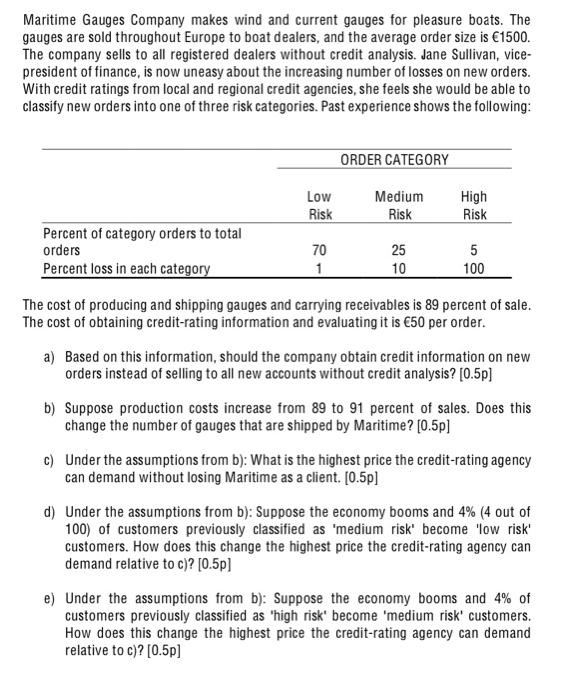

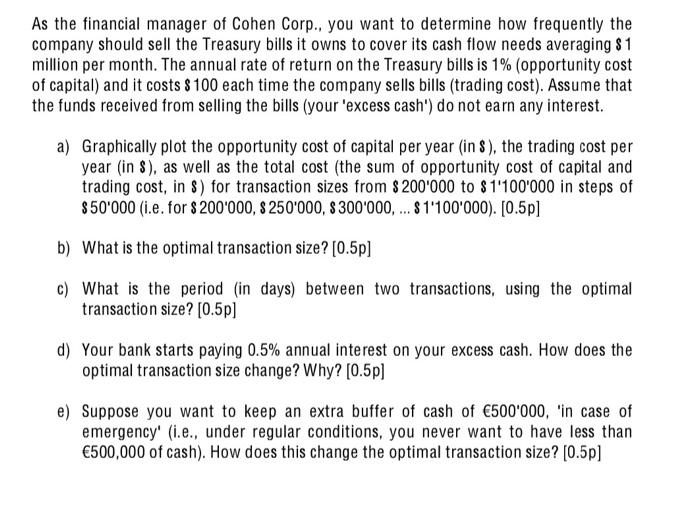

Maritime Gauges Company makes wind and current gauges for pleasure boats. The gauges are sold throughout Europe to boat dealers, and the average order size is 1500. The company sells to all registered dealers without credit analysis. Jane Sullivan, vice- president of finance, is now uneasy about the increasing number of losses on new orders. With credit ratings from local and regional credit agencies, she feels she would be able to classify new orders into one of three risk categories. Past experience shows the following: ORDER CATEGORY Low Risk Medium Risk High Risk Percent of category orders to total orders Percent loss in each category 70 1 25 10 5 100 The cost of producing and shipping gauges and carrying receivables is 89 percent of sale. The cost of obtaining credit-rating information and evaluating it is 50 per order. a) Based on this information, should the company obtain credit information on new orders instead of selling to all new accounts without credit analysis? [0.5p) b) Suppose production costs increase from 89 to 91 percent of sales. Does this change the number of gauges that are shipped by Maritime? [0.5p] c) Under the assumptions from b): What is the highest price the credit-rating agency can demand without losing Maritime as a client. [0.5p] d) Under the assumptions from b): Suppose the economy booms and 4% (4 out of 100) of customers previously classified as 'medium risk" become 'low risk' customers. How does this change the highest price the credit-rating agency can demand relative to c)? [0.5p) e) Under the assumptions from b): Suppose the economy booms and 4% of customers previously classified as "high risk' become 'medium risk' customers. How does this change the highest price the credit-rating agency can demand relative to c)? [0.5p] As the financial manager of Cohen Corp., you want to determine how frequently the company should sell the Treasury bills it owns to cover its cash flow needs averaging $1 million per month. The annual rate of return on the Treasury bills is 1% (opportunity cost of capital) and it costs $ 100 each time the company sells bills (trading cost). Assume that the funds received from selling the bills (your 'excess cash') do not earn any interest. a) Graphically plot the opportunity cost of capital per year (in 8), the trading cost per year (in 8), as well as the total cost (the sum of opportunity cost of capital and trading cost, in 8) for transaction sizes from $200'000 to $1'100'000 in steps of $ 50'000 (i.e. for $200'000, $ 250'000, $ 300'000, ... $ 1'100'000). [0.5p] b) What is the optimal transaction size? [0.5p] c) What is the period (in days) between two transactions, using the optimal transaction size? [0.5p] d) Your bank starts paying 0.5% annual interest on your excess cash. How does the optimal transaction size change? Why? [0.5p] e) Suppose you want to keep an extra buffer of cash of 500'000, 'in case of emergency' (i.e., under regular conditions, you never want to have less than 500,000 of cash). How does this