Mark Adams grew up always working with his father in a workshop in their backyard. This lead him to pursue carpentry as his career.

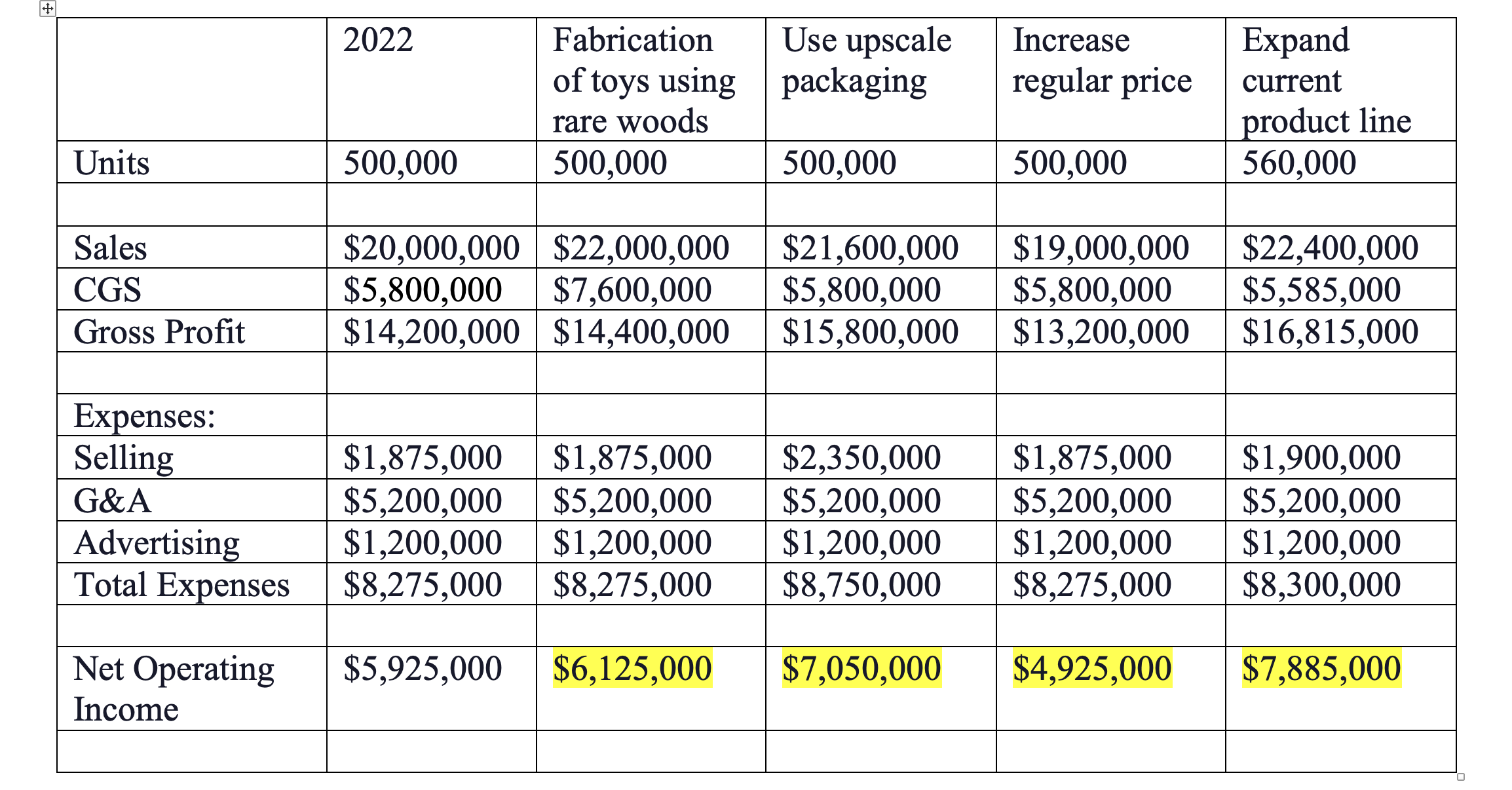

Mark Adams grew up always working with his father in a workshop in their backyard. This lead him to pursue carpentry as his career. He incorporated Mini Wooden Toys Company (MWTC) 10 years ago and he now owned over 250 stores across Canada. Mark made a commitment to himself to use sustainable wood sources (wood from tree farms rather than old forest logging) but still create a top-quality product. He has always wanted to remain innovative and creative. A few years ago, he won the Gold Leaf Environment Award and The New Toy of the Year award. He is actively engaged with local charities. Over the years, Mark maintained close contact with the shop managers. They are telling him that once a customer buys a few pieces of one product line, they keep coming back to complete a set. MWTC now has over 20 product lines. Mark always believes that the shop managers are his best source of information for new products and demand. In order to plan for the upcoming Christmas season for 2023, Mark collected the following information and came up with 4 options for his consideration: Fabrication of toys using rare woods: O O Customers are willing to pay up to 10% more in order to have the wooden toys in higher quality and using rarer woods. It would cost MWTC 55% more in the cost of direct materials by sourcing these new and exotic rare woods. Use upscale packaging: O Higher quality packaging with a more upscale design would increase sales by about 8%. The packaging redesign could be done with a one time design fee for $ 100,000 and an ongoing increase in shipping (selling) costs of $ 0.75 per package. Increase regular price O If the regular price for their product line is increased by 5%, the number of units sold will be reduced by 5%. Expand current product line Adding a complete product line on wooden people to accompany the building sets will add 60,000 units to sales. This will, however, take away sales from each of the other lines by 14%. It is possible that the addition of the wooden people will make the lines of toys more appealing to young girls and bring additional new sales for all of the lines. The new product line of wooden people would sell for $ 40 per set, and the costs associated with the line would be Direct Materials: $ 5; Direct Labour: $ 2; Variable Overhead $ 2. The variable selling and general administrative expenses would remain the same per unit as for the other products. Fixed Manufacturing Overhead cost will be an additional of $ 50,000 per year. Fixed Selling expenses will be an additional of $ 25,000 per year. + 2022 Fabrication of toys using Use upscale packaging Increase Expand regular price current Units 500,000 rare woods 500,000 500,000 500,000 product line 560,000 Sales CGS Gross Profit $20,000,000 $22,000,000 $5,800,000 $7,600,000 $14,200,000 $14,400,000 $21,600,000 $19,000,000 $22,400,000 $5,800,000 $5,800,000 $5,585,000 $15,800,000 $13,200,000 $16,815,000 Expenses: Selling $1,875,000 $1,875,000 $2,350,000 $1,875,000 $1,900,000 G&A Advertising Total Expenses $5,200,000 $5,200,000 $1,200,000 $1,200,000 $1,200,000 $8,275,000 $8,275,000 $8,750,000 $5,200,000 $5,200,000 $5,200,000 $1,200,000 $1,200,000 $8,275,000 $8,300,000 Net Operating Income $5,925,000 $6,125,000 $7,050,000 $4,925,000 $7,885,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started