Answered step by step

Verified Expert Solution

Question

1 Approved Answer

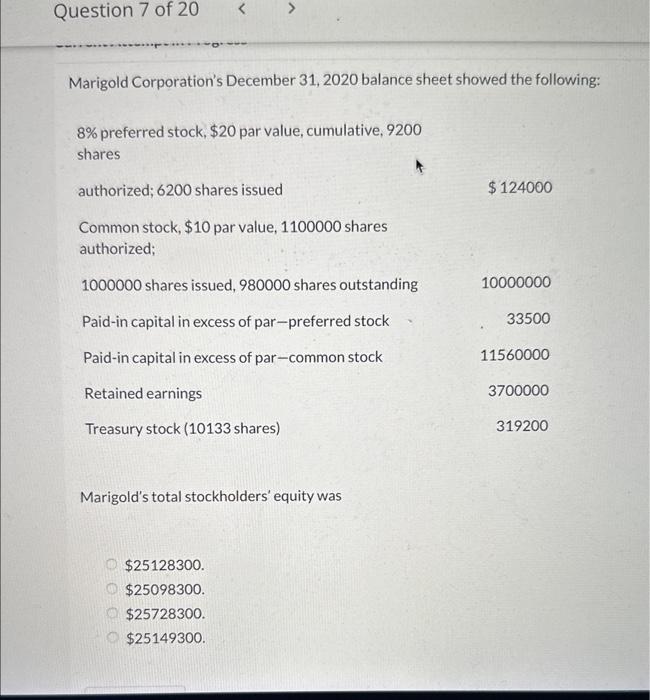

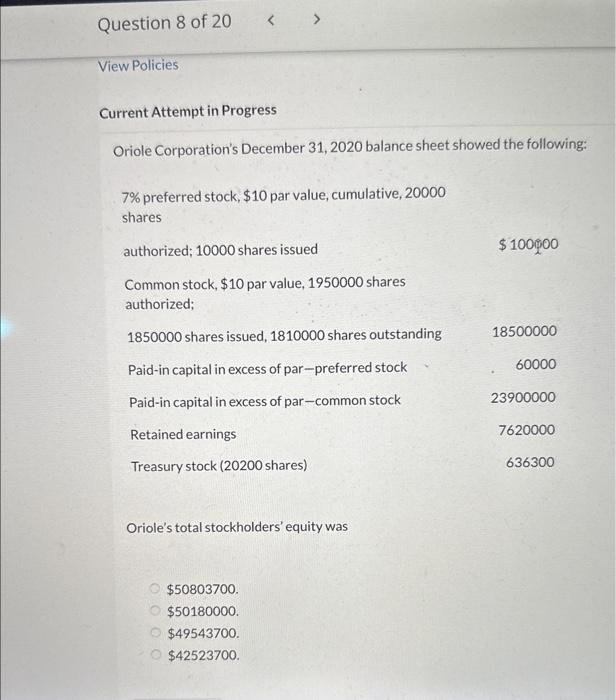

Marigold Corporation's December 31, 2020 balance sheet showed the following: 8% preferred stock, $20 par value, cumulative, 9200 Marigold's total stockholders' equity was $25128300.$25098300.$25728300.$25149300. Oriole's

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started