Question

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses GAAP for its external financial reporting. During the year ended December 31,

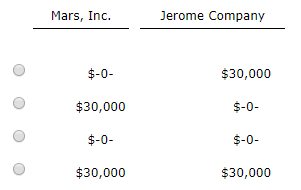

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses GAAP for its external financial reporting. During the year ended December 31, 2018, both companies changed from using the completed-contract method of revenue recognition for long-term construction contracts to the percentage-of-completion method. Both companies experienced an indirect effect, related to increased profit-sharing payments in 2018, of $30,000. As a result of this change, how much expense related to the profit-sharing payment must be recognized by each company on the income statement for the year ended December 31, 2018?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started