Question

Mart Corporation bonds have a $1,000 face value and will mature in four years. The bonds have a 7 percent coupon rate. Interest is

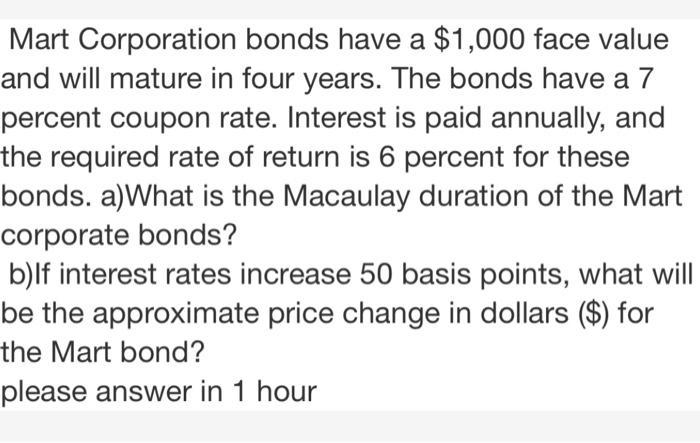

Mart Corporation bonds have a $1,000 face value and will mature in four years. The bonds have a 7 percent coupon rate. Interest is paid annually, and the required rate of return is 6 percent for these bonds. a) What is the Macaulay duration of the Mart corporate bonds? b)lf interest rates increase 50 basis points, what will be the approximate price change in dollars ($) for the Mart bond? please answer in 1 hour

Step by Step Solution

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Macaulay duration of the Mart corporate bonds we first need to calculate the presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Finance The Logic and Practice of Financial Management

Authors: Arthur J. Keown, John D. Martin, J. William Petty

8th edition

132994879, 978-0132994873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App