Answered step by step

Verified Expert Solution

Question

1 Approved Answer

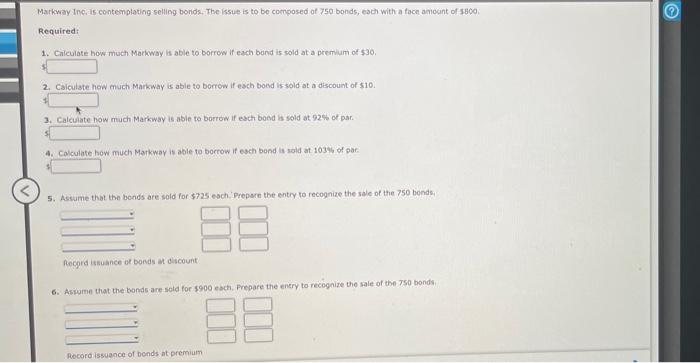

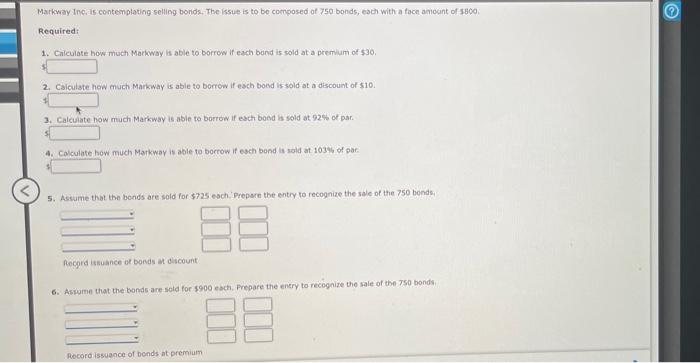

Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a foce amount of $300 Required: 1. Calculate

Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a foce amount of $300 Required: 1. Calculate how much Markway is able to borrow if each band is sold at a premium of $30, 2. Calculate how much Markway is able to borrow it each bond is sold at a discount of 10 3. Calculate how much Markway is able to borrow if each bond is sold at 92% of par. 4. Calculate how much Markway is able to borrow if each bond is sold at 103% of par 5. Assume that the bonds are sold for $725 each. Prepare the entry to recognize the sale of the 750 bonds 89 Recordistance of bonds at discount 6. Assume that the bonds are sold for $900 each. Prepare the entry to recognize the sale of the 750 bonds Record issuance of bonds at premium

Markway Inc. is contemplating selling bonds. The issue is to be composed of 750 bonds, each with a foce amount of $300 Required: 1. Calculate how much Markway is able to borrow if each band is sold at a premium of $30, 2. Calculate how much Markway is able to borrow it each bond is sold at a discount of 10 3. Calculate how much Markway is able to borrow if each bond is sold at 92% of par. 4. Calculate how much Markway is able to borrow if each bond is sold at 103% of par 5. Assume that the bonds are sold for $725 each. Prepare the entry to recognize the sale of the 750 bonds 89 Recordistance of bonds at discount 6. Assume that the bonds are sold for $900 each. Prepare the entry to recognize the sale of the 750 bonds Record issuance of bonds at premium

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started