is employed as a teacher at Hobart Primary School; she is an Australian tax resident. Marie has been working for the school

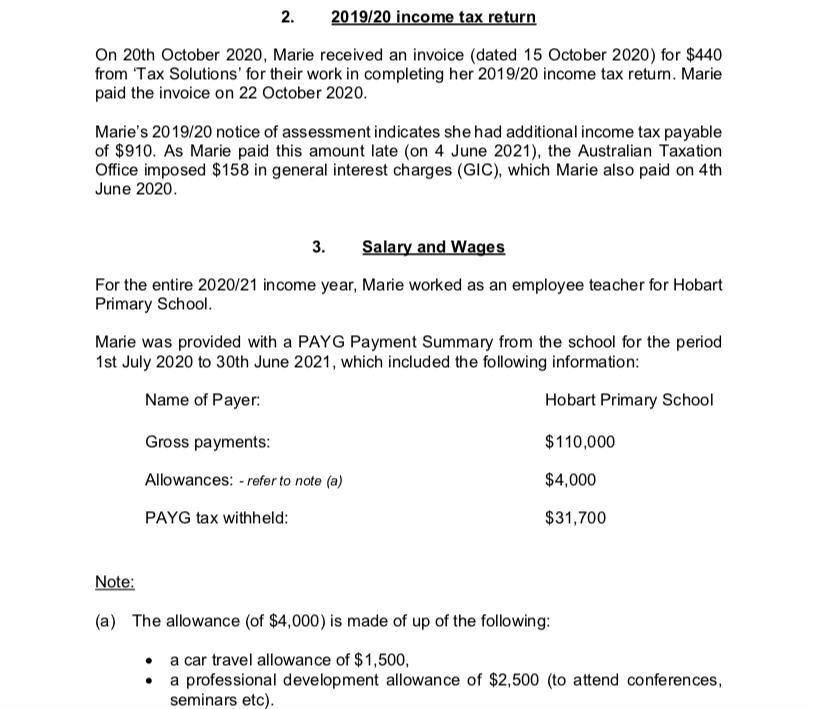

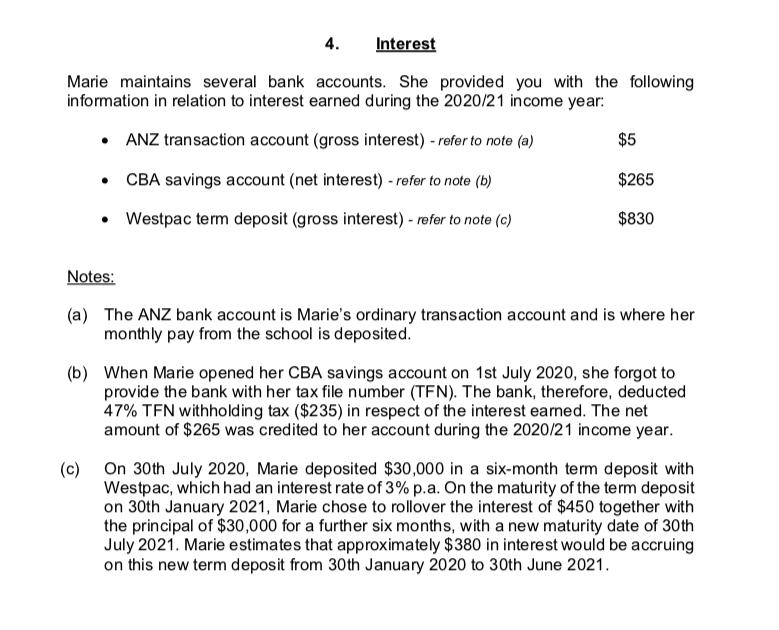

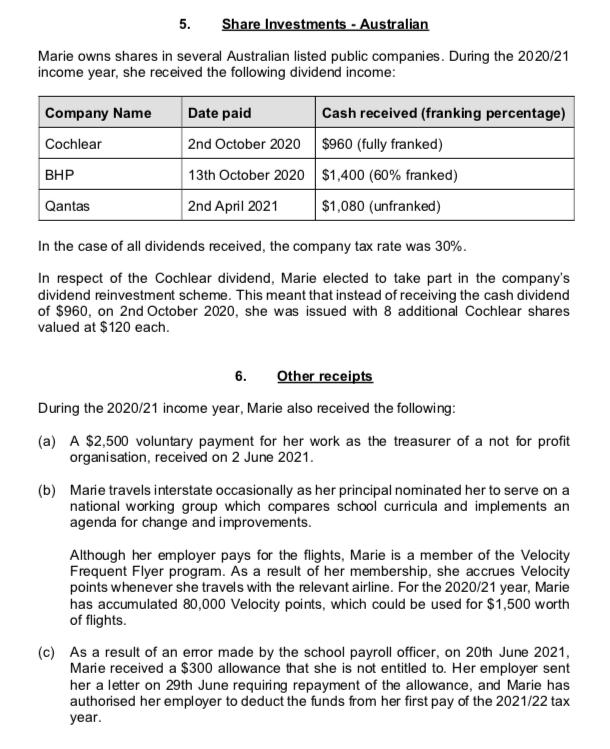

Marie Monahan is employed as a teacher at Hobart Primary School; she is an Australian tax resident. Marie has been working for the school since she graduated from university. Marie is currently single and has no dependants. Last year, Marie used the services of a registered tax agent 'Tax Solutions' in Sandy Bay to complete her 2019/20 income tax return. After the tax return was finalised and she received her notice of assessment determined that the consultant did not claim all the deductions she was entitled to, and she has now approached you for assistance with preparing her 2020/21 income tax return. Marie has supplied you with the information set out below relating to her personal income tax return for the year ended 30th June 2021. Because she is uncertain as to which items are assessable or deductible, she has asked you to consider each item to determine whether it is assessable or deductible. Marie wishes to minimise her 2020/21 taxable income wherever legally possible. Full Name: Date of Birth: Main occupation: 1. Personal information Marie Monahan 5th May 1985 Teacher 2019/20 income tax return On 20th October 2020, Marie received an invoice (dated 15 October 2020) for $440 from 'Tax Solutions' for their work in completing her 2019/20 income tax return. Marie paid the invoice on 22 October 2020. 2. Marie's 2019/20 notice of assessment indicates she had additional income tax payable of $910. As Marie paid this amount late (on 4 June 2021), the Australian Taxation Office imposed $158 in general interest charges (GIC), which Marie also paid on 4th June 2020. Salary and Wages For the entire 2020/21 income year, Marie worked as an employee teacher for Hobart Primary School. 3. Marie was provided with a PAYG Payment Summary from the school for the period 1st July 2020 to 30th June 2021, which included the following information: Name of Payer: Gross payments: Allowances: - refer to note (a) PAYG tax withheld: . Hobart Primary School $110,000 $4,000 $31,700 Note: (a) The allowance (of $4,000) is made of up of the following: a car travel allowance of $1,500, a professional development allowance of $2,500 (to attend conferences, seminars etc). 4. Interest Marie maintains several bank accounts. She provided you with the following information in relation to interest earned during the 2020/21 income year: ANZ transaction account (gross interest) - refer to note (a) CBA savings account (net interest) - refer to note (b) Westpac term deposit (gross interest) - refer to note (c) $5 $265 $830 Notes: (a) The ANZ bank account is Marie's ordinary transaction account and is where her monthly pay from the school is deposited. (b) When Marie opened her CBA savings account on 1st July 2020, she forgot to provide the bank with her tax file number (TFN). The bank, therefore, deducted 47% TFN withholding tax ($235) in respect of the interest earned. The net amount of $265 was credited to her account during the 2020/21 income year. (c) On 30th July 2020, Marie deposited $30,000 in a six-month term deposit with Westpac, which had an interest rate of 3% p.a. On the maturity of the term deposit on 30th January 2021, Marie chose to rollover the interest of $450 together with the principal of $30,000 for a further six months, with a new maturity date of 30th July 2021. Marie estimates that approximately $380 in interest would be accruing on this new term deposit from 30th January 2020 to 30th June 2021. 5. Share Investments - Australian Marie owns shares in several Australian listed public companies. During the 2020/21 income year, she received the following dividend income: Company Name Cochlear Qantas Date paid 2nd October 2020 13th October 2020 2nd April 2021 Cash received (franking percentage) $960 (fully franked) $1,400 (60% franked) $1,080 (unfranked) In the case of all dividends received, the company tax rate was 30%. In respect of the Cochlear dividend, Marie elected to take part in the company's dividend reinvestment scheme. This meant that instead of receiving the cash dividend of $960, on 2nd October 2020, she was issued with 8 additional Cochlear shares valued at $120 each. 6. Other receipts During the 2020/21 income year, Marie also received the following: (a) A $2,500 voluntary payment for her work as the treasurer of a not for profit organisation, received on 2 June 2021. (b) Marie travels interstate occasionally as her principal nominated her to serve on a national working group which compares school curricula and implements an agenda for change and improvements. Although her employer pays for the flights, Marie is a member of the Velocity Frequent Flyer program. As a result of her membership, she accrues Velocity points whenever she travels with the relevant airline. For the 2020/21 year, Marie has accumulated 80,000 Velocity points, which could be used for $1,500 worth of flights. (c) As a result of an error made by the school payroll officer, on 20th June 2021, Marie received a $300 allowance that she is not entitled to. Her employer sent her a letter on 29th June requiring repayment of the allowance, and Marie has authorised her employer to deduct the funds from her first pay of the 2021/22 tax year. 7. Expenses During the 2020/21 income year Marie incurred the expenses listed below, and she believes that some are related to her employment as a teacher. Marie has advised you that she has receipts for all the expenses listed. Education Conference (for professional development purposes) During the 2020/21 income year, Marie paid for and attended an education conference. She considers this to be an important aspect of her ongoing development as an effective teacher. The conference cost $1,000 to attend. Travel expenses The conference was held on a day when Marie would normally be teaching. She drove to school on the morning of the conference to complete some teaching administration work and then she drove 10 kilometres to the conference venue. At the end of the conference, she did not return to her workplace and instead drove directly home (15 kilometres). Marie did not keep a logbook for any of her car travel in 2020/21. Public transport During 2020/21, Marie discovered that her car required an engine rebuild and, consequently, she did not have access to her car for four weeks. During this time, she travelled to and from work by bus. She kept a record of her bus fares for the 2020/21 and they were $74 in total. DVD Marie teaches history and she purchased The Civil War on DVD to use in her classes. Union membership fees $1,000 $? $74 $40 $1,100 Marie is a member of the Australian Education Union and she pays her membership fees each month by direct debit. Shoes Marie purchased a pair of brown leather shoes on 1 July 2020 that she wears exclusively to work. She is keen to claim a deduction for this expense as she considers that it is the type of footwear that is appropriate for the workplace and that there is no private use benefit. $250

Step by Step Solution

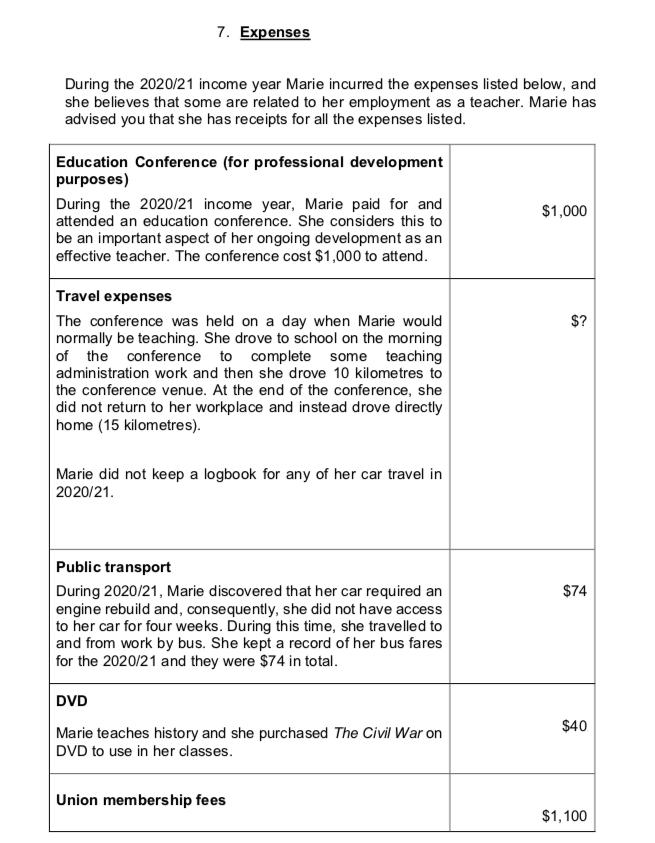

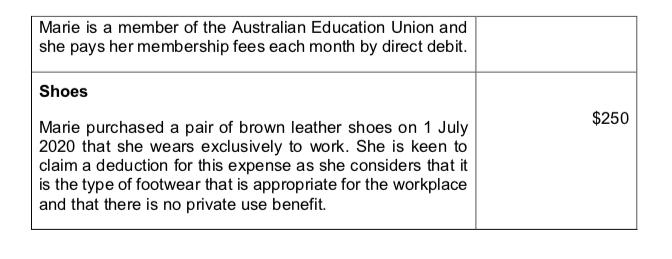

★★★★★

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

SNo Income Amount Taxability Reason 2 201920 Income Tax Return Payment to Tax Solution 440 Not Deductible Tax preparation fees are a miscellaneous ite...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started