Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mark received 5 ISOs at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each

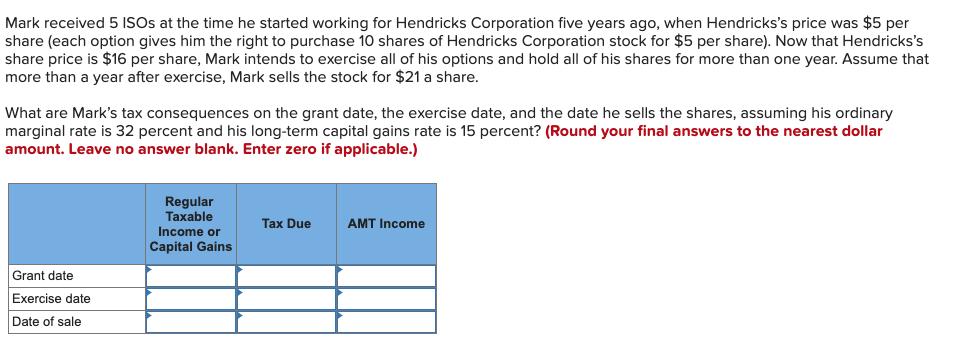

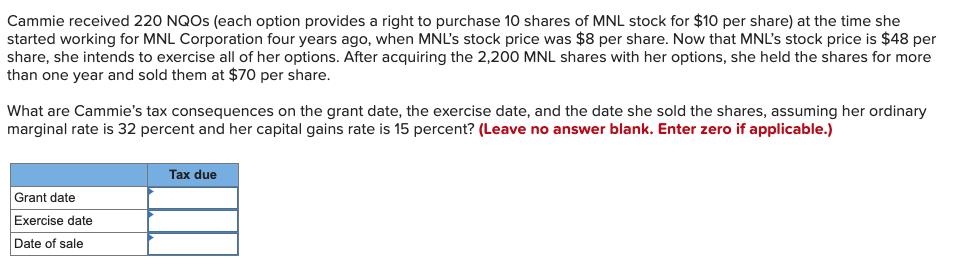

Mark received 5 ISOs at the time he started working for Hendricks Corporation five years ago, when Hendricks's price was $5 per share (each option gives him the right to purchase 10 shares of Hendricks Corporation stock for $5 per share). Now that Hendricks's share price is $16 per share, Mark intends to exercise all of his options and hold all of his shares for more than one year. Assume that more than a year after exercise, Mark sells the stock for $21 a share. What are Mark's tax consequences on the grant date, the exercise date, and the date he sells the shares, assuming his ordinary marginal rate is 32 percent and his long-term capital gains rate is 15 percent? (Round your final answers to the nearest dollar amount. Leave no answer blank. Enter zero if applicable.) Regular Taxable Tax Due AMT Income Income or Capital Gains Grant date Exercise date Date of sale Cammie received 220 NQOS (each option provides a right to purchase 10 shares of MNL stock for $10 per share) at the time she started working for MNL Corporation four years ago, when MNL's stock price was $8 per share. Now that MNL's stock price is $48 per share, she intends to exercise all of her options. After acquiring the 2,200 MNL shares with her options, she held the shares for more than one year and sold them at $70 per share. What are Cammie's tax consequences on the grant date, the exercise date, and the date she sold the shares, assuming her ordinary marginal rate is 32 percent and her capital gains rate is 15 percent? (Leave no answer blank. Enter zero if applicable.) Tax due Grant date Exercise date Date of sale

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Grant date 551032 80 Exercise date 21510 551032 256 Sale date 21510 2151032 0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started