Marigold, Inc. has had some turnover in its parts inventory area. As a result, some inventory counting errors have been made in taking the

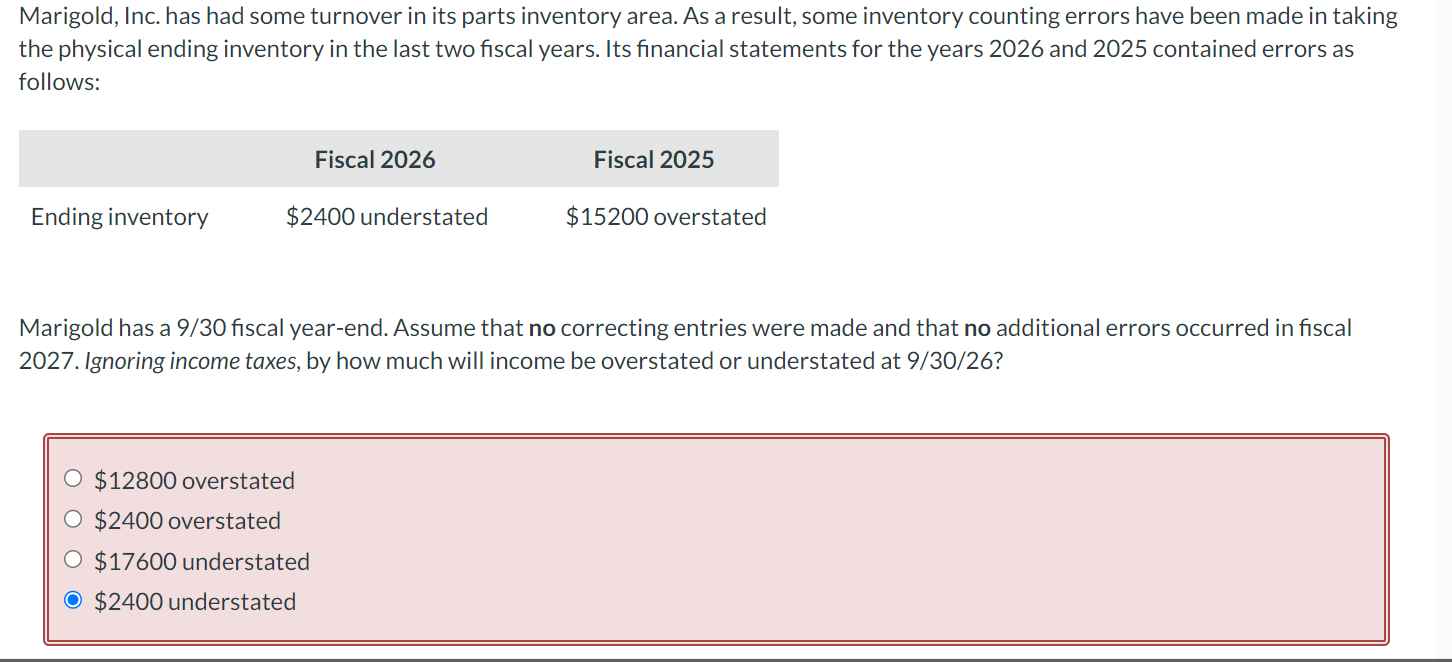

Marigold, Inc. has had some turnover in its parts inventory area. As a result, some inventory counting errors have been made in taking the physical ending inventory in the last two fiscal years. Its financial statements for the years 2026 and 2025 contained errors as follows: Fiscal 2026 Fiscal 2025 Ending inventory $2400 understated $15200 overstated Marigold has a 9/30 fiscal year-end. Assume that no correcting entries were made and that no additional errors occurred in fiscal 2027. Ignoring income taxes, by how much will income be overstated or understated at 9/30/26? O $12800 overstated O $2400 overstated O $17600 understated O $2400 understated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the impact of inventory errors on income at 93026 lets analyze the inventory errors for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started