Answered step by step

Verified Expert Solution

Question

1 Approved Answer

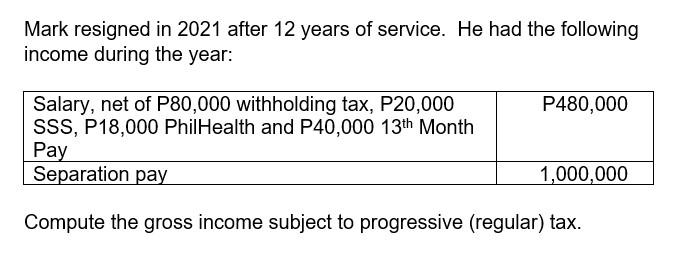

Mark resigned in 2021 after 12 years of service. He had the following income during the year: Salary, net of P80,000 withholding tax, P20,000

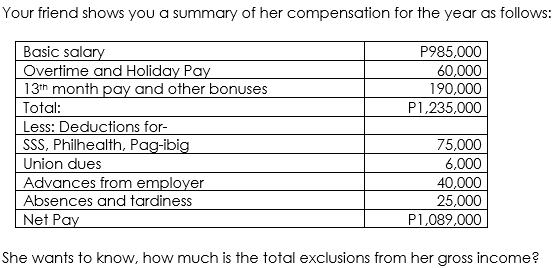

Mark resigned in 2021 after 12 years of service. He had the following income during the year: Salary, net of P80,000 withholding tax, P20,000 SSS, P18,000 PhilHealth and P40,000 13th Month Pay Separation pay Compute the gross income subject to progressive (regular) tax. P480,000 1,000,000 Your friend shows you a summary of her compensation for the year as follows: Basic salary P985,000 Overtime and Holiday Pay 60,000 13th month pay and other bonuses 190,000 P1,235,000 Total: Less: Deductions for- SSS, Philhealth, Pag-ibig Union dues 75,000 6,000 40,000 25,000 P1,089,000 Advances from employer Absences and tardiness Net Pay She wants to know, how much is the total exclusions from her gross income?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the total exclusions from your friends gross income we need to identify the specific it...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started