(Marriott Income Statement)

(Choice Hotels Income Statement)

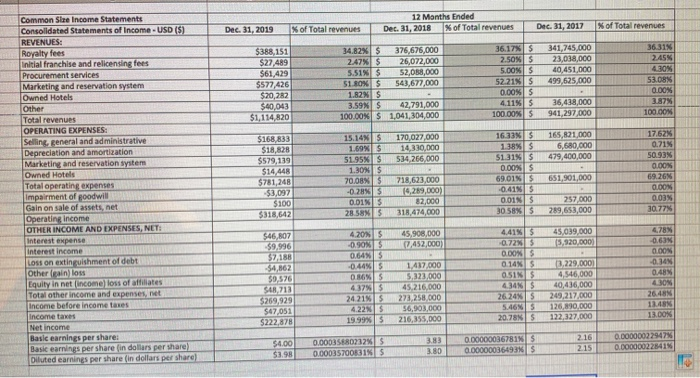

1. What are two accounts in the Choice Hotels income statement that show the biggest change over the past 3 years?

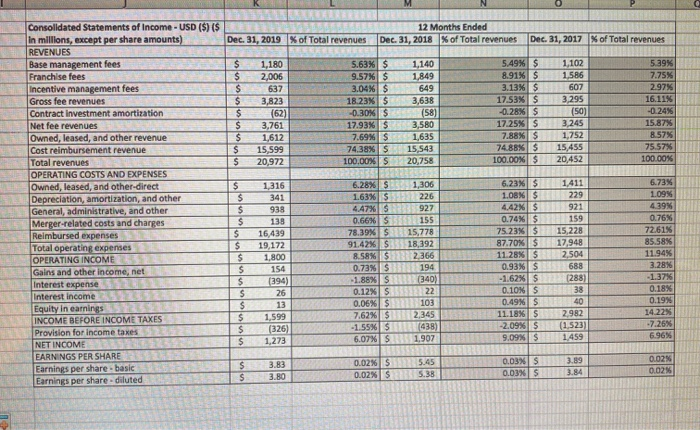

2. What are two accounts in the Marriott income statement that show the biggest change over the past 3 years?

3. Which of the two companies has the financially stronger income statement? Explain your rationale.

12 Months Ended Dec. 31, 2018 % of Total revenues Dec. 31, 2019 % of Total revenues Dec. 31, 2017 IN of Total revenues 5 9 3 5 8 3 7 5.39% .75% 2.97% 1 $ $ $ $ $ $ $ S $ 1, 180 2,006 637 3, 823 (62) 3.761 1612 15.599 20.972 .63% $ .57% $ .04% $ 23 $ -0.30% $ 7.93 7.69% $ 7438 00.00XS 1, 140 1, 849 649 3,638 (58) 3.580 1. 635 15 543 20.758 .49% .91% .13% 17.53% -0.285 17.25% .8 4 88% 00 DON $ $ $ $ $ $ $ $ $ 1,102 1, 586 607 3.295 (50) 3.245 1.752 15,455 20.452 1 7 -0.24% 15.87% 8.57% 75 5796 100.00% 7 1 1 Consolidated Statements of Income - USD ($) ($ in millions, except per share amounts) REVENUES Base management fees Franchise fees Incentive management fees Gross fee revenues Contract investment amortization Net fee revenues Owned, leased, and other revenue Cost reimbursement revenue Total revenues OPERATING COSTS AND EXPENSES Owned, leased, and other direct Depreciation, amortization, and other General, administrative, and other Merger-related costs and charges Reimbursed expenses Total operating expemes OPERATING INCOME Gains and other income, net Interest expense s Interest income Equity in earnings INCOME BEFORE INCOME TAXES Provision for income taxes NET INCOME EARNINGS PER SHARE Earnings per share basic Earnings per share diluted 6 1 4 6 1 4 9 TS1316 $ 341 $ 938 $ 138 $ 16,439 $ 19, 172 $ 1.800 $ 154 (394 $ 26 $ 13 $ 1, 599 $ (326) $ 1, 273 .28% 1. 306 .63% 226 .47% 2927 0.66% $ 155 78.39% $ 15,778 1.42% $ 18,392 RS 2 366 .73% 3 194 1.88XS (340) .12% 5 22 . 06 103 .62% 2. 345 1.55 $ 438 .07% 5 1.907 .23% $ 1.411 .08 $ 229 .42% $ 921 0.74% $ 159 7 5.23% $ 15,228 87.70% 17.948 1 125 2504 0.93% $ 688 1.62% $ 2881 .10% S 38 0 49 1 1.18% 5 2.982 -2093 12520 9.09% 1459 6.73% 1.09% 4.39% 0.76 72.61% 85.58% 11.94% 3.286 137% 0.185 0.19% 14.22% -7.2586 6.96% 0 0 0 0 7 6 $ $ 3. 83 3. 80 0 0 .02 .02 $ $ 5. 45 5. 38 0 0 .03% $ 3.89 .03% 53 .84 002% 0.02% Dec 31, 2019 of Total revenues 12 Months Ended Dec. 31, 2018 X of Total revenues Dec 31, 2017 Nof Total revenues $ $3.88.151 $27,489 $61.429 $577 426 $20,282 $40,043 $1,114,820 $ $ $ 34,825 247 5515 51. ROW 1.825 3.59% 100.00% 376.676.000 2 6,072,000 5 200.000 541.672.000 36.17% 2.50% 5.00 52215 0.00% 4.11% 100.00% 341,745.000 23,038,000 0451.000 499525.000 $ 430 5309 0.00% 3.87% 100.00% $ $ $ S 42,791,000 1,041,204.000 36,418.000 941.297.000 Common Stue Income Statements Consolidated Statements of income. USD ($) REVENUES: Rovelty fees Initial franchise and relicensing fees Procurement services Marketing and reservation system Owned Hotels Other Total revenues OPERATING EXPENSES Selling general and administrative Depreciation and amortization Marketing and reservation syste Owned Hotels Total operating expenses Impairment of goodwill Gain on sale of assets, het Operating income OTHER INCOME AND EXPENSES, NET Interest expense S $ 165,821 000 $168.833 SLO $579,139 $14,448 $781,248 170,027.000 1330.000 $34.266.000 17.62% 0.715 509355 DOO 4 79,400,000 $ $ 15.14 1.695 5195 1.30% 70.08 -0.28% 0.01 28.58 16.33 1383 513151 0.00 69.01% -0.415 0.01 30 58 651,901,000 718,623,000 4,289,000) $ $ GOON $ $100 $3181642 82.000 257,000 289,653.000 0.03% 30.77% 318,474,000 $ 450.000 1452.000 49.000 3,320,000 DOON $4607 $9.996 $7,188 54.362 $9,576 SUR 713 $269929 $47,051 522223781 420 ONE 064N S -0.44% $ 0 36 4375 24 215 422 19. 9 5 Lost on extinguishment of debt Other lainou Equity in net income) loss of affiliates Total other income and expenses, net Income before income taxes Income taxes Net income Basic earnings per share: Basic earnings per share in dollars per share) Diluted earnings per share in dollars per share) 5 1.437,000 ,323,000 4 5 216.000 273 258.000 36.903.000 216,355,000 4.41% 0.72 0.00% 0.14 0.51% 434 26 24 5.66S 20.78 0,229,0001 4,546,000 40,436.000 249 217.000 1260 ,000 122327,000 2649 2 $4.000 $3.98 .0003 SER0212 0.0003570033INS 383 3.80 0.00000036781 0.00000036493 16 215 0.00000022947% 0.00000022841%