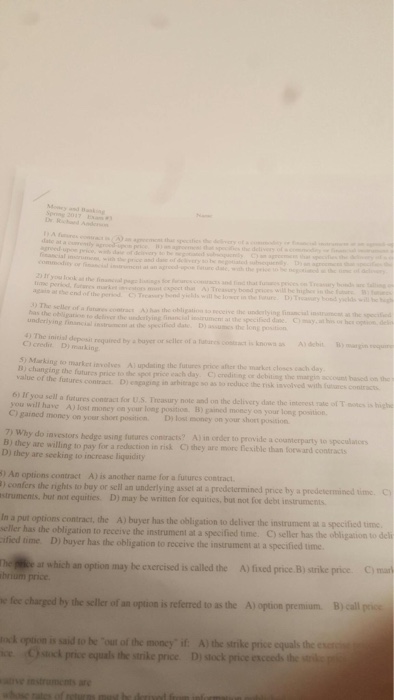

Marking to market A) updating the function price after market close each day. B) changing the futures price to the each day. C) crediting or debuting the account based on the value of the futures contract. D) engaging in so as to reduce the risk involved with contracts. If you sell a futures constrict for U.S. Treasury note and on the delivery date the interest rate of T notes is high you will have A) lost money on your long positions. B) gained money on your long position. C) gained money on your shot position. D) lost money on your short position. Why do investors hedge using futures contracts? A) in order to provide a counterparty to B) they are willing to pay for a pay for a reduction in risk C) they are more flexible than forward contracts D) they are seeking to increase liquidity An options contract A) is another for a futures contract. Coafers the rights to buy or sell an underlying asset at a predetermined price by a predetermined time. c) instruments, but not equities. D) may be written for equities, but not for dept instruments. Marking to market A) updating the function price after market close each day. B) changing the futures price to the each day. C) crediting or debuting the account based on the value of the futures contract. D) engaging in so as to reduce the risk involved with contracts. If you sell a futures constrict for U.S. Treasury note and on the delivery date the interest rate of T notes is high you will have A) lost money on your long positions. B) gained money on your long position. C) gained money on your shot position. D) lost money on your short position. Why do investors hedge using futures contracts? A) in order to provide a counterparty to B) they are willing to pay for a pay for a reduction in risk C) they are more flexible than forward contracts D) they are seeking to increase liquidity An options contract A) is another for a futures contract. Coafers the rights to buy or sell an underlying asset at a predetermined price by a predetermined time. c) instruments, but not equities. D) may be written for equities, but not for dept instruments