Answered step by step

Verified Expert Solution

Question

1 Approved Answer

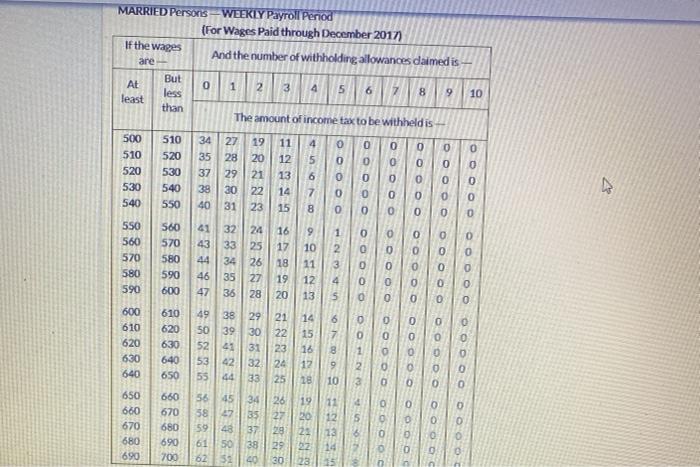

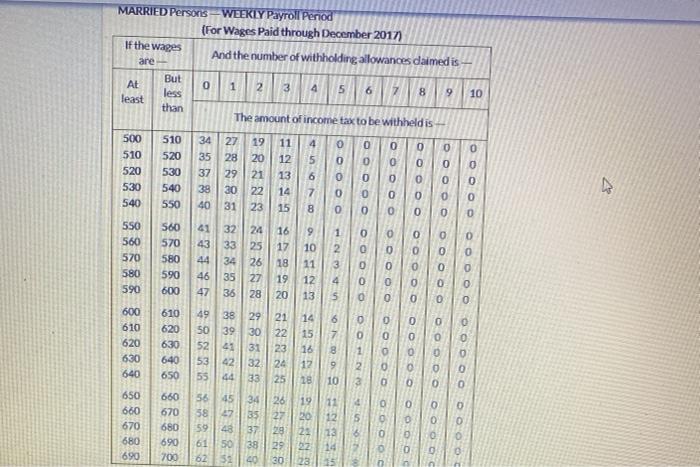

MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017 And the number of withholding allowances daimed is If the wages are 0

