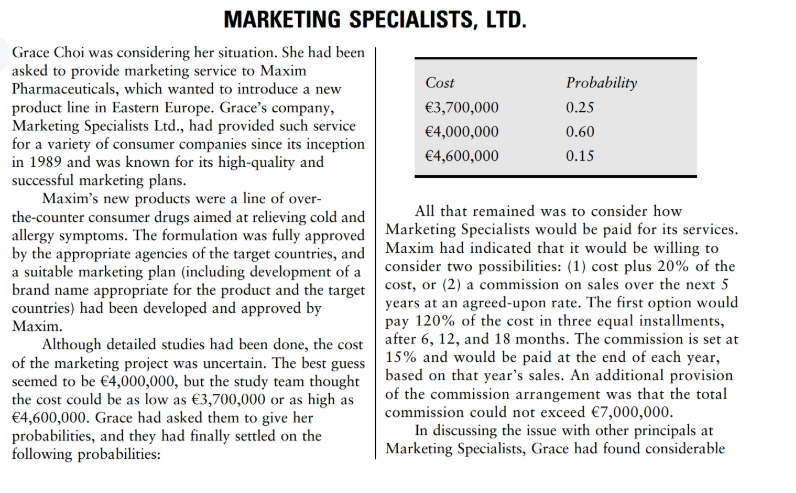

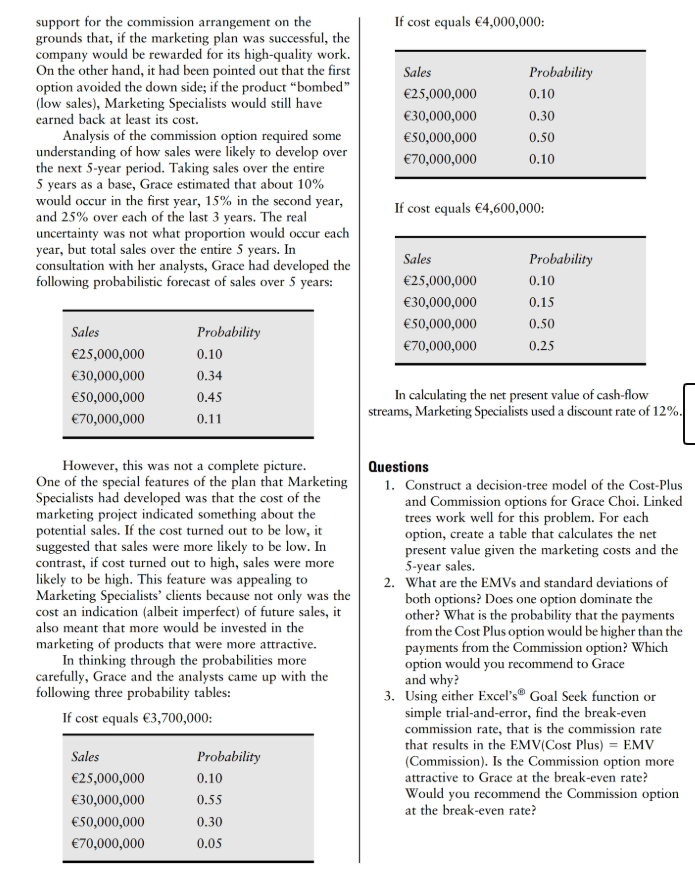

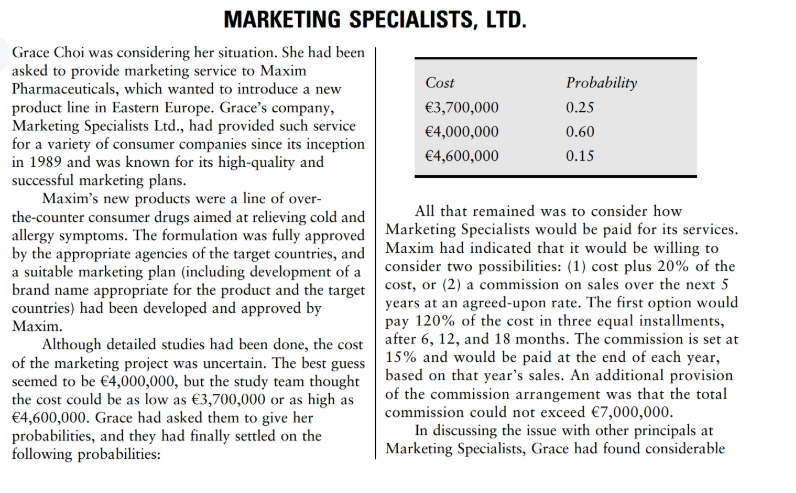

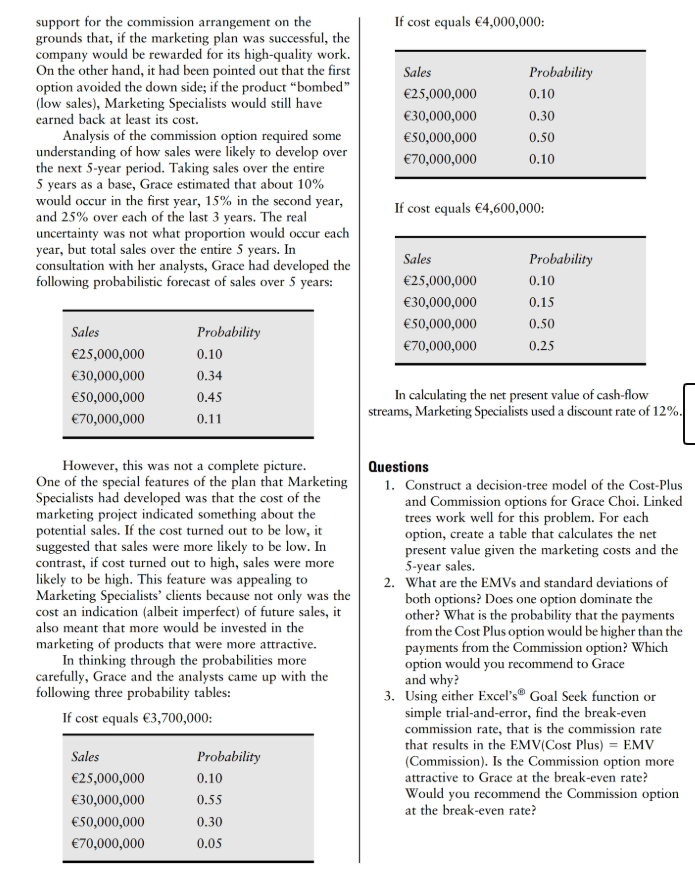

MARKETING SPECIALISTS, LTD. Grace Choi was considering her situation. She had been asked to provide marketing service to Maxim Pharmaceuticals, which wanted to introduce a new Cost Probability product line in Eastern Europe. Grace's company, 3,700,000 0.25 Marketing Specialists Ltd., had provided such service 4,000,000 0.60 for a variety of consumer companies since its inception in 1989 and was known for its high-quality and 4,600,000 0.15 successful marketing plans. Maxim's new products were a line of over- the-counter consumer drugs aimed at relieving cold and All that remained was to consider how allergy symptoms. The formulation was fully approved Marketing Specialists would be paid for its services. by the appropriate agencies of the target countries, and Maxim had indicated that it would be willing to a suitable marketing plan (including development of a consider two possibilities: (1) cost plus 20% of the brand name appropriate for the product and the target cost, or (2) a commission on sales over the next 5 countries) had been developed and approved by years at an agreed-upon rate. The first option would Maxim. pay 120% of the cost in three equal installments, Although detailed studies had been done, the cost after 6, 12, and 18 months. The commission is set at of the marketing project was uncertain. The best guess 15% and would be paid at the end of each year, seemed to be 4,000,000, but the study team thought based on that year's sales. An additional provision the cost could be as low as 3,700,000 or as high as of the commission arrangement was that the total 4,600,000. Grace had asked them to give her commission could not exceed 7,000,000. probabilities, and they had finally settled on the In discussing the issue with other principals at following probabilities: Marketing Specialists, Grace had found considerable If cost equals 4,000,000: support for the commission arrangement on the grounds that, if the marketing plan was successful, the company would be rewarded for its high-quality work. On the other hand, it had been pointed out that the first option avoided the down side; if the product "bombed" (low sales), Marketing Specialists would still have earned back at least its cost. Analysis of the commission option required some understanding of how sales were likely to develop over the next 