change the optimal transaction size? [0.5p] Maritime Gauges Company makes wind and current gauges for pleasure boats. The gauges are sold throughout Europe to boat dealers, and the average order size is 1500. The company sells to all registered dealers without credit analysis. Jane Sullivan, vice- president of finance, is now uneasy about the increasing number of losses on new orders. With credit ratings from local and regional credit agencies, she feels she would be able to classify new orders into one of three risk categories. Past experience shows the following: ORDER CATEGORY Low Risk Medium Risk High Risk Percent of category orders to total orders Percent loss in each category 70 1 25 10 5 100 The cost of producing and shipping gauges and carrying receivables is 89 percent of sale. The cost of obtaining credit-rating information and evaluating it is 50 per order. a) Based on this information, should the company obtain credit information on new orders instead of selling to all new accounts without credit analysis? [0.5p) b) Suppose production costs increase from 89 to 91 percent of sales. Does this change the number of gauges that are shipped by Maritime? [0.5p] c) Under the assumptions from b): What is the highest price the credit-rating agency can demand without losing Maritime as a client. [0.5p] d) Under the assumptions from b): Suppose the economy booms and 4% (4 out of 100) of customers previously classified as 'medium risk" become 'low risk' customers. How does this change the highest price the credit-rating agency can demand relative to c)? [0.5p) e) Under the assumptions from b): Suppose the economy booms and 4% of customers previously classified as "high risk' become 'medium risk' customers. How does this change the highest price the credit-rating agency can demand relative to c)? [0.5p] As the financial manager of Cohen Corp., you want to determine how frequently the company should sell the Treasury bills it owns to cover its cash flow needs averaging $1 million per month. The annual rate of return on the Treasury bills is 1% (opportunity cost of capital) and it costs $ 100 each time the company sells bills (trading cost). Assume that the funds received from selling the bills (your 'excess cash') do not earn any interest. a) Graphically plot the opportunity cost of capital per year (in 8), the trading cost per year (in 8), as well as the total cost (the sum of opportunity cost of capital and trading cost, in 8) for transaction sizes from $200'000 to $1'100'000 in steps of $ 50'000 (i.e. for $200'000, $ 250'000, $ 300'000, ... $ 1'100'000). [0.5p] b) What is the optimal transaction size? [0.5p] c) What is the period (in days) between two transactions, using the optimal transaction size? [0.5p] d) Your bank starts paying 0.5% annual interest on your excess cash. How does the optimal transaction size change? Why? [0.5p] e) Suppose you want to keep an extra buffer of cash of 500'000, 'in case of emergency' (i.e., under regular conditions, you never want to have less than 500,000 of cash). How does this change the optimal transaction size? [0.5p]