Answered step by step

Verified Expert Solution

Question

1 Approved Answer

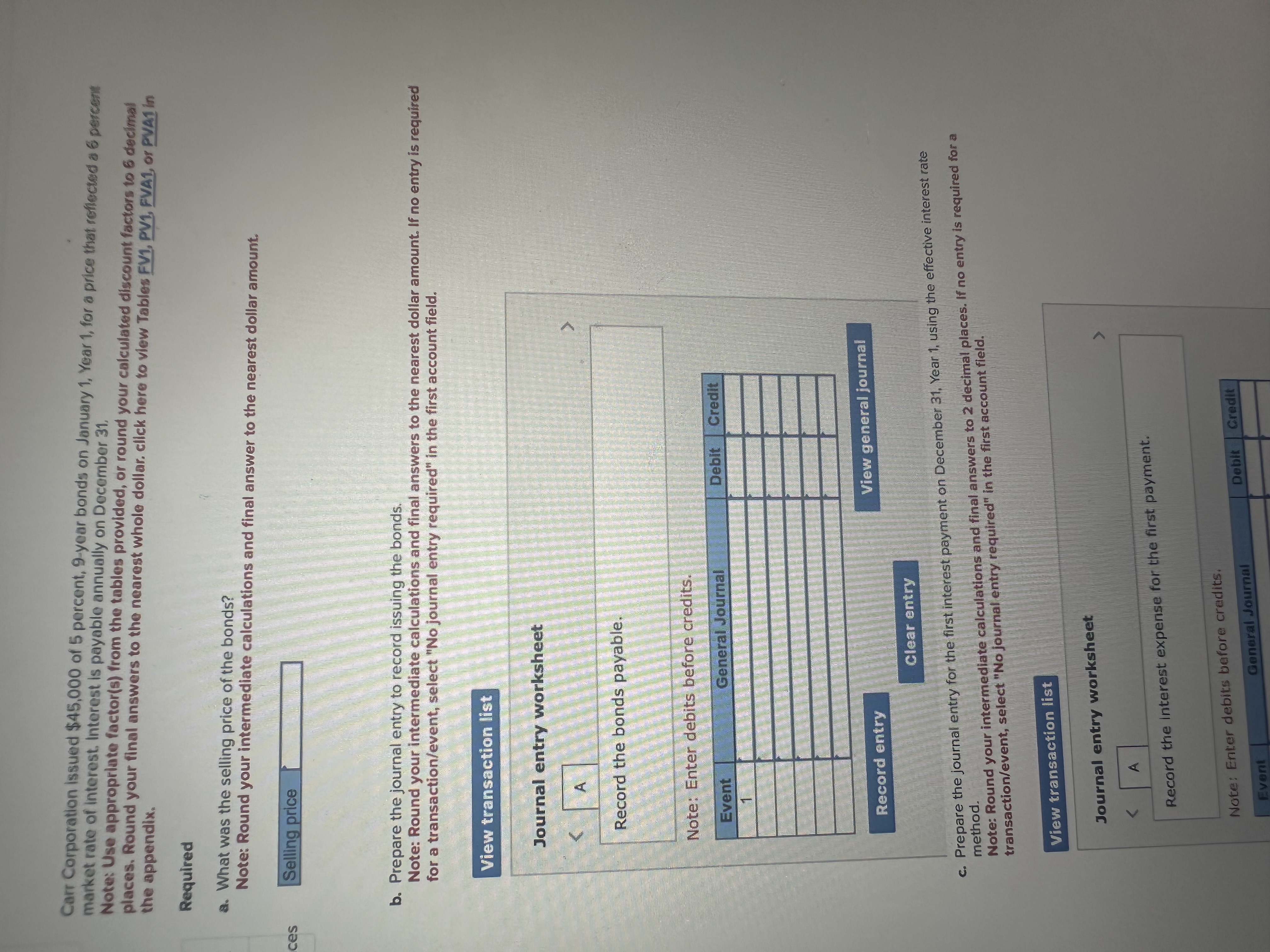

market rate of interest. Interest is payable annually on December 31, Carr Corporation issued $45,000 of 5 percent, 9-year bonds on January 1, Year

market rate of interest. Interest is payable annually on December 31, Carr Corporation issued $45,000 of 5 percent, 9-year bonds on January 1, Year 1, for a price that reflected a 6 percent Note: Use appropriate factor(s) from the tables provided, or round your calculated discount factors to 6 decimal the appendix. places. Round your final answers to the nearest whole dollar. click here to view Tables FV1, PV1, FVA1, or PVA1 in Required a. What was the selling price of the bonds? Note: Round your intermediate calculations and final answer to the nearest dollar amount. ces Selling price b. Prepare the journal entry to record issuing the bonds. Note: Round your intermediate calculations and final answers to the nearest dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet A Record the bonds payable. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal c. Prepare the journal entry for the first interest payment on December 31, Year 1, using the effective interest rate method. Note: Round your intermediate calculations and final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A Record the interest expense for the first payment. Note: Enter debits before credits. Event General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started