Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider two proposed manufacturing plants: a conventional plant and a highly automated one. Both plants are designed to have a life of 10 years.

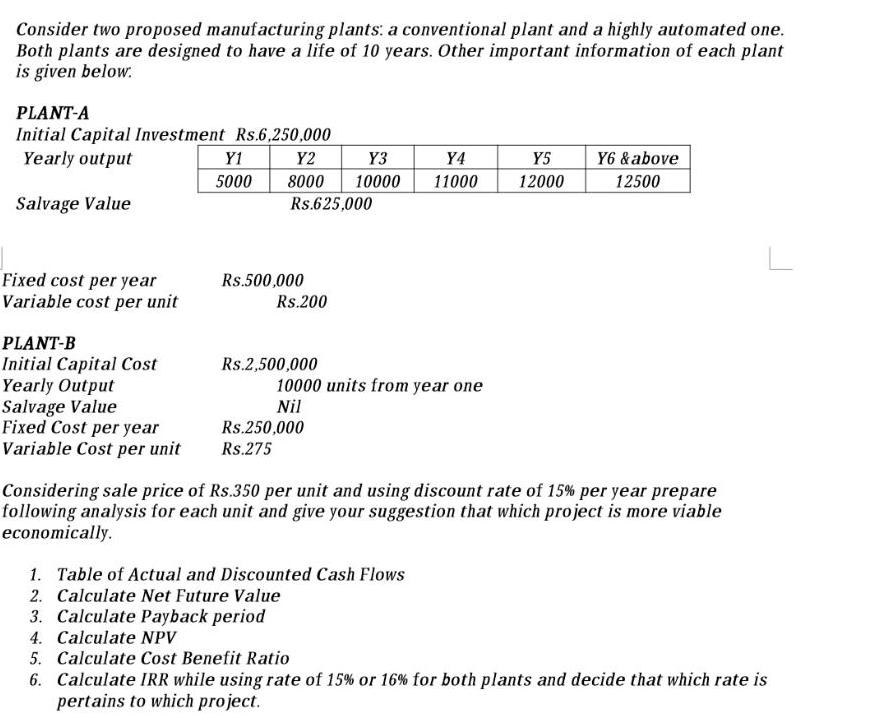

Consider two proposed manufacturing plants: a conventional plant and a highly automated one. Both plants are designed to have a life of 10 years. Other important information of each plant is given below. PLANT-A Initial Capital Investment Rs.6,250,000 Yearly output Y1 Y2 Y3 Y4 Y5 Y6 &above 5000 8000 10000 11000 12000 12500 Salvage Value Rs.625,000 Fixed cost per year Variable cost per unit Rs.500,000 Rs.200 PLANT-B Initial Capital Cost Yearly Output Salvage Value Fixed Cost per year Variable Cost per unit Rs.2,500,000 10000 units from year one Nil Rs.250,000 Rs.275 Considering sale price of Rs.350 per unit and using discount rate of 15% per year prepare following analysis for each unit and give your suggestion that which project is more viable economically. 1. Table of Actual and Discounted Cash Flows 2. Calculate Net Future Value 3. Calculate Payback period 4. Calculate NPV 5. Calculate Cost Benefit Ratio 6. Calculate IRR while using rate of 15% or 16% for both plants and decide that which rate is pertains to which project.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started