Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martha is an Australian and has been working as an engineer for OCC Sdn Bhd in Malaysia for a few years. Her contract ends

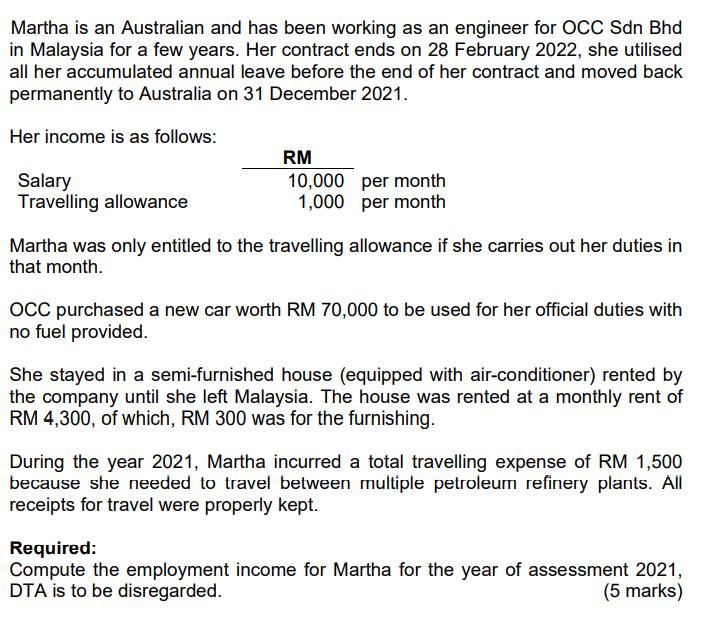

Martha is an Australian and has been working as an engineer for OCC Sdn Bhd in Malaysia for a few years. Her contract ends on 28 February 2022, she utilised all her accumulated annual leave before the end of her contract and moved back permanently to Australia on 31 December 2021. Her income is as follows: RM Salary 10,000 per month 1,000 per month Travelling allowance Martha was only entitled to the travelling allowance if she carries out her duties in that month. OCC purchased a new car worth RM 70,000 to be used for her official duties with no fuel provided. She stayed in a semi-furnished house (equipped with air-conditioner) rented by the company until she left Malaysia. The house was rented at a monthly rent of RM 4,300, of which, RM 300 was for the furnishing. During the year 2021, Martha incurred a total travelling expense of RM 1,500 because she needed to travel between multiple petroleum refinery plants. All receipts for travel were properly kept. Required: Compute the employment income for Martha for the year of assessment 2021, DTA is to be disregarded. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers The employment income of Martha in the period of 10 months Feb 28 to Dec 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started