5-year period. Taking sales over the entire 5 years as a base, Grace estimated that about 10% would occur in the first year, 15% in the second year, and 25% over each of the last 3 years. The real uncertainty was not what proportion would occur each year, but total sales over the entire 5 years. In consultation with her analysts, Grace had developed the following probabilistic forecast of sales over 5 years: Sales 25,000,000 30,000,000 50,000,000 70,000,000 Probability 0.10 0.30 0.50 0.10 If cost equals 4,600,000: Sales 25,000,000 30,000,000 50,000,000 70,000,000 Probability 0.10 0.15 0.50 0.25 Sales 25,000,000 30,000,000 50,000,000 70,000,000 Probability 0.10 0.34 0.45 In calculating the net present value of cash-flow streams, Marketing Specialists used a discount rate of 12%. 0.11 However, this was not a complete picture. One of the special features of the plan that Marketing Specialists had developed was that the cost of the marketing project indicated something about the potential sales. If the cost turned out to be low, it suggested that sales were more likely to be low. In contrast, if cost turned out to high, sales were more likely to be high. This feature was appealing to Marketing Specialists' clients because not only was the cost an indication (albeit imperfect) of future sales, it also meant that more would be invested in the marketing of products that were more attractive. In thinking through the probabilities more carefully, Grace and the analysts came up with the following three probability tables: If cost equals 3,700,000: Questions 1. Construct a decision-tree model of the Cost-Plus and Commission options for Grace Choi. Linked trees work well for this problem. For each option, create a table that calculates the net present value given the marketing costs and the 5-year sales. 2. What are the EMVs and standard deviations of both options? Does one option dominate the other? What is the probability that the payments from the Cost Plus option would be higher than the payments from the Commission option? Which option would you recommend to Grace and why? 3. Using either Excel's Goal Seek function or simple trial-and-error, find the break-even commission rate, that is the commission rate that results in the EMV(Cost Plus) = EMV (Commission). Is the Commission option more attractive to Grace at the break-even rate? Would you recommend the Commission option at the break-even rate? Sales 25,000,000 30,000,000 50,000,000 70,000,000 Probability 0.10 0.55 0.30 0.05