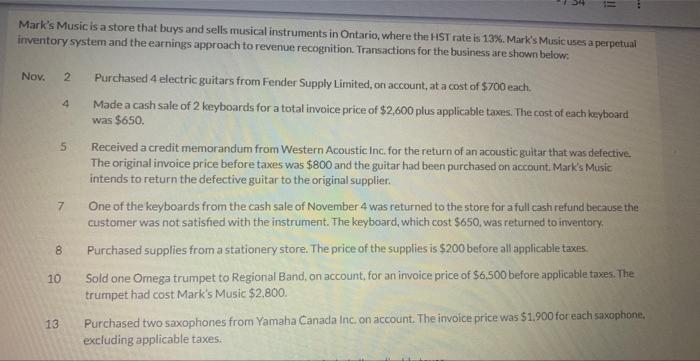

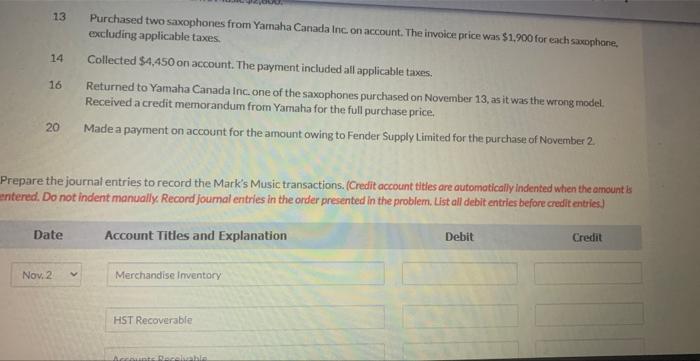

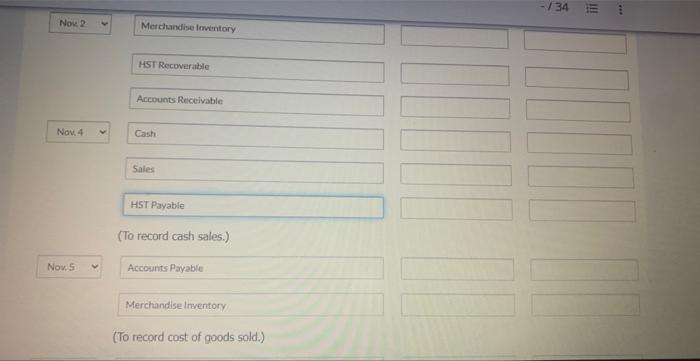

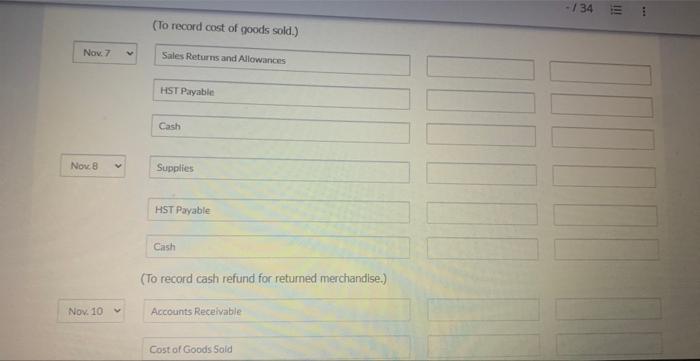

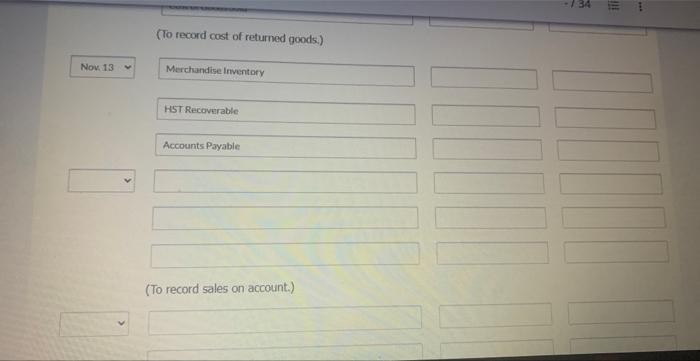

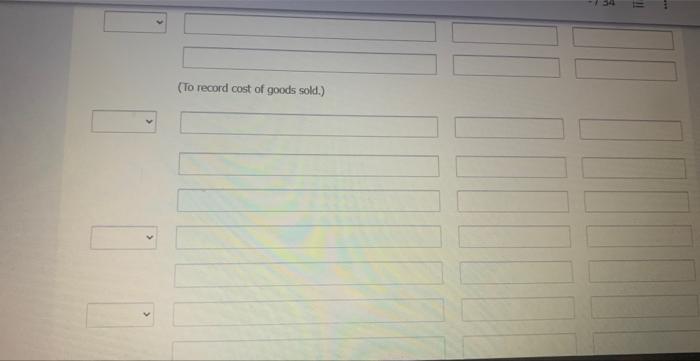

Mark's Music is a store that buys and sells musical instruments in Ontario, where the HST rate is 13\%. Mark's Music uses a perpetual inventory system and the earnings approach to revenue recognition. Transactions for the business are shown below: Nov. 2 Purchased 4 electric guitars from Fender Supply Limited, on account, at a cost of $700 each. 4. Made a cash sale of 2 keyboards for a total invoice price of $2,600 plus applicable taxes. The cost of each keyboard was $650. 5 Received a credit memorandum from Western Acoustic inc. for the return of an acoustic guitar that was defective. The original invoice price before taxes was $800 and the guitar had been purchased on account. Mark's Music intends to return the defective guitar to the original supplier. 7 One of the keyboards from the cash sale of November 4 was returned to the store for a full cash refund because the customer was not satisfied with the instrument. The keyboard, which cost $650, was returned to inventory, 8 Purchased supplies from a stationery store. The price of the supplies is $200 before all applicable taxes. 10 Sold one Omega trumpet to Regional Band, on account, for an invoice price of $6,500 before applicable taxes. The trumpet had cost Mark's Music $2,800. 13 Purchased two saxophones from Yamaha Canada Inc on account. The invoice price was $1,900 for each simophone, excluding applicable taxes. 13 Purchased two saxophones from Yarnaha Canada Inc on account. The invoice price was $1,900 for ench saxophone. excluding applicable taxes. 14 Collected $4,450 on account. The payment included all applicable taxes. 16 Returned to Yamaha Canada inc. one of the saxophones purchased on November 13, as it was the wrong mode. Received a credit memorandum from Yamaha for the full purchase price. 20 Made a payment on account for the amount owing to Fender Supply Limited for the purchase of Novernber 2. Fepare the journal entries to record the Mark's Music transactions. (Credit account tities are outomatically indented when the omount is tered. Do not indent manually. Record joumal entries in the order presented in the problem. List all debit entries before credit entries. Noke 2 Merchandise lementory. MST Recoveratle Accounts Receivable (To record cash sales.) Accounts Payable Merchandise Inventory (To record cost of goods sold.) (To record cost of goods sold.) Sales Returns and Allowances HST Payable Cash Supplies HST Payable (To record cash refund for retumed merchandise.) Accounts Receivable Cost of Goods Sold (To record cost of returned goods.) Merchandise Inventory HST Recoverable Accounts Payable (To record sales on account.) (To record cost of goods sold.)