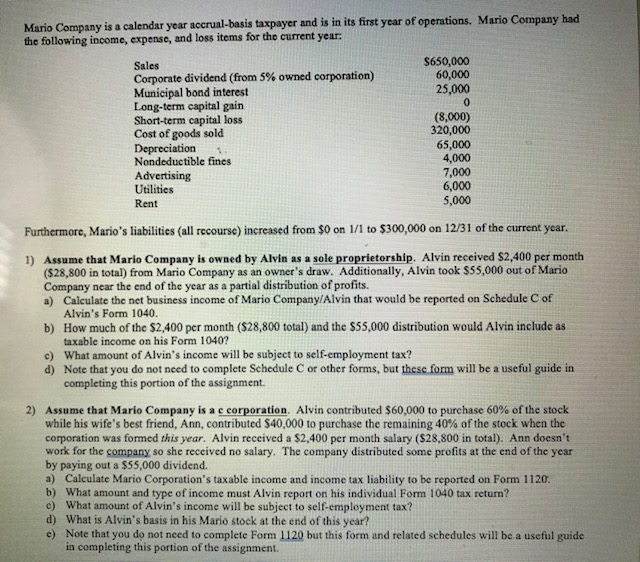

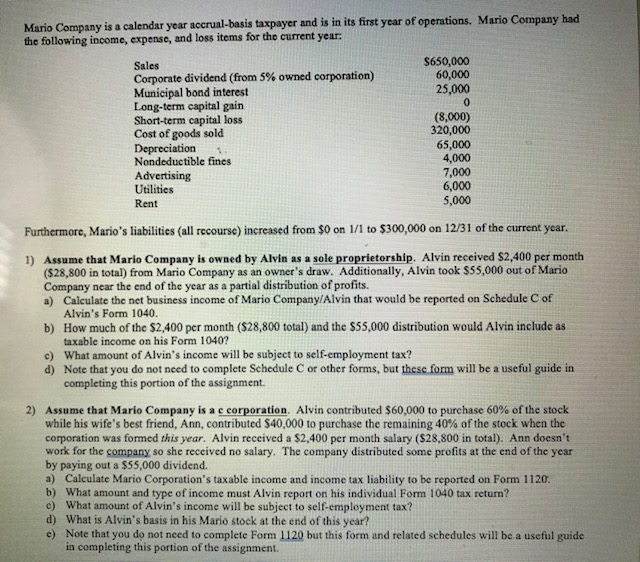

Mario Company is a calendar year accrual basis taxpayer and is in its first year of operations. Mario Company had the following income, expense, and loss items for the current year: $650,000 60,000 25,000 Sales Corporate dividend (from 5% owned corporation) Municipal bond interest Long-term capital gain Short-term capital loss Cost of goods sold Depreciation Nondeductible fines Advertising Utilities Rent (8,000) 320,000 65,000 4,000 7,000 6,000 5,000 Furthermore, Mario's liabilities (all recourse) increased from $0 on 1/1 to $300,000 on 12/31 of the current year. 1) Assume that Mario Company is owned by Alvin as a sole proprietorship. Alvin received $2,400 per month (528,800 in total) from Mario Company as an owner's draw. Additionally, Alvin took $55.000 out of Mario Company near the end of the year as a partial distribution of profits. a) Calculate the net business income of Mario Company Alvin that would be reported on Schedule C of Alvin's Form 1040. b) How much of the $2,400 per month (528,800 total) and the $55,000 distribution would Alvin include as taxable income on his Form 1040? c) What amount of Alvin's income will be subject to self-employment tax? d) Note that you do not need to complete Schedule C or other forms, but these form will be a useful guide in completing this portion of the assignment. 2) Assume that Mario Company is a c corporation. Alvin contributed $60,000 to purchase 60% of the stock while his wife's best friend, Ann, contributed $40,000 to purchase the remaining 40% of the stock when the corporation was formed this year. Alvin received a $2,400 per month salary ($28,800 in total). Ann doesn't work for the company so she received no salary. The company distributed some profits at the end of the year by paying out a $55,000 dividend. a) Calculate Mario Corporation's taxable income and income tax liability to be reported on Form 1120. b) What amount and type of income must Alvin report on his individual Form 1040 tax return? c) What amount of Alvin's income will be subject to self-employment tax? d) What is Alvin's basis in his Mario stock at the end of this year? e) Note that you do not need to complete Form 1120 but this form and related schedules will be a useful guide in completing this portion of the assignment. Mario Company is a calendar year accrual basis taxpayer and is in its first year of operations. Mario Company had the following income, expense, and loss items for the current year: $650,000 60,000 25,000 Sales Corporate dividend (from 5% owned corporation) Municipal bond interest Long-term capital gain Short-term capital loss Cost of goods sold Depreciation Nondeductible fines Advertising Utilities Rent (8,000) 320,000 65,000 4,000 7,000 6,000 5,000 Furthermore, Mario's liabilities (all recourse) increased from $0 on 1/1 to $300,000 on 12/31 of the current year. 1) Assume that Mario Company is owned by Alvin as a sole proprietorship. Alvin received $2,400 per month (528,800 in total) from Mario Company as an owner's draw. Additionally, Alvin took $55.000 out of Mario Company near the end of the year as a partial distribution of profits. a) Calculate the net business income of Mario Company Alvin that would be reported on Schedule C of Alvin's Form 1040. b) How much of the $2,400 per month (528,800 total) and the $55,000 distribution would Alvin include as taxable income on his Form 1040? c) What amount of Alvin's income will be subject to self-employment tax? d) Note that you do not need to complete Schedule C or other forms, but these form will be a useful guide in completing this portion of the assignment. 2) Assume that Mario Company is a c corporation. Alvin contributed $60,000 to purchase 60% of the stock while his wife's best friend, Ann, contributed $40,000 to purchase the remaining 40% of the stock when the corporation was formed this year. Alvin received a $2,400 per month salary ($28,800 in total). Ann doesn't work for the company so she received no salary. The company distributed some profits at the end of the year by paying out a $55,000 dividend. a) Calculate Mario Corporation's taxable income and income tax liability to be reported on Form 1120. b) What amount and type of income must Alvin report on his individual Form 1040 tax return? c) What amount of Alvin's income will be subject to self-employment tax? d) What is Alvin's basis in his Mario stock at the end of this year? e) Note that you do not need to complete Form 1120 but this form and related schedules will be a useful guide in completing this portion of the assignment