Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark Cuban Corporation purchased a truck at the beginning of 2025 for $51,500. The truck is estimated to have a salvage value of $2,060

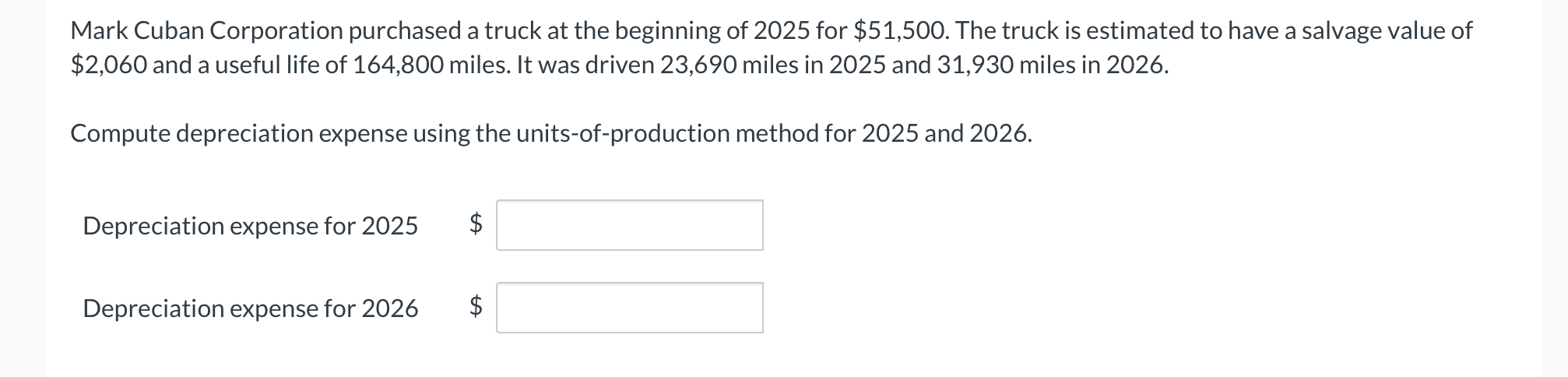

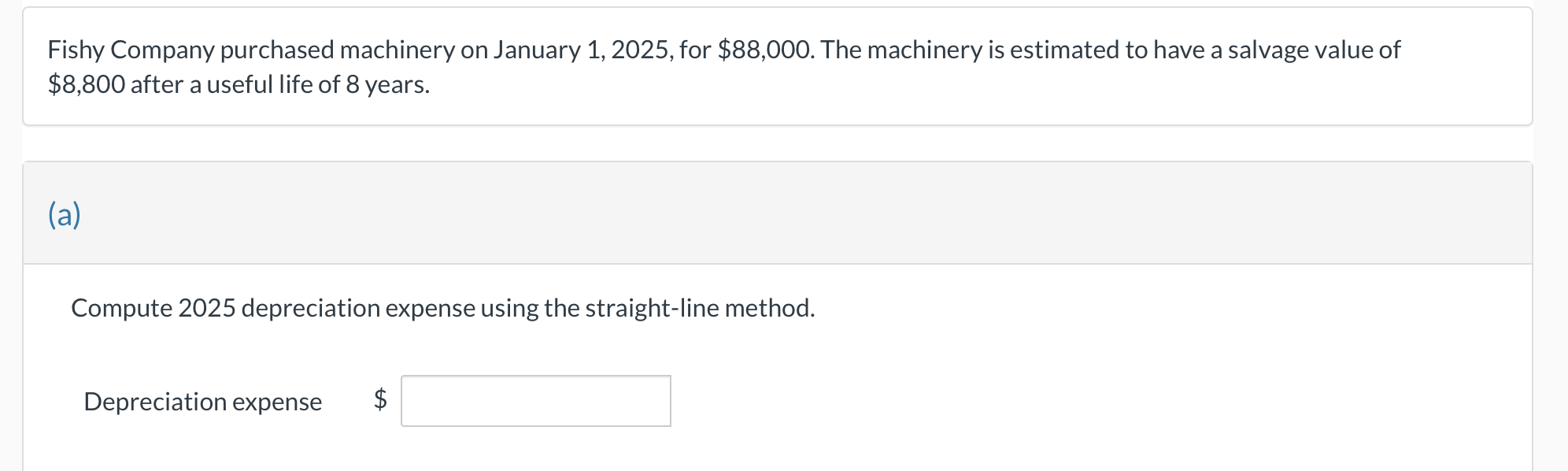

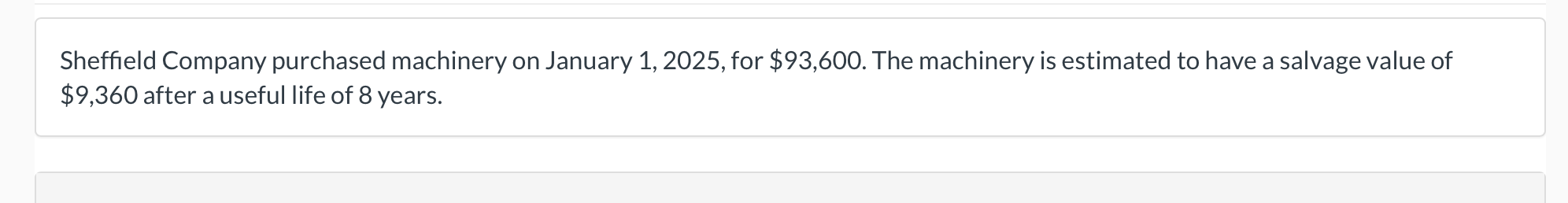

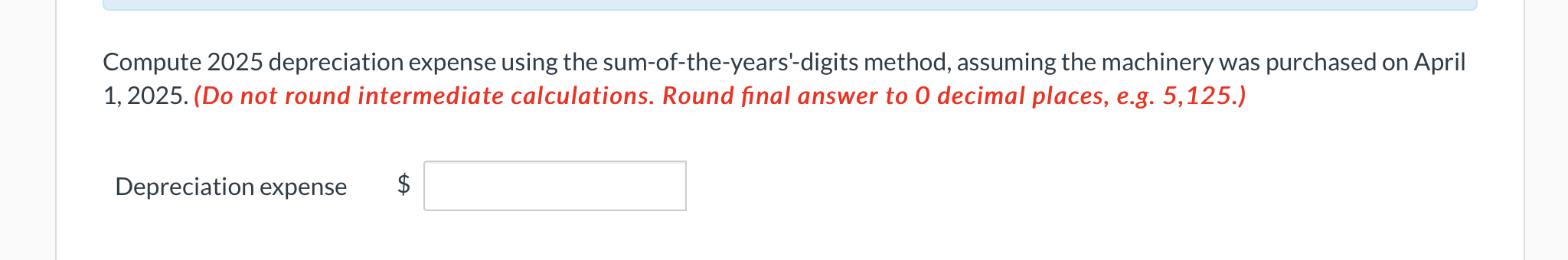

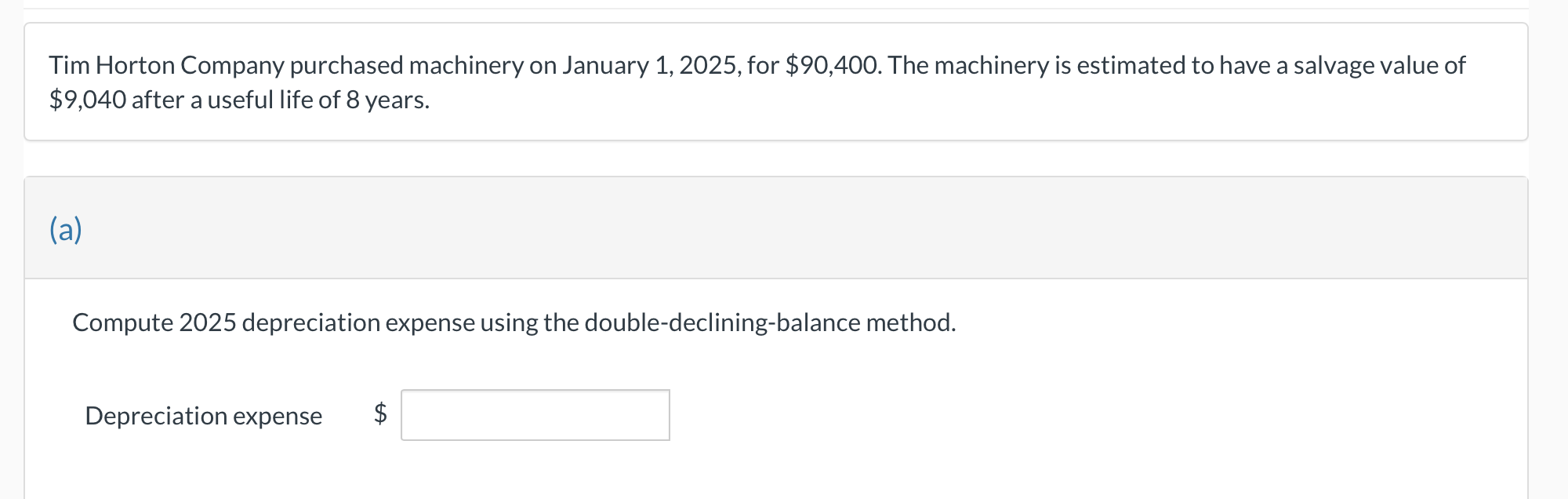

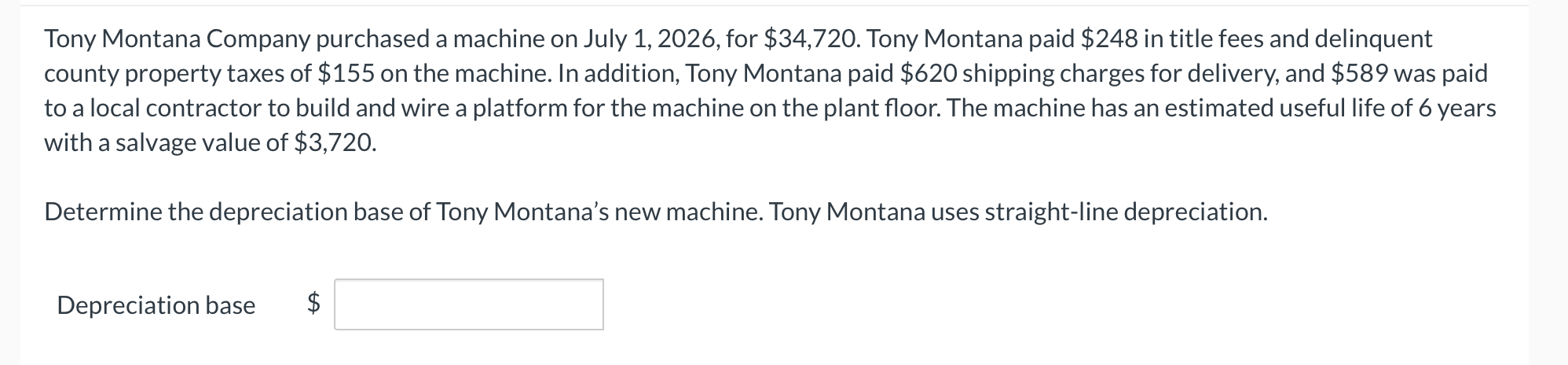

Mark Cuban Corporation purchased a truck at the beginning of 2025 for $51,500. The truck is estimated to have a salvage value of $2,060 and a useful life of 164,800 miles. It was driven 23,690 miles in 2025 and 31,930 miles in 2026. Compute depreciation expense using the units-of-production method for 2025 and 2026. Depreciation expense for 2025 $ Depreciation expense for 2026 $ Fishy Company purchased machinery on January 1, 2025, for $88,000. The