Answered step by step

Verified Expert Solution

Question

1 Approved Answer

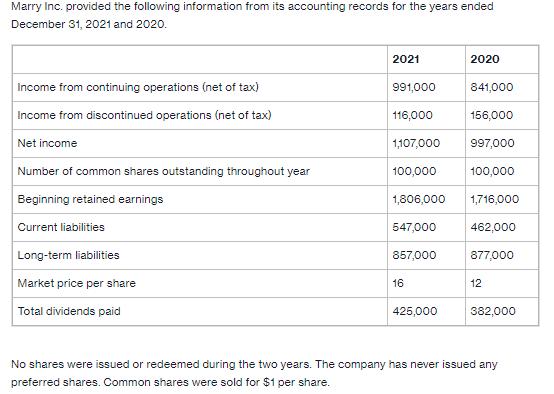

Marry Inc. provided the following information from its accounting records for the years ended December 31, 2021 and 2020. Income from continuing operations (net

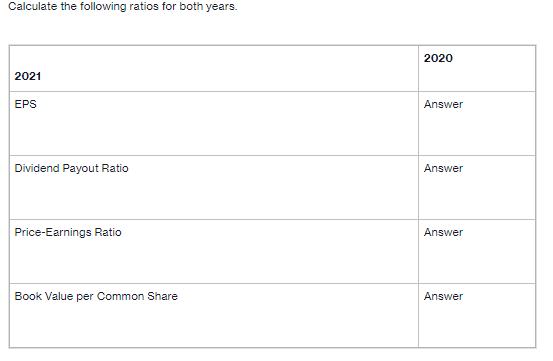

Marry Inc. provided the following information from its accounting records for the years ended December 31, 2021 and 2020. Income from continuing operations (net of tax) Income from discontinued operations (net of tax) Net income Number of common shares outstanding throughout year Beginning retained earnings Current liabilities Long-term liabilities Market price per share Total dividends paid 2021 991,000 116,000 1,107,000 100,000 100,000 1,806,000 1,716,000 462,000 547,000 857,000 16 2020 425,000 841,000 156,000 997,000 877,000 12 382,000 No shares were issued or redeemed during the two years. The company has never issued any preferred shares. Common shares were sold for $1 per share. Calculate the following ratios for both years. 2021 EPS Dividend Payout Ratio Price-Earnings Ratio Book Value per Common Share 2020 Answer Answer Answer Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Earnings per Share EPS EPS Net Income Preferred Dividends Weighted Average Common Shares Outstandi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started