Answered step by step

Verified Expert Solution

Question

1 Approved Answer

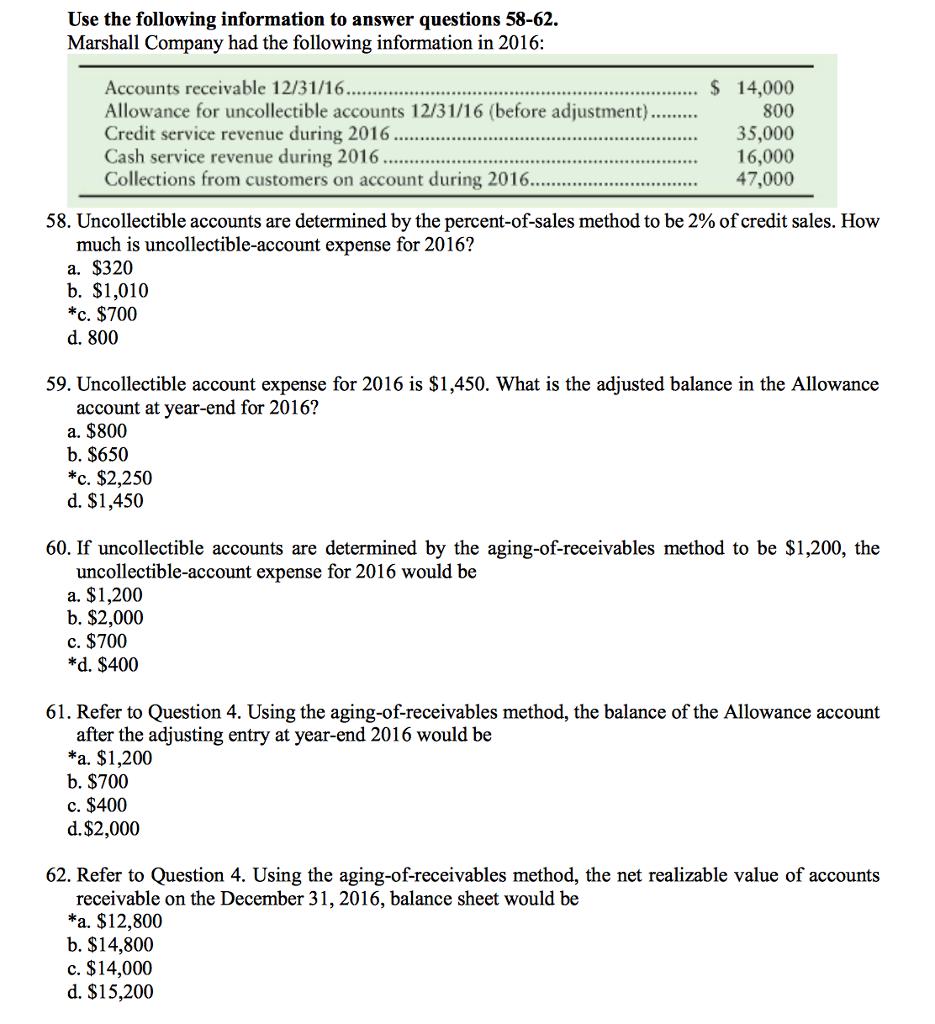

Use the following information to answer questions 58-62. Marshall Company had the following information in 2016: $ 14,000 800 Accounts receivable 12/31/16. Allowance for

Use the following information to answer questions 58-62. Marshall Company had the following information in 2016: $ 14,000 800 Accounts receivable 12/31/16. Allowance for uncollectible accounts 12/31/16 (before adjustment) Credit service revenue during 2016 Cash service revenue during 2016 Collections from customers on account during 2016.. 35,000 16,000 47,000 58. Uncollectible accounts are determined by the percent-of-sales method to be 2% of credit sales. How much is uncollectible-account expense for 2016? a. $320 b. $1,010 *c. $700 d. 800 59. Uncollectible account expense for 2016 is $1,450. What is the adjusted balance in the Allowance account at year-end for 2016? a. $800 b. $650 *c. $2,250 d. $1,450 60. If uncollectible accounts are determined by the aging-of-receivables method to be $1,200, the uncollectible-account expense for 2016 would be a. $1,200 b. $2,000 c. $700 *d. $400 61. Refer to Question 4. Using the aging-of-receivables method, the balance of the Allowance account after the adjusting entry at year-end 2016 would be *a. $1,200 b. $700 c. $400 d.$2,000 62. Refer to Question 4. Using the aging-of-receivables method, the net realizable value of accounts receivable on the December 31, 2016, balance sheet would be *a. $12,800 b. $14,800 c. $14,000 d. $15,200

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

58 Its mentioned that uncollectible accounts are 2 of cred...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started