Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maritime Industries is a fabrication business located in Toronto, Ontario. The following payroll information for the week ended August 21, 2021. All employees donate

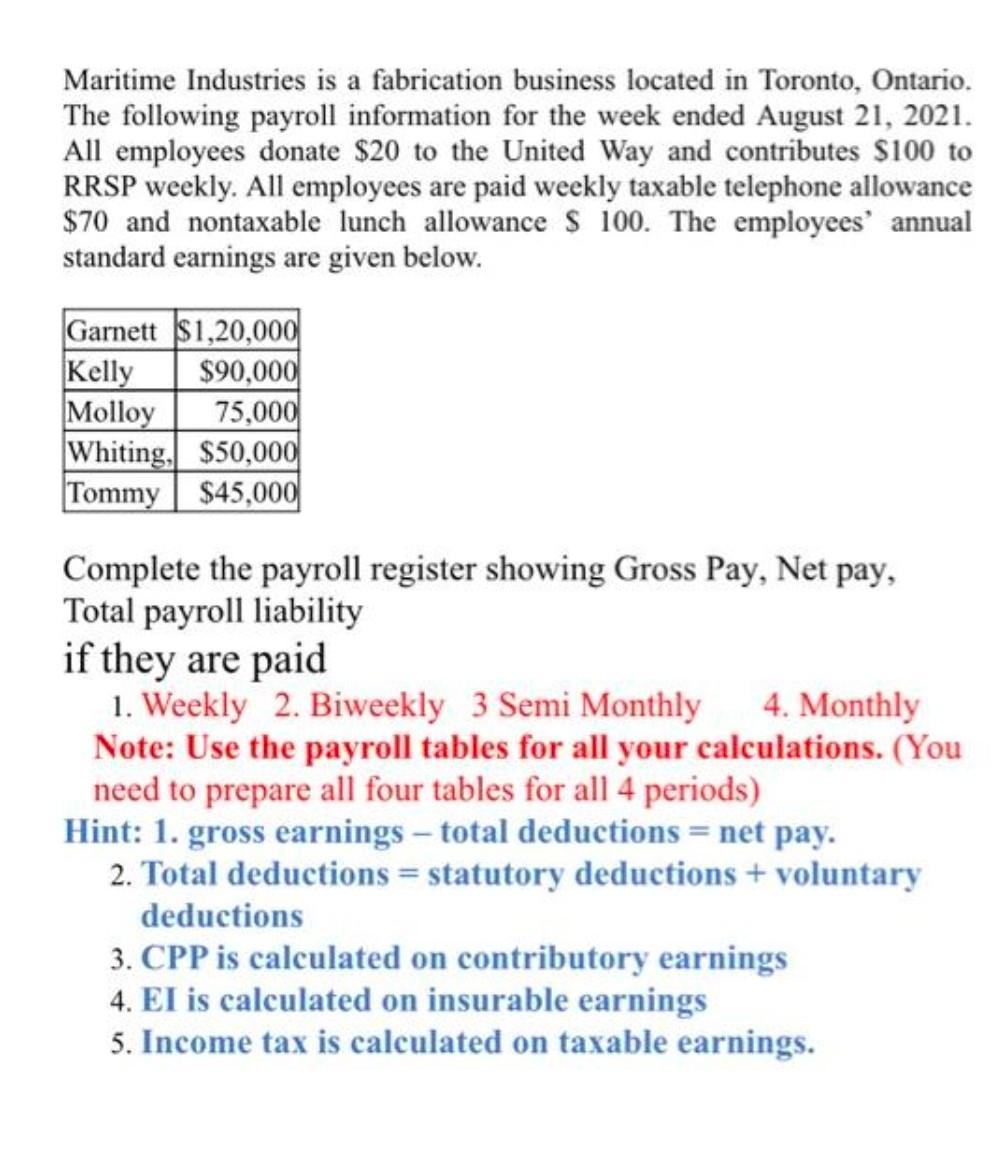

Maritime Industries is a fabrication business located in Toronto, Ontario. The following payroll information for the week ended August 21, 2021. All employees donate $20 to the United Way and contributes $100 to RRSP weekly. All employees are paid weekly taxable telephone allowance $70 and nontaxable lunch allowance $ 100. The employees' annual standard earnings are given below. Garnett $1,20,000 Kelly $90,000 Molloy 75,000 Whiting, $50,000 Tommy $45,000 Complete the payroll register showing Gross Pay, Net pay, Total payroll liability if they are paid 1. Weekly 2. Biweekly 3 Semi Monthly 4. Monthly Note: Use the payroll tables for all your calculations. (You need to prepare all four tables for all 4 periods) Hint: 1. gross earnings - total deductions = net pay. 2. Total deductions = statutory deductions + voluntary deductions 3. CPP is calculated on contributory earnings 4. EI is calculated on insurable earnings 5. Income tax is calculated on taxable earnings.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Annual earnings of Garnett 120000 Kelly 90000 Molloy 75000 Whiting 50000 Tommy 45000 Particulars Gar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started