Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mars Musical Instrument Company and Tiger Company engaged in the following trans- actions with each other during July 2018: July 2 Mars Musical Instrument Company

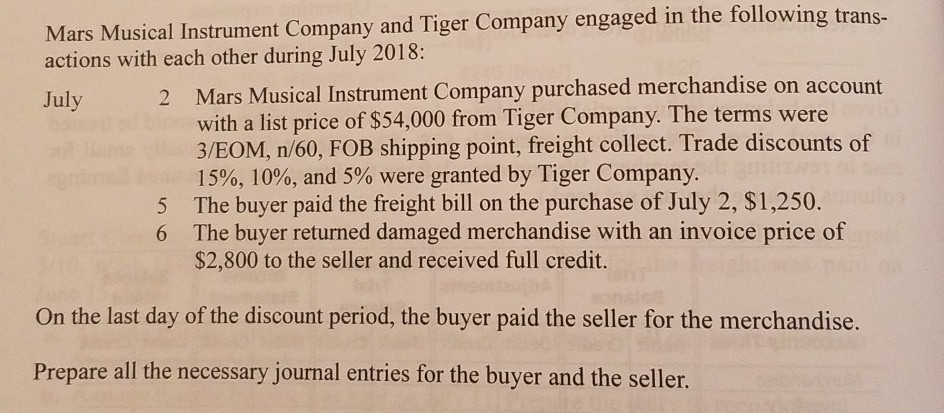

Mars Musical Instrument Company and Tiger Company engaged in the following trans- actions with each other during July 2018: July 2 Mars Musical Instrument Company purchased merchandise on account with a list price of $54,000 from Tiger Company. The terms were 3/EOM, n/60, FOB shipping point, freight collect. Trade discounts of 15%, 10%, and 5% were granted by Tiger Company. 5 The buyer paid the freight bill on the purchase of July 2, $1,250. 6 The buyer returned damaged merchandise with an invoice price of $2,800 to the seller and received full credit. On the last day of the discount period, the buyer paid the seller for the merchandise. Prepare all the necessary journal entries for the buyer and the seller

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started