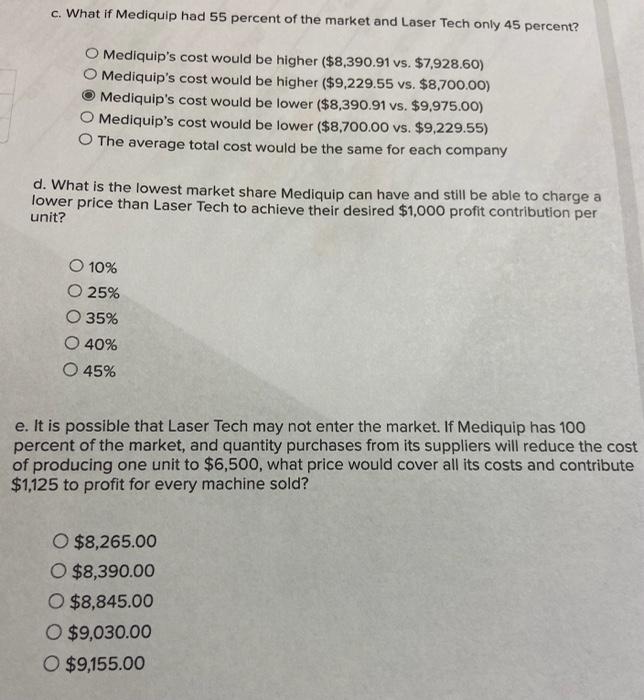

Marketing Analytics: Competito... Saved Help Save & Exit Submit 1 O Mediquip's cost would be lower ($8,390.91 vs. $9,975.00) Mediquip's cost would be lower ($8,700.00 vs. $9,229.55) The average total cost would be the same for each company c. What if Mediquip had 55 percent of the market and Laser Tech only 45 percent? nts O Mediquip's cost would be higher ($8,390.91 vs. $7,928.60) O Mediquip's cost would be higher ($9,229.55 vs. $8,700.00) Mediquip's cost would be lower ($8,390.91 vs. $9,975.00) ook Print O Mediquip's cost would be lower ($8,700.00 vs. $9,229.55) rences O The average total cost would be the same for each company d. What is the lowest market share Mediquip can have and still be able to charge a lower price than Laser Tech to achieve their desired $1,000 profit contribution per unit? O 10% O 25% 0 00

