Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marlon and his wife filed joint tax returns for 15 years. In December of tax year 2021, they separated and filed a separate return.

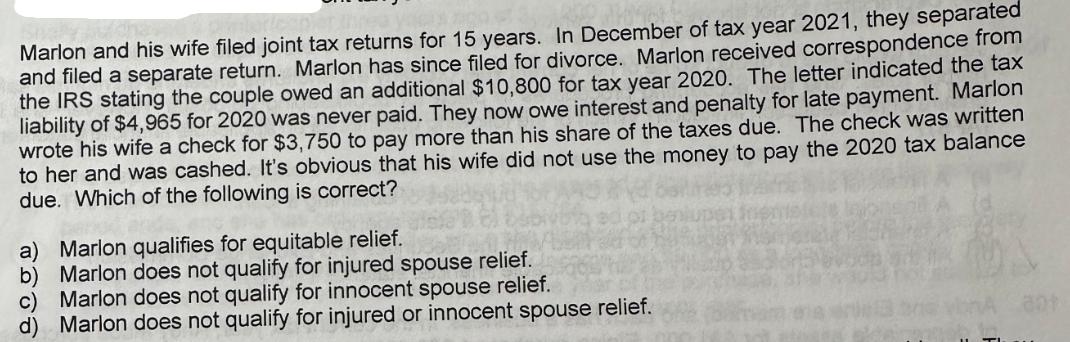

Marlon and his wife filed joint tax returns for 15 years. In December of tax year 2021, they separated and filed a separate return. Marlon has since filed for divorce. Marlon received correspondence from the IRS stating the couple owed an additional $10,800 for tax year 2020. The letter indicated the tax liability of $4,965 for 2020 was never paid. They now owe interest and penalty for late payment. Marlon wrote his wife a check for $3,750 to pay more than his share of the taxes due. The check was written to her and was cashed. It's obvious that his wife did not use the money to pay the 2020 tax balance due. Which of the following is correct? a) Marlon qualifies for equitable relief. b) Marlon does not qualify for injured spouse relief. c) Marlon does not qualify for innocent spouse relief. d) Marlon does not qualify for injured or innocent spouse relief.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Introduction Marlon and his wife who filed joint tax returns for 15 years separated in De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started