Answered step by step

Verified Expert Solution

Question

1 Approved Answer

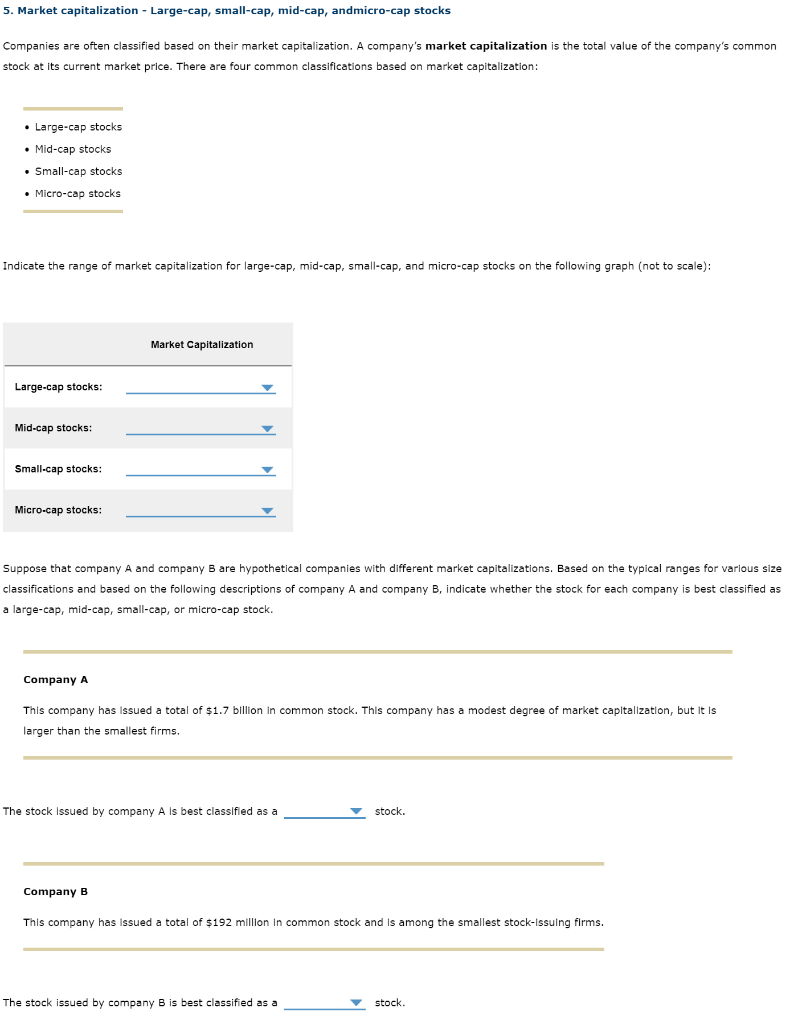

Market Capitalization Multiple Choice Options: $2 billion to $10 billion $50 million to $300 million $300 million to $2 billion Greater than $10 billion Company

Market Capitalization Multiple Choice Options:

$2 billion to $10 billion

$50 million to $300 million

$300 million to $2 billion

Greater than $10 billion

Company A & Company B Multiple Choice Options:

small-cap

mid-cap

large-cap

micro-cap

5. Market capitalization - Large-cap, small-cap, mid-cap, andmicro-cap stocks Companies are often classified based on their market capitalization. A company's market capitalization is the total value of the company's common stock at its current market price. There are four common classifications based on market capitalization: Large-cap stocks Mid-cap stocks Small-cap stocks Micro-cap stocks Indicate the range of market capitalization for large-cap, mid-cap, small-cap, and micro-cap stocks on the following graph (not to scale): Market Capitalization Large-cap stocks: Mid-cap stocks: Small-cap stocks: Micro-cap stocks: Suppose that company and company B are hypothetical companies with different market capitalizations. Based on the typical ranges for various size classifications and based on the following descriptions of company and company B, indicate whether the stock for each company is best classified as a large-cap, mid-cap, small-cap, or micro-cap stock. Company A This company has issued a total of $1.7 billion in common stock. This company has a modest degree of market capitalization, but it is larger than the smallest firms. The stock Issued by company A is best classified as a stock. Company B This company has issued a total of $192 million in common stock and is among the smallest stock-issuing firms. The stock issued by company B is best classified as a stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started