machinery is estimated to have a salvage value of $8,800 after a useful life of 8 years. (a) Compute 2025 depreciation expense using the straight-line method. Depreciation expense $ AA Sheffield Company purchased machinery on January 1, 2025, for $93,600. The machinery is estimated to have a salvage value of $9,360 after a useful life of 8 years. Compute 2025 depreciation expense using the sum-of-the-years'-digits method, assuming the machinery was purchased on April 1, 2025. (Do not round intermediate calculations. Round final answer to O decimal places, e.g. 5,125.) Depreciation expense A Tim Horton Company purchased machinery on January 1, 2025, for $90,400. The machinery is estimated to have a salvage value of $9,040 after a useful life of 8 years. (a) Compute 2025 depreciation expense using the double-declining-balance method. Depreciation expense A Tony Montana Company purchased a machine on July 1, 2026, for $34,720. Tony Montana paid $248 in title fees and delinquent county property taxes of $155 on the machine. In addition, Tony Montana paid $620 shipping charges for delivery, and $589 was paid to a local contractor to build and wire a platform for the machine on the plant floor. The machine has an estimated useful life of 6 years with a salvage value of $3,720. Determine the depreciation base of Tony Montana's new machine. Tony Montana uses straight-line depreciation. Depreciation base

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer calculate the depreciation expenses for each scenario Mark Cuban Corporation UnitsofProduction Method Calculate the depreciable cost Depreciabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e9315c2762_954498.pdf

180 KBs PDF File

663e9315c2762_954498.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started