Answered step by step

Verified Expert Solution

Question

1 Approved Answer

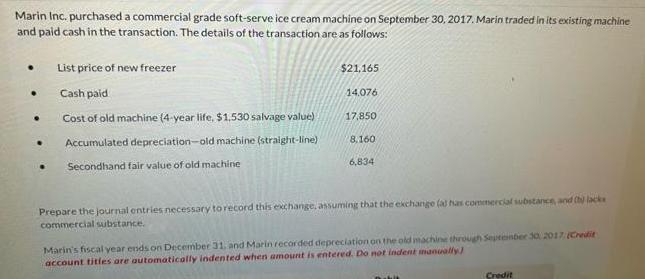

Marin Inc. purchased a commercial grade soft-serve ice cream machine on September 30, 2017. Marin traded in its existing machine and paid cash in

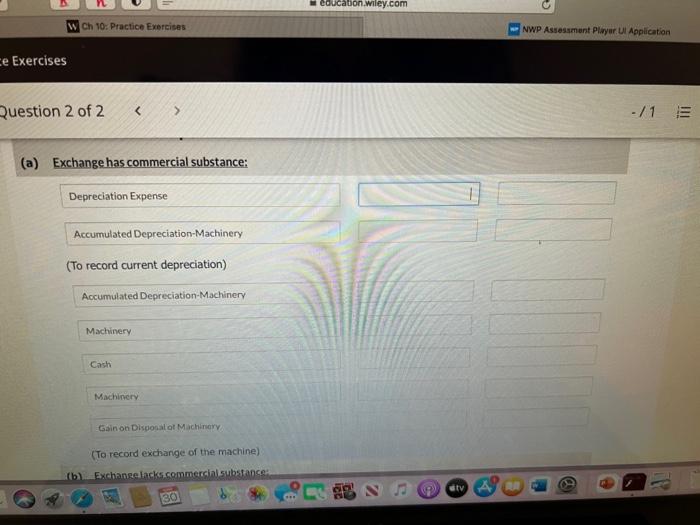

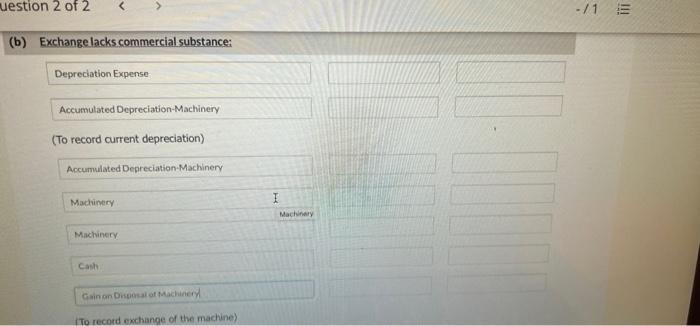

Marin Inc. purchased a commercial grade soft-serve ice cream machine on September 30, 2017. Marin traded in its existing machine and paid cash in the transaction. The details of the transaction are as follows: List price of new freezer $21,165 Cash paid 14.076 Cost of old machine (4-year life, $1,530 salvage value) 17,850 8,160 Accumulated depreciation-old machine (straight-line) 6,834 Secondhand fair value of old machine Prepare the journal entries necessary to record this exchange, assuming that the exchange (al has commercial substance, and () lacke commercial suibstance. Marin's fiscal year ends on December 31. and Marin recorded depreciation on the old imachine through Septenber 3o 2017 (Credit account titles are automatically indented when amount is entered. Do not indent manually Credit education.wiley.com W Ch 10: Practice Exercises NWP Assessment Player Ul Application ce Exercises Question 2 of 2 -/1 E (a) Exchange has commercial substance: Depreciation Expense Accumulated Depreciation-Machinery (To record current depreciation) Accumulated Depreciation-Machinery Machinery Cash Machinery Gain on Disposal of MachineryY (To record exchange of the machine) (b) Exchange lacks.commercial substance: dtv 30 uestion 2 of 2 -/1 (b) Exchange lacks commercial substance: Depreciation Expense Accumulated Depreciation-Machinery (To record current depreciation) Accumulated Depreciation-Machinery Machinery Machinery Machinery Cash Gain on Disposal of Machinery (To record exchange of the machine) I!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DATE ACCOUNTS DEBIT CREDIT Depreciation Expense Accumula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started