Question

Martin construction Limited incurs significant finance costs on its financing for the construction of supermarkets. Its chosen accounting policy to date has been to expense

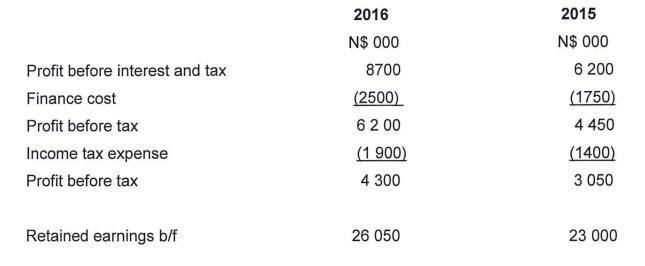

Martin construction Limited incurs significant finance costs on its financing for the construction of supermarkets. Its chosen accounting policy to date has been to expense the finance costs as incurred. The final accounts for the year ended 31 December 2015 and the 2016 draft accounts reflect this policy and show the following:

The directors of Martin construction Limited have now decided to change the accounting policy in 2016 to capitalization of finance costs as per IAS 23. Martin construction limited incurs no finance costs other than those related to the construction of the supermarkets. Martin construction limited paid a dividend of N$ 1 million during the year ended 31 December 2016.

The directors of Martin construction Limited have now decided to change the accounting policy in 2016 to capitalization of finance costs as per IAS 23. Martin construction limited incurs no finance costs other than those related to the construction of the supermarkets. Martin construction limited paid a dividend of N$ 1 million during the year ended 31 December 2016.

Required:

Show how the change in accounting policy will be reflected in the statement of profit or loss and other comprehensive income, and the statement of changes in equity for the year ended 31 December 2016

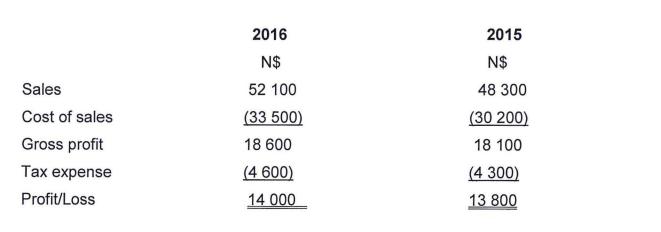

(b) During the year 2016, JJK Limited discovered certain items that had been included in the inventory at 31 December 2015 at a value of N$2.5 million but they had been infact sold before the year end. The Statement of profit or loss and other comprehensive income below for JJK for 2015 and 2016 are as follows

Required:

Show the 2016 Statement of profit or loss and other comprehensive income with comparatives after the error has been corrected.

Profit before interest and tax Finance cost Profit before tax Income tax expense Profit before tax Retained earnings b/f 2016 N$ 000 8700 (2500) 6 200 (1 900) 4 300 26 050 2015 N$ 000 6 200 (1750) 4 450 (1400) 3 050 23 000 Profit before interest and tax Finance cost Profit before tax Income tax expense Profit before tax Retained earnings b/f 2016 N$ 000 8700 (2500) 6 200 (1 900) 4 300 26 050 2015 N$ 000 6 200 (1750) 4 450 (1400) 3 050 23 000

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of profit or loss and other comprehensive income for the year ended 31 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started