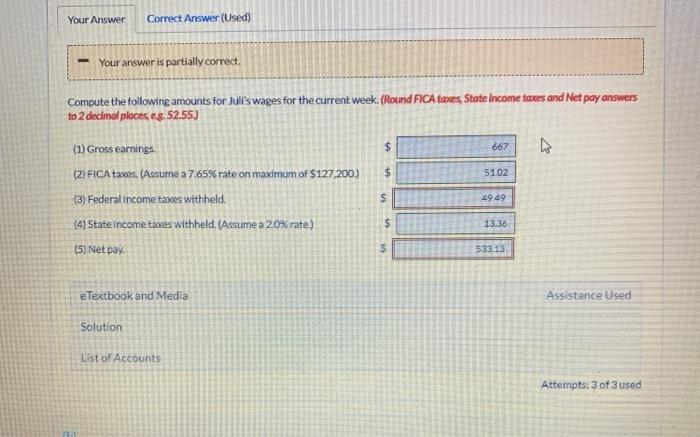

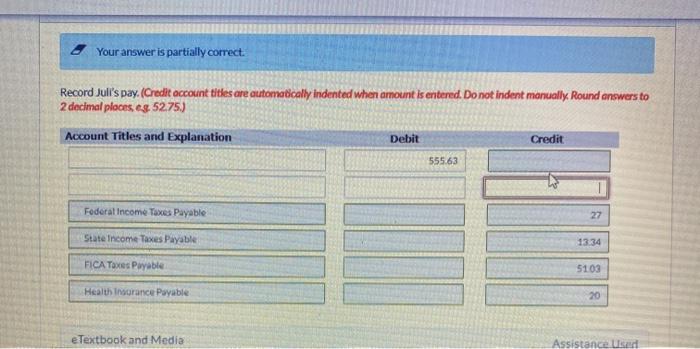

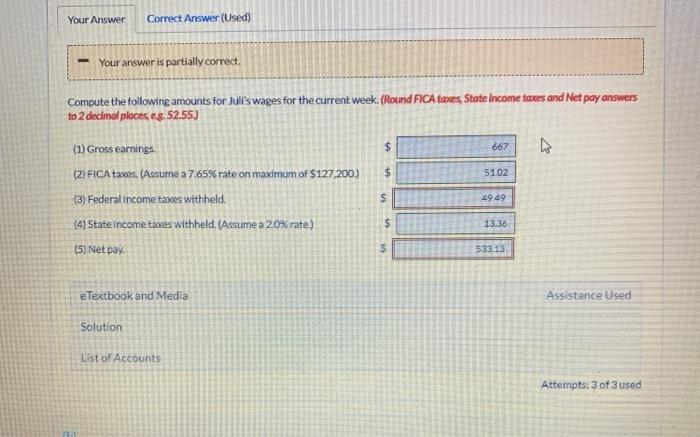

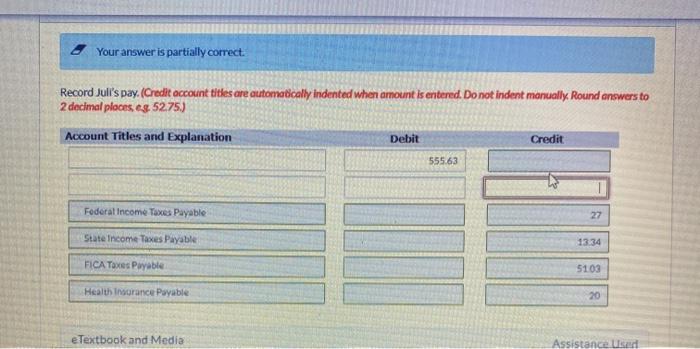

MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017 And the number of withholding allowances daimed is If the wages are 0 1 N 3 4 5 6 7 8 9 10 The amount of income tax to be withheldis- 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 10000 0 0 COU 0 0 0 0 0 0 5 egg86 Egggg %%B9% Huebsmw9mm338mm ownHaw ws OOO 0 OOOO 630 OD OOOOO OOO OOOOO OOO 670 680 690 OOOO 10 n Your Answer Correct Answer (Used) Your answer is partially correct Compute the following amounts for Juli's wages for the current week. (Round FICA taxes, State Income taxes and Net pay answers to 2 decimal places, es. 52.55.) $ 667 7 $ 5102 (1) Gross earnings (2) FICA taxes, (Assume a 7.65% rate on maximum of $127.200.) (3) Federal income taxes withheld. (4) State income taxes withheld. (Assume a 20% rate) (5) Net pay S 49.49 $ 13.36 S 533.13 e Textbook and Media Assistance Used Solution List of Accounts Attempts: 3 of 3 used Your answer is partially correct. Record Jull's pay. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal ploors eg. 5275) Account Titles and Explanation Debit Credit 555.63 Federal Income Taxes Payable 27 State Income Taxes Payable 13:34 FICA Taxes Puyable 5103 Health Insurance Payable 20 e Textbook and Media Assistance user MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017 And the number of withholding allowances daimed is If the wages are 0 1 N 3 4 5 6 7 8 9 10 The amount of income tax to be withheldis- 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 10000 0 0 COU 0 0 0 0 0 0 5 egg86 Egggg %%B9% Huebsmw9mm338mm ownHaw ws OOO 0 OOOO 630 OD OOOOO OOO OOOOO OOO 670 680 690 OOOO 10 n Your Answer Correct Answer (Used) Your answer is partially correct Compute the following amounts for Juli's wages for the current week. (Round FICA taxes, State Income taxes and Net pay answers to 2 decimal places, es. 52.55.) $ 667 7 $ 5102 (1) Gross earnings (2) FICA taxes, (Assume a 7.65% rate on maximum of $127.200.) (3) Federal income taxes withheld. (4) State income taxes withheld. (Assume a 20% rate) (5) Net pay S 49.49 $ 13.36 S 533.13 e Textbook and Media Assistance Used Solution List of Accounts Attempts: 3 of 3 used Your answer is partially correct. Record Jull's pay. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal ploors eg. 5275) Account Titles and Explanation Debit Credit 555.63 Federal Income Taxes Payable 27 State Income Taxes Payable 13:34 FICA Taxes Puyable 5103 Health Insurance Payable 20 e Textbook and Media Assistance user

MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017 And the number of withholding allowances daimed is If the wages are 0 1 N 3 4 5 6 7 8 9 10 The amount of income tax to be withheldis- 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 10000 0 0 COU 0 0 0 0 0 0 5 egg86 Egggg %%B9% Huebsmw9mm338mm ownHaw ws OOO 0 OOOO 630 OD OOOOO OOO OOOOO OOO 670 680 690 OOOO 10 n Your Answer Correct Answer (Used) Your answer is partially correct Compute the following amounts for Juli's wages for the current week. (Round FICA taxes, State Income taxes and Net pay answers to 2 decimal places, es. 52.55.) $ 667 7 $ 5102 (1) Gross earnings (2) FICA taxes, (Assume a 7.65% rate on maximum of $127.200.) (3) Federal income taxes withheld. (4) State income taxes withheld. (Assume a 20% rate) (5) Net pay S 49.49 $ 13.36 S 533.13 e Textbook and Media Assistance Used Solution List of Accounts Attempts: 3 of 3 used Your answer is partially correct. Record Jull's pay. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal ploors eg. 5275) Account Titles and Explanation Debit Credit 555.63 Federal Income Taxes Payable 27 State Income Taxes Payable 13:34 FICA Taxes Puyable 5103 Health Insurance Payable 20 e Textbook and Media Assistance user MARRIED Persons - WEEKLY Payroll Period (For Wages Paid through December 2017 And the number of withholding allowances daimed is If the wages are 0 1 N 3 4 5 6 7 8 9 10 The amount of income tax to be withheldis- 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 10000 0 0 COU 0 0 0 0 0 0 5 egg86 Egggg %%B9% Huebsmw9mm338mm ownHaw ws OOO 0 OOOO 630 OD OOOOO OOO OOOOO OOO 670 680 690 OOOO 10 n Your Answer Correct Answer (Used) Your answer is partially correct Compute the following amounts for Juli's wages for the current week. (Round FICA taxes, State Income taxes and Net pay answers to 2 decimal places, es. 52.55.) $ 667 7 $ 5102 (1) Gross earnings (2) FICA taxes, (Assume a 7.65% rate on maximum of $127.200.) (3) Federal income taxes withheld. (4) State income taxes withheld. (Assume a 20% rate) (5) Net pay S 49.49 $ 13.36 S 533.13 e Textbook and Media Assistance Used Solution List of Accounts Attempts: 3 of 3 used Your answer is partially correct. Record Jull's pay. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal ploors eg. 5275) Account Titles and Explanation Debit Credit 555.63 Federal Income Taxes Payable 27 State Income Taxes Payable 13:34 FICA Taxes Puyable 5103 Health Insurance Payable 20 e Textbook and Media Assistance user

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started