Answered step by step

Verified Expert Solution

Question

1 Approved Answer

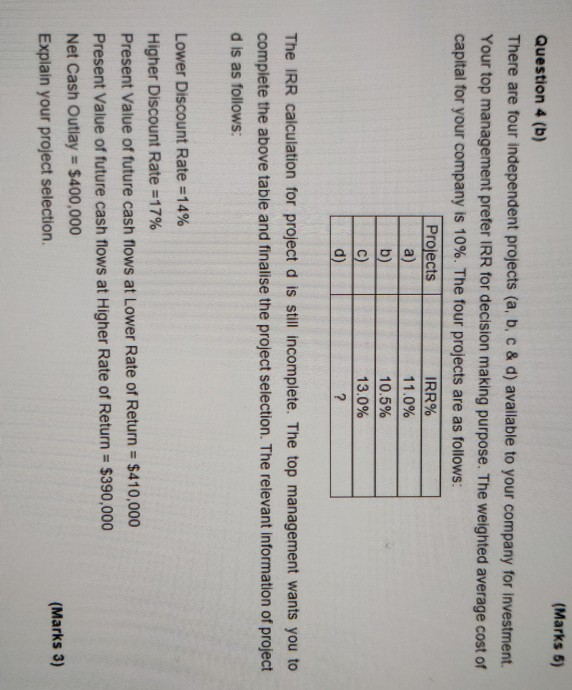

(Marks 5) Question 4 (b) There are four independent projects (a, b, c & d) available to your company for investment. Your top management prefer

(Marks 5) Question 4 (b) There are four independent projects (a, b, c & d) available to your company for investment. Your top management prefer IRR for decision making purpose. The weighted average cost of capital for your company is 10%. The four projects are as follows: Projects IRR% a) 11.0% b) 10.5% c) 13.0% d) ? The IRR calculation for project d is still incomplete. The top management wants you to complete the above table and finalise the project selection. The relevant information of project d is as follows: Lower Discount Rate = 14% Higher Discount Rate =17% Present Value of future cash flows at Lower Rate of Return = $410,000 Present Value of future cash flows at Higher Rate of Return = $390,000 Net Cash Outlay = $400,000 Explain your project selection. (Marks 3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started