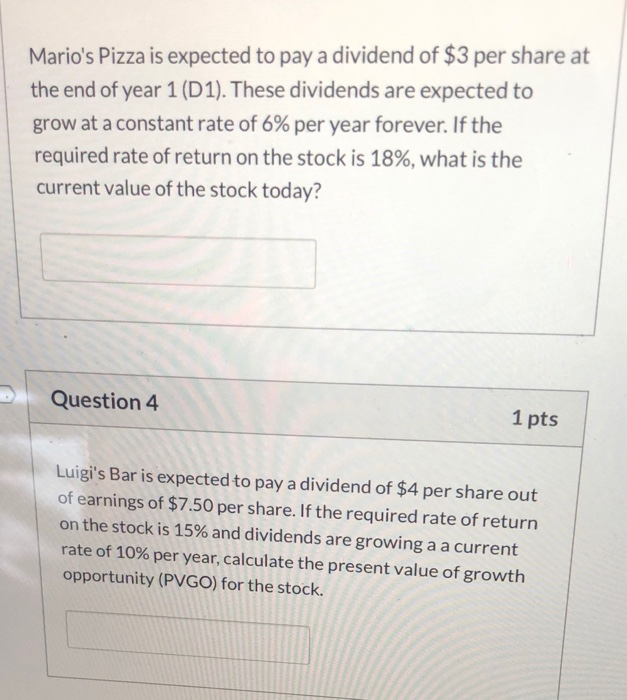

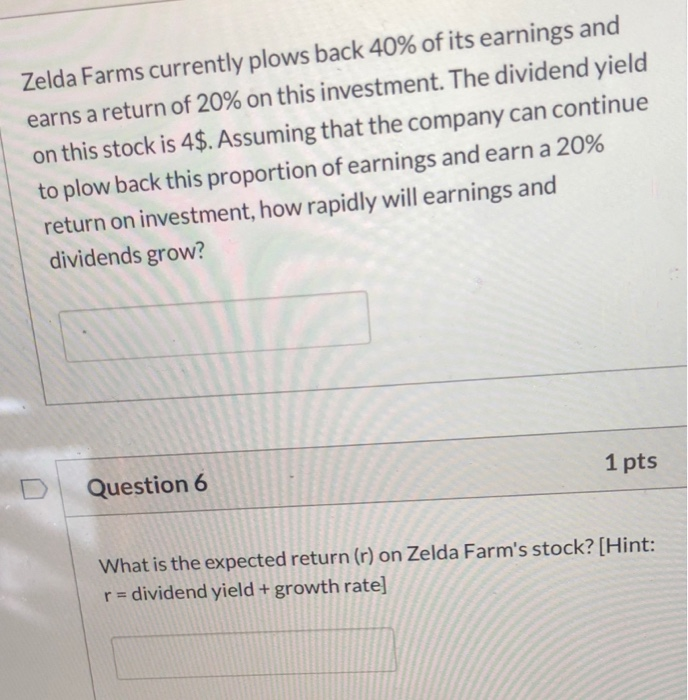

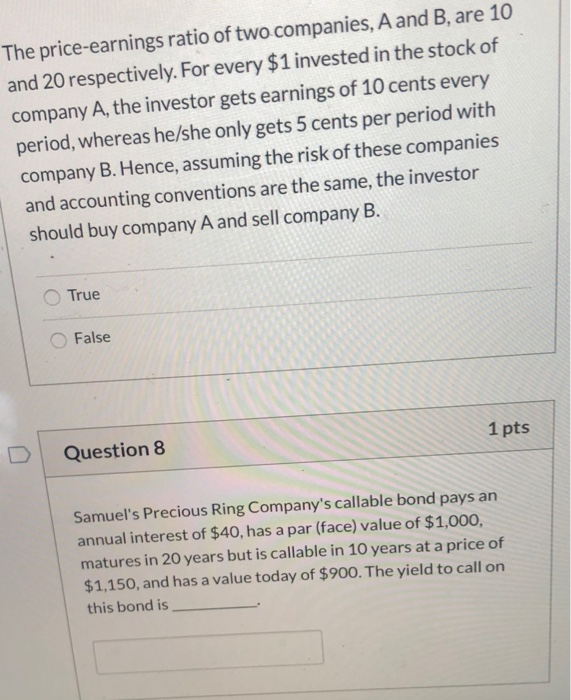

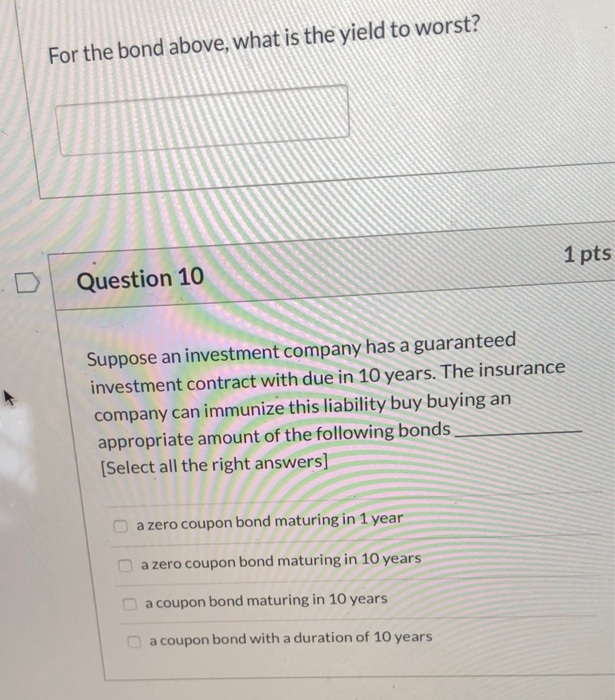

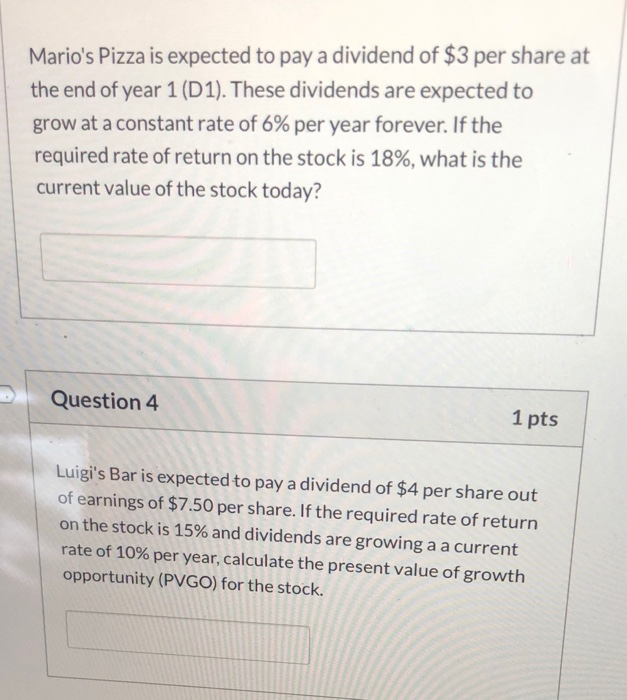

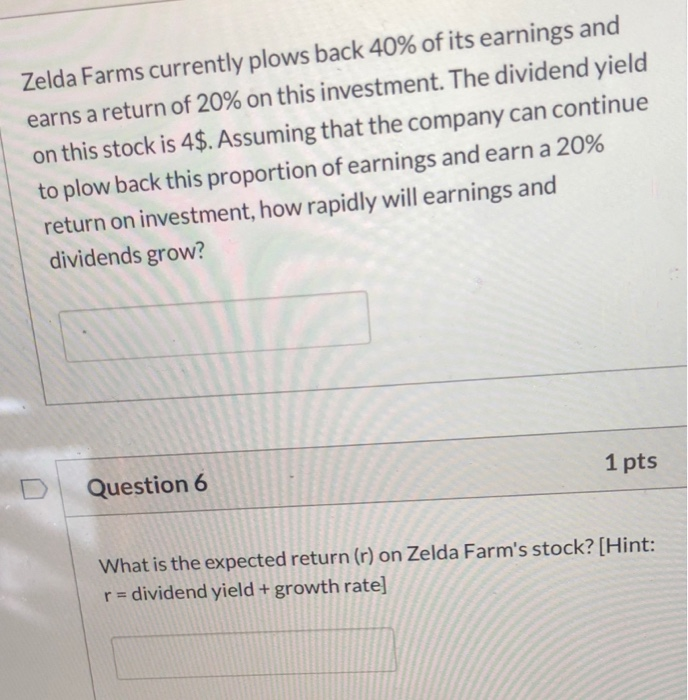

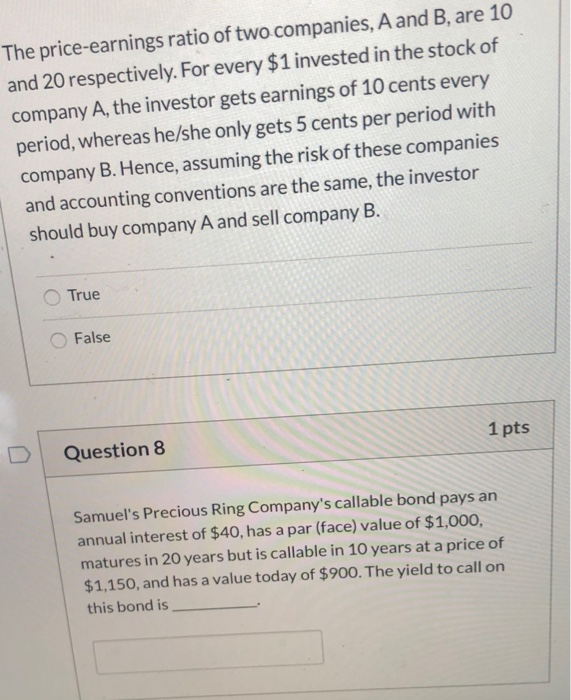

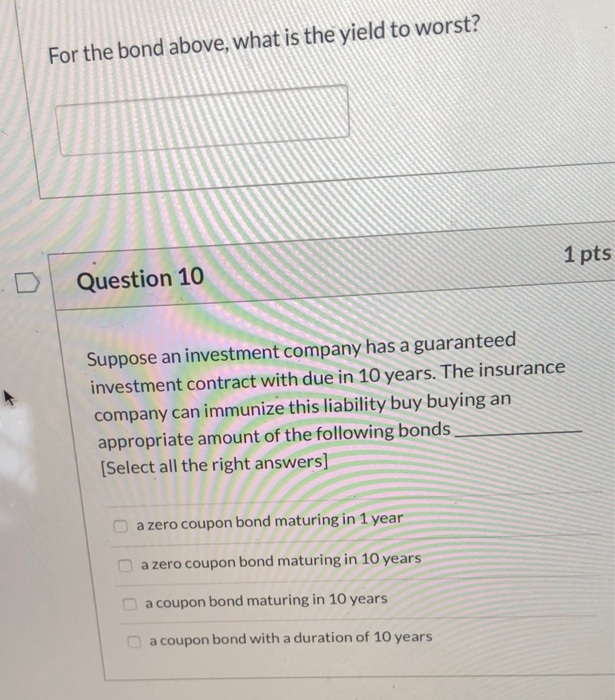

Mario's Pizza is expected to pay a dividend of $3 per share at the end of year 1 (D1). These dividends are expected to grow at a constant rate of 6% per year forever. If the required rate of return on the stock is 18%, what is the current value of the stock today? Question 4 1 pts Luigi's Bar is expected to pay a dividend of $4 per share out of earnings of $7.50 per share. If the required rate of return on the stock is 15% and dividends are growing a a current rate