Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martha Shine owned the following in 2020 2 Rental Properties (Property 1: land $70,000, building $55,000) (Property 2 land $90,000, building $60,000) -Net rental

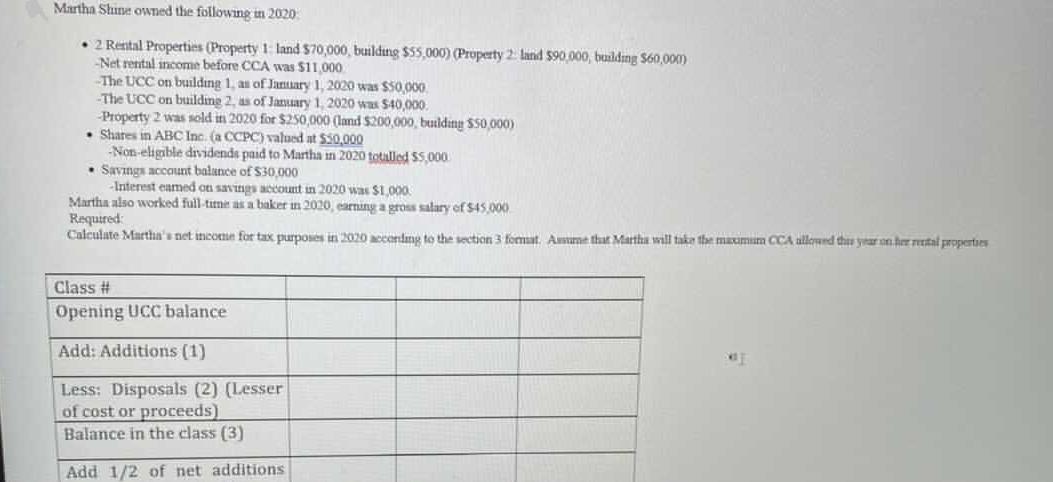

Martha Shine owned the following in 2020 2 Rental Properties (Property 1: land $70,000, building $55,000) (Property 2 land $90,000, building $60,000) -Net rental income before CCA was $11,000 The UCC on building 1, as of January 1, 2020 was $50,000 -The UCC on building 2, as of January 1, 2020 was $40,000. Property 2 was sold in 2020 for $250,000 (land $200,000, building $50,000) Shares in ABC Inc. (a CCPC) valued at $50,000 -Non-eligible dividends paid to Martha in 2020 totalled $5,000 . Savings account balance of $30,000 -Interest eamed on savings account in 2020 was $1,000 Martha also worked full-time as a baker in 2020, earning a gross salary of $45,000 Required: Calculate Martha's net income for tax purposes in 2020 according to the section 3 format. Assume that Martha will take the maximum CCA allowed this year on her rental properties Class # Opening UCC balance Add: Additions (1) Less: Disposals (2) (Lesser of cost or proceeds) Balance in the class (3) Add 1/2 of net additions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate Marthas net income for tax purposes in 2020 according to the section 3 format Rental Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started