Answered step by step

Verified Expert Solution

Question

1 Approved Answer

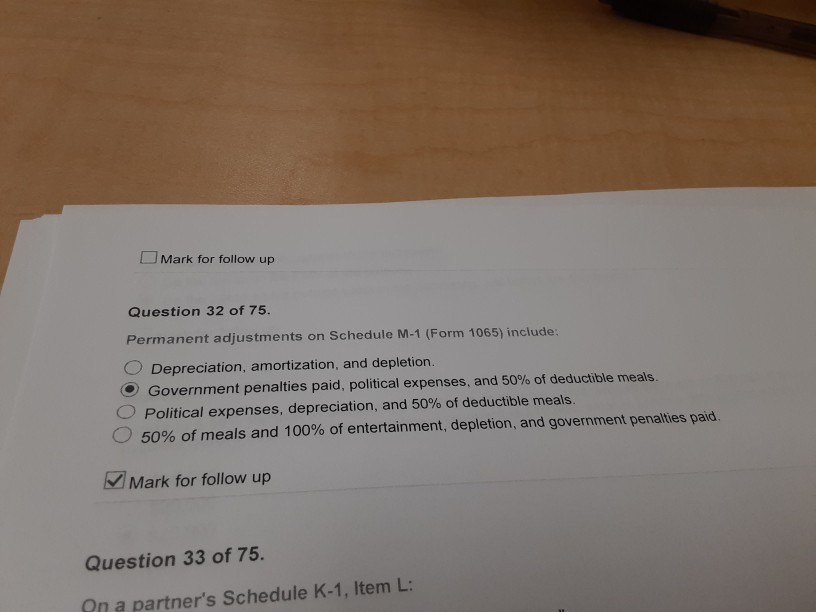

Mark for follow up Question 32 of 75. Permanent adjustments on Schedule M-1 (Form 1065) include: Depreciation, amortization, and depletion. Government penalties paid, political expenses,

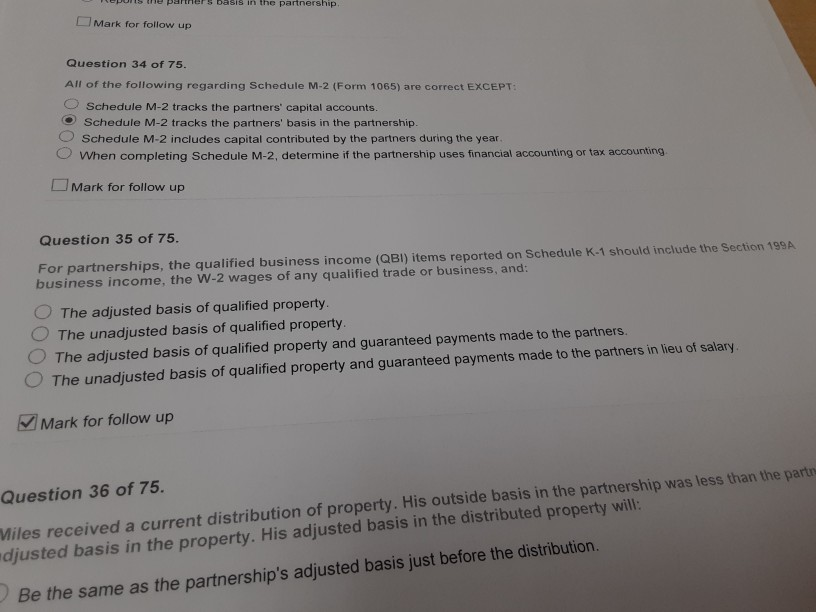

Mark for follow up Question 32 of 75. Permanent adjustments on Schedule M-1 (Form 1065) include: Depreciation, amortization, and depletion. Government penalties paid, political expenses, and 50% of deductible meals. Political expenses, depreciation, and 50% of deductible meals. 50% of meals and 100% of entertainment, depletion, and government penalties paid Mark for follow up Question 33 of 75. On a partner's Schedule K-1, Item L: lers basis in the partnership Mark for follow up Question 34 of 75. All of the following regarding Schedule M-2 (Form 1065) are correct EXCEPT: Schedule M-2 tracks the partners' capital accounts. Schedule M-2 tracks the partners' basis in the partnership. Schedule M-2 includes capital contributed by the partners during the year. When completing Schedule M-2, determine if the partnership uses financial accounting or tax accounting Mark for follow up Question 35 of 75. For partnerships, the qualified business income (QBI) items reported on Schedule K-1 should include the Section 199A business income, the W-2 wages of any qualified trade or business, and: The adjusted basis of qualified property. The unadjusted basis of qualified property. The adjusted basis of qualified property and guaranteed payments made to the partners. O The unadjusted basis of qualified property and guaranteed payments made to the partners in lieu of salary Mark for follow up Question 36 of 75. Miles received a current distribution of property. His outside basis in the partnership was less than the part djusted basis in the property. His adjusted basis in the distributed property will: Be the same as the partnership's adjusted basis just before the distribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started