Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Martin, Brown and Grant (MBG) Company have reported net income of $110,000 and $150,000 for the years ended 12-31-17 and 12-31-18 respectively. Upon the

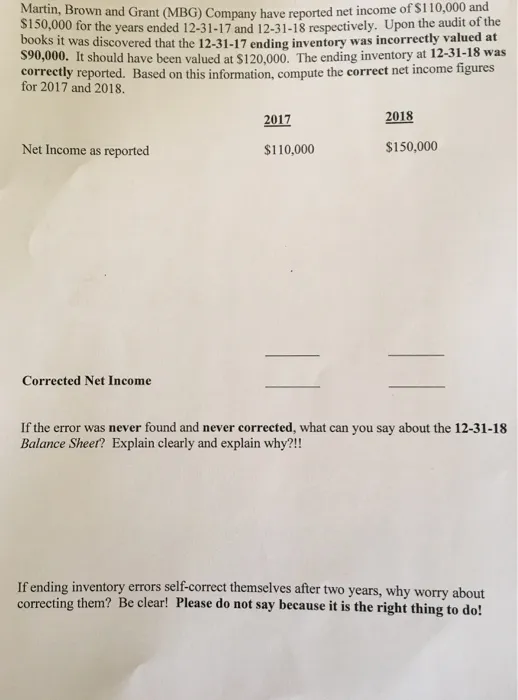

Martin, Brown and Grant (MBG) Company have reported net income of $110,000 and $150,000 for the years ended 12-31-17 and 12-31-18 respectively. Upon the audit of the books it was discovered that the 12-31-17 ending inventory was incorrectly valued at $90,000. It should have been valued at $120,000. The ending inventory at 12-31-18 was correctly reported. Based on this information, compute the correct net income figures for 2017 and 2018. Net Income as reported Corrected Net Income 2017 2018 $110,000 $150,000 If the error was never found and never corrected, what can you say about the 12-31-18 Balance Sheer? Explain clearly and explain why?!! If ending inventory errors self-correct themselves after two years, why worry about correcting them? Be clear! Please do not say because it is the right thing to do!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started