Question

Mark Watt is considering making an investment in Western Holdings Ltd. He has done some research and is happy about the fundamentals of Western

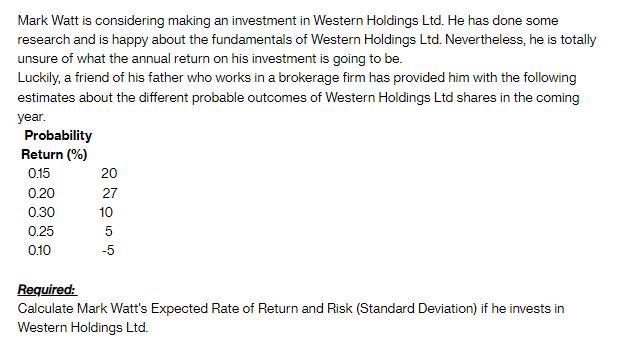

Mark Watt is considering making an investment in Western Holdings Ltd. He has done some research and is happy about the fundamentals of Western Holdings Ltd. Nevertheless, he is totally unsure of what the annual return on his investment is going to be. Luckily, a friend of his father who works in a brokerage firm has provided him with the following estimates about the different probable outcomes of Western Holdings Ltd shares in the coming year. Probability Return (%) 0.15 0.20 0.30 0.25 0.10 27055 10 -5 Required: Calculate Mark Watt's Expected Rate of Return and Risk (Standard Deviation) if he invests in Western Holdings Ltd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Mark Watts Expected Rate of Return and Risk Standard Deviation for his investment in We...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey

4th Edition

0730369382, 978-0730369387

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App