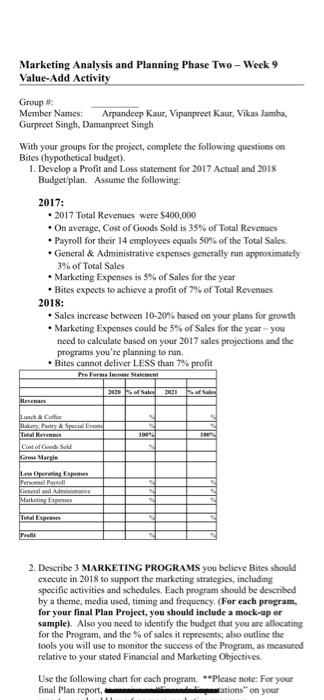

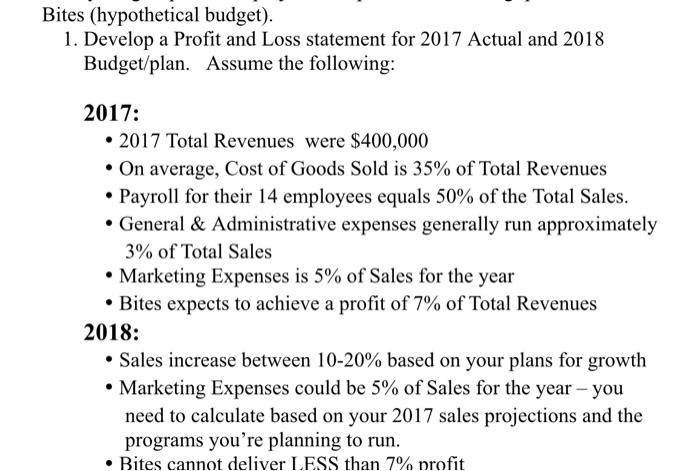

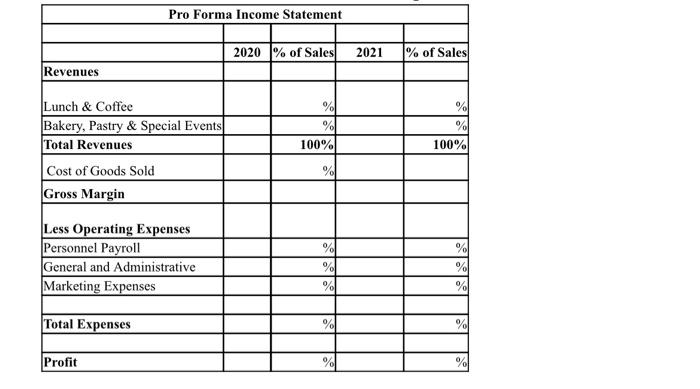

Marketing Analysis and Planning Phase Two-Week 9 Value-Add Activity Group: Member Names: Arpandeep Kaur, Vipanpreet Kaur, Vikas lamba Gurpreet Singh, Damanpreet Singh With your groups for the project, complete the following questions on Bites (hypothetical budget). 1. Develop a Profit and Loss statement for 2017 Actual and 2018 Budget plan. Assume the following: 2017: . 2017 Total Revenues were $400,000 On average, Cost of Goods Sold is 35% of Total Revenues Payroll for their 14 employees equals 50% of the Total Sales . General & Administrative expenses generally run approximately 3% of Total Sales Marketing Expenses is 5% of Sales for the year Bites expects to achieve a profit of 7% of Total Revenues 2018: Sales increase between 10-20% based on your plans for growth Marketing Expenses could be 5% of Sales for the year - you need to calculate based on your 2017 sales projections and the programs you're planning to run Bites cannot deliver LESS than 7% profit Pro Forest Statement 2830 2021 Heren Lunch & Co Pakar Pestry & Special Event Turen Coast of God. Sold Margie Persela Kineral and Me Marketing lipo Pro 2. Describe 3 MARKETING PROGRAMS you believe Bites should execute in 2018 to support the marketing strategies, including specific activities and schedules. Each program should be described by a theme, media used, timing and frequency. (For each program, for your final Plan Project, you should include a mock-up or sample). Also you need to identify the budget that you are allocating for the Program, and the % of sales it represents also outline the tools you will use to monitor the success of the Program, as measured relative to your stated Financial and Marketing Objectives. Use the following chart for each program. **Please note: For your final Plan report, tations on your actor Aniceno Aalto ad AaB CID MOON With your group for the common shabu 1 tempatando de . 2017 20170,000 Om Gouda Payroll for their employees of the Sales Manisa respective or 2018: Sale 10-20 based on the Save the opet Pro Forma Income Sweet 2020 2021 of Sales Revenues Lunch & Walery, Pastry Speciales Totale 100% 100 Gro Martin La Operating en 3 . B + 2 + % 5 8 7 6 C 9 > 0 8 T Y U o P T 1 1 G H J K L 1 B N M > Bites (hypothetical budget). 1. Develop a Profit and Loss statement for 2017 Actual and 2018 Budget/plan. Assume the following: 2017: 2017 Total Revenues were $400,000 On average, Cost of Goods Sold is 35% of Total Revenues Payroll for their 14 employees equals 50% of the Total Sales. General & Administrative expenses generally run approximately 3% of Total Sales Marketing Expenses is 5% of Sales for the year Bites expects to achieve a profit of 7% of Total Revenues 2018: Sales increase between 10-20% based on your plans for growth Marketing Expenses could be 5% of Sales for the year - you need to calculate based on your 2017 sales projections and the programs you're planning to run. Bites cannot deliver LESS than 7% profit Pro Forma Income Statement 2020 % of Sales 2021 % of Sales Revenues Lunch & Coffee Bakery, Pastry & Special Events Total Revenues Cost of Goods Sold Gross Margin % % 100% 100% % 70 Less Operating Expenses Personnel Payroll General and Administrative Marketing Expenses % % % 02 70 % Total Expenses % Profit 0