of 10% per year, calculate the present value of growth opportunity (PVGO) for the stock. Zelda Farms currently plows back 40% of its earnings and earns a return of 20% on this investment. The dividend yield on this stock is 4$. Assuming that the company can continue to plow back this proportion of earnings and earn a 20% return on investment, how rapidly will earnings and dividends grow? 1 pts Question 6 What is the expected return (r) on Zelda Farm's stock? (Hint: r = dividend yield + growth rate) The price-earnings ratio of two companies, A and B, are 10 and 20 respectively. For every $1 invested in the stock of company A, the investor gets earnings of 10 cents every period, whereas he/she only gets 5 cents per period with company B. Hence, assuming the risk of these companies and accounting conventions are the same, the investor should buy company A and sell company B. True False 1 pts Question 8 Samuel's Precious Ring Company's callable bond pays an annual interest of $40, has a par (face) value of $1,000, matures in 20 years but is callable in 10 years at a price of $1,150, and has a value today of $900. The yield to call on this bond is For the bond above, what is the yield to worst? 1 pts . Question 10 Suppose an investment company has a guaranteed investment contract with due in 10 years. The insurance company can immunize this liability buy buying an appropriate amount of the following bonds [Select all the right answers] a zero coupon bond maturing in 1 year a zero coupon bond maturing in 10 years a coupon bond maturing in 10 years a coupon bond with a duration of 10 years