Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martin, a licensed insurance agent, meets with his client Kim for an insurance review. Kim had purchased a 10-year term policy from Martin a

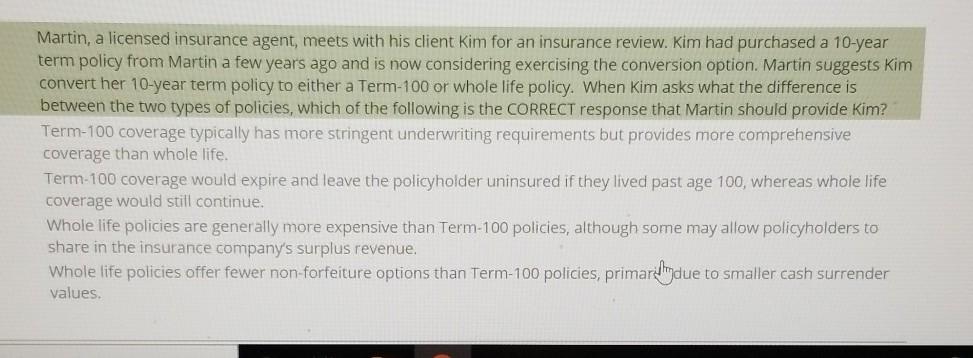

Martin, a licensed insurance agent, meets with his client Kim for an insurance review. Kim had purchased a 10-year term policy from Martin a few years ago and is now considering exercising the conversion option. Martin suggests Kim convert her 10-year term policy to either a Term-100 or whole life policy. When Kim asks what the difference is between the two types of policies, which of the following is the CORRECT response that Martin should provide Kim? Term-100 coverage typically has more stringent underwriting requirements but provides more comprehensive coverage than whole life. Term-100 coverage would expire and leave the policyholder uninsured if they lived past age 100, whereas whole life coverage would still continue. Whole life policies are generally more expensive than Term-100 policies, although some may allow policyholders to share in the insurance company's surplus revenue. Whole life policies offer fewer non-forfeiture options than Term-100 policies, primary due to smaller cash surrender values.

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

c whole life policies are generally more expensive ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started