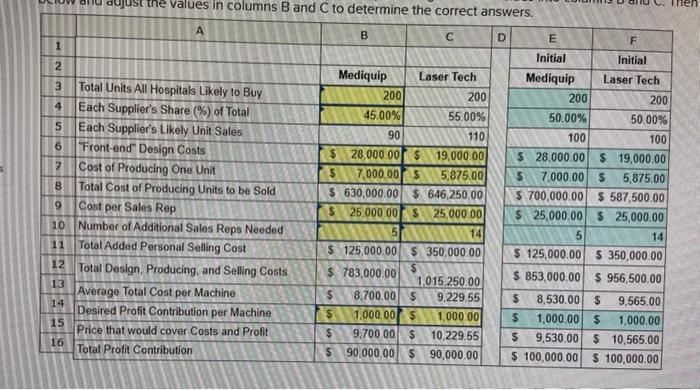

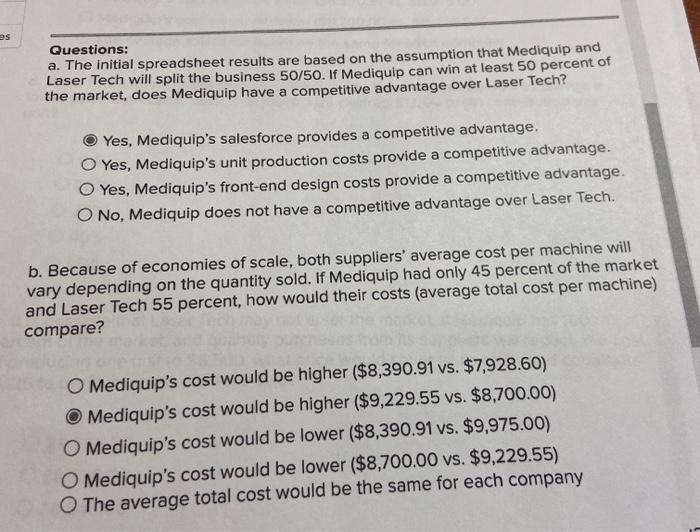

uust the values in columns B and C to determine the correct answers. A B D 1 2 3 Total Units All Hospitals Likely to Buy 4 Each Supplier's Share (%) of Total S Each Supplier's Likely Unit Sales 6 "Front-end Design Costs 7 Cost of Producing One Unit 8 Total Cost of Producing Units to be Sold 9 Cost per Sales Rep 10 Number of Additional Sales Reps Needed 11 Total Added Personal Selling Cost 12. Total Design Producing, and Selling Costs 13 Average Total Cost per Machine 14 Desired Profit Contribution per Machine 15 Price that would cover Costs and Profit 16 Total Profit Contribution Mediquip Laser Tech 200 200 45.00% 55.00% 90 110 28,000.00 $ 19,000.00 $ 7,000.00 $ 5,875.00 $ 630,000.00 $ 646 250.00 $ 25,000.00 $ 25,000.00 5 14 $ 125,000.00 $ 350,000.00 $ 783,000.00 $ 1,015,250.00 $ 8.700.00 $ 9,229.55 $ 1,000.00 $ 1,000.00 $ 9.700.00 $ 10,229.55 $ 90,000.00 5 90,000.00 E F Initial Initial Mediquip Laser Tech 200 200 50.00% 50.00% 100 100 $ 28,000.00 $ 19,000.00 $ 7,000.00 $ 5,875.00 $ 700,000.00 $ 587,500.00 $ 25,000.00 $ 25,000.00 5 14 $ 125,000.00 $ 350,000.00 $ 853,000.00 $ 956,500.00 $ 8,530.00 $ 9,565.00 $ 1,000.00 $ 1,000.00 $ 9,530.00 $ 10,565.00 $ 100,000.00 $ 100,000.00 es Questions: a. The initial spreadsheet results are based on the assumption that Mediquip and Laser Tech will split the business 50/50. If Mediquip can win at least 50 percent of the market, does Mediquip have a competitive advantage over Laser Tech? Yes, Mediquip's salesforce provides a competitive advantage. Yes, Mediquip's unit production costs provide a competitive advantage. Yes, Mediquip's front-end design costs provide a competitive advantage. O No, Mediquip does not have a competitive advantage over Laser Tech. b. Because of economies of scale, both suppliers' average cost per machine will vary depending on the quantity sold. If Mediquip had only 45 percent of the market and Laser Tech 55 percent, how would their costs (average total cost per machine) compare? O Mediquip's cost would be higher ($8,390.91 vs. $7,928.60) Mediquip's cost would be higher ($9,229.55 vs. $8,700.00) O Mediquip's cost would be lower ($8,390.91 vs. $9,975.00) O Mediquip's cost would be lower ($8,700.00 vs. $9,229.55) The average total cost would be the same for each company c. What if Mediquip had 55 percent of the market and Laser Tech only 45 percent? Mediquip's cost would be higher ($8,390.91 vs. $7,928.60) O Mediquip's cost would be higher ($9,229.55 vs. $8,700.00) Mediquip's cost would be lower ($8,390.91 vs. $9,975.00) O Mediquip's cost would be lower ($8,700.00 vs. $9,229.55) The average total cost would be the same for each company d. What is the lowest market share Mediquip can have and still be able to charge a lower price than Laser Tech to achieve their desired $1,000 profit contribution per unit? O 10% O 25% O 35% O 40% 0 45% e. It is possible that Laser Tech may not enter the market. If Mediquip has 100 percent of the market, and quantity purchases from its suppliers will reduce the cost of producing one unit to $6,500, what price would cover all its costs and contribute $1,125 to profit for every machine sold? O $8,265.00 O $8,390.00 O $8,845.00 O $9,030.00 O $9,155.00