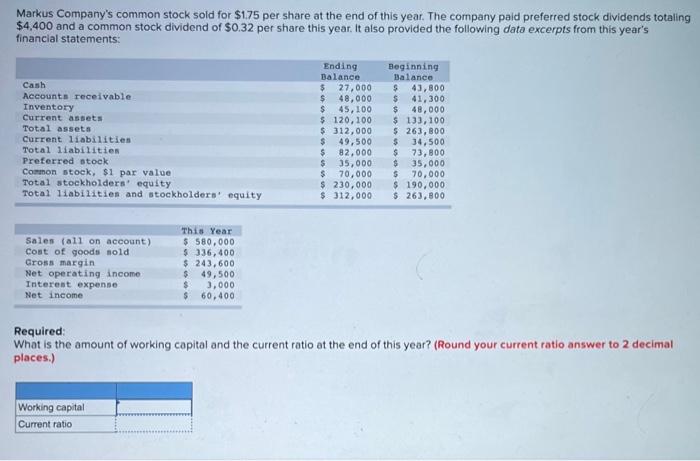

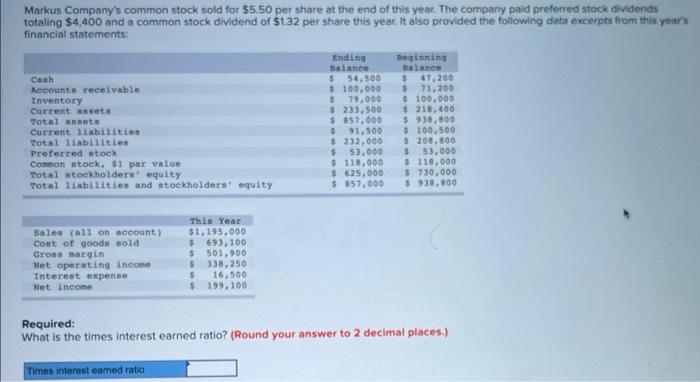

Markus Company's common stock sold for $175 per share at the end of this year. The company paid preferred stock dividends totaling $4,400 and a common stock dividend of $0.32 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Preferred stock Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Ending Balance $ 27,000 $ 48,000 $ 45,100 $ 120,100 $ 312,000 $ 49,500 $ 82,000 $ 35,000 $70,000 $ 230,000 $. 312.000 Beginning Balance $ 43,800 $ 41,300 $ 48,000 $ 133,100 $ 263,800 $ 34,500 $ 73,800 $ 35,000 $ 70,000 $ 190,000 $ 263.800 Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This $ 580,000 $336, 400 $ 243,600 $ 49,500 $ 3.000 $ 60,400 Required: What is the amount of working capital and the current ratio at the end of this year? (Round your current ratio answer to 2 decimal places.) Working capital Current ratio Markus Company's common stock sold for $5.50 per share at the end of this year. The company paid preferred stock dividends totaling $4,400 and a common stock dividend of $132 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total Assets Current liabilities Total liabilities Preferred stock Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Ending Balance $ 54,500 $100,000 $ 79.000 $ 233,500 $ 857,000 $91,500 $ 232.000 $ 53,000 $ 118,000 $ 625,000 $ 857.000 Beginning Balance $ 47.200 $ 71.200 $ 100.000 $ 218,400 $938.800 $ 100,500 $ 200,000 $ 53,000 $ 118,000 $ 730.000 $ 938.800 Sales (all on account) Cost of goods sold Cross margin Net operating income Interest expense Net Income This Year $1,195,000 $ 693,100 $ 501,900 $ 338,250 5 16,500 $199.100 Required: What is the times interest earned ratio? (Round your answer to 2 decimal places.) Times interest oamed ratio