Answered step by step

Verified Expert Solution

Question

1 Approved Answer

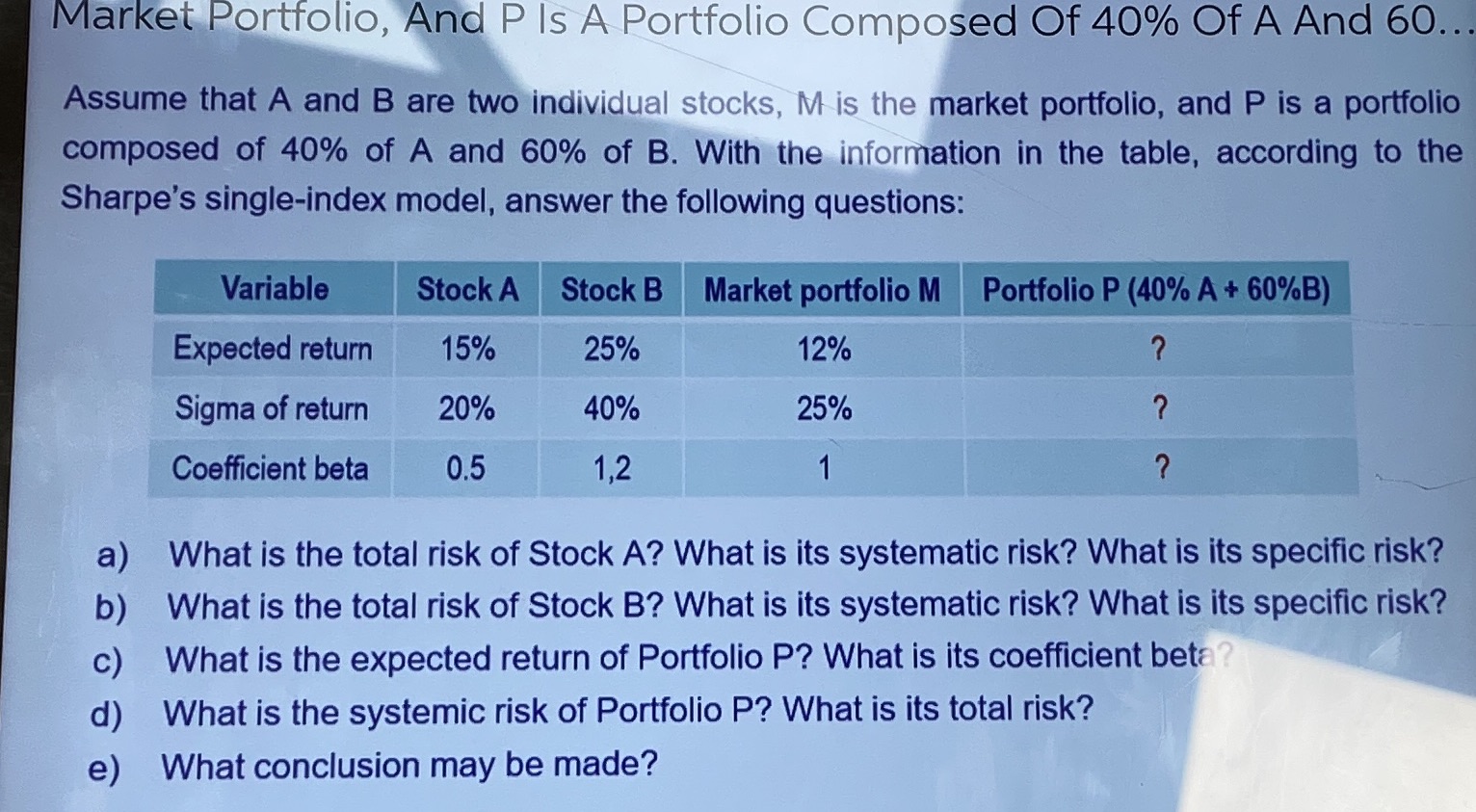

Market Portfolio, And P Is A Portfolio Composed Of 40% Of A And 60... Assume that A and B are two individual stocks, M

Market Portfolio, And P Is A Portfolio Composed Of 40% Of A And 60... Assume that A and B are two individual stocks, M is the market portfolio, and P is a portfolio composed of 40% of A and 60% of B. With the information in the table, according to the Sharpe's single-index model, answer the following questions: Variable Stock A Stock B Market portfolio M Portfolio P (40% A + 60%B) Expected return 15% 25% 12% ? Sigma of return 20% 40% 25% ? Coefficient beta 0.5 1,2 1 ? a) What is the total risk of Stock A? What is its systematic risk? What is its specific risk? b) What is the total risk of Stock B? What is its systematic risk? What is its specific risk? What is the expected return of Portfolio P? What is its coefficient beta? d) What is the systemic risk of Portfolio P? What is its total risk? e) What conclusion may be made?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets address each question a For Stock A Total risk Sigma of return 20 Systematic risk Beta Sigma of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664238bb5acad_984314.pdf

180 KBs PDF File

664238bb5acad_984314.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started