Answered step by step

Verified Expert Solution

Question

1 Approved Answer

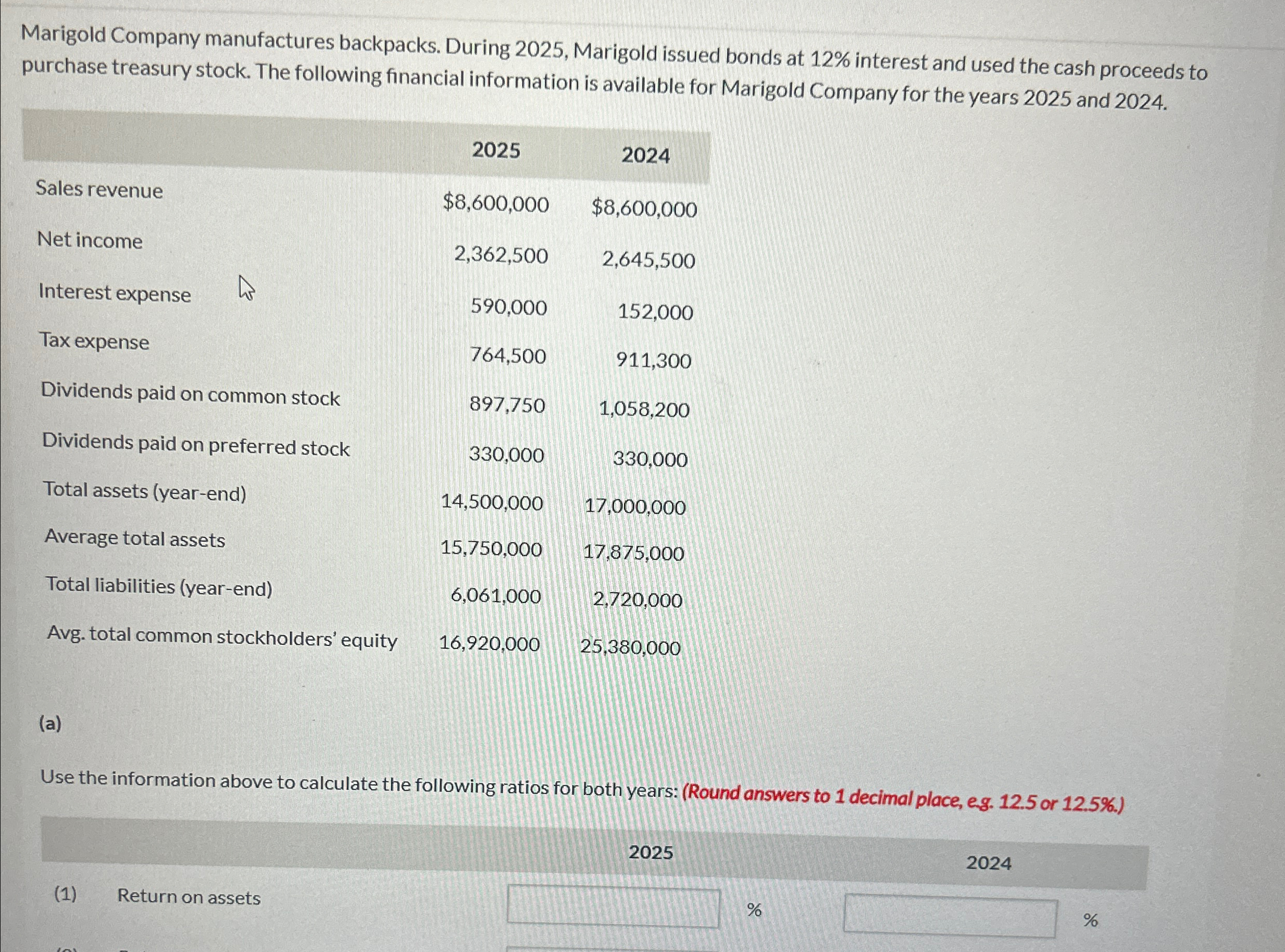

Marigold Company manufactures backpacks. During 2025, Marigold issued bonds at 12% interest and used the cash proceeds to purchase treasury stock. The following financial

Marigold Company manufactures backpacks. During 2025, Marigold issued bonds at 12% interest and used the cash proceeds to purchase treasury stock. The following financial information is available for Marigold Company for the years 2025 and 2024. 2025 2024 Sales revenue $8,600,000 $8,600,000 Net income 2,362,500 2,645,500 Interest expense W 590,000 152,000 Tax expense 764,500 911,300 Dividends paid on common stock 897,750 1,058,200 Dividends paid on preferred stock 330,000 330,000 Total assets (year-end) 14,500,000 17,000,000 Average total assets 15,750,000 17.875.000 Total liabilities (year-end) 6,061,000 2,720,000 Avg. total common stockholders' equity 16,920,000 25,380,000 (a) Use the information above to calculate the following ratios for both years: (Round answers to 1 decimal place, e.g. 12.5 or 12.5%.) (1) Return on assets 2025 % do